1. Focus on an investment goal

Investing is just a way of saving – but not in a bank account.

Before you decide on the right investments, it is important to determine what it is you are investing for. Many people have more than one investment goal – for example saving for a new car, saving for a house deposit and saving for retirement. It is important to remember that you may need different investment strategies for different goals.

2. Decide on an investment timeframe

Break down your investment goals into short, medium and long-term goals. This will determine the investment timeframe for each goal.

As a rule of thumb, for medium term goals such as saving for a house deposit over five years, you can typically afford to take on more risk as you have more time to ride out market ups and downs.

If, however, you want to buy a new car in a year or two, you will likely be slowed down by historically low interest rates if you are saving in a bank account and may need to expand your investment horizons beyond bank deposits.

To get your money working a bit harder there are a range of investment options higher up on the risk scale. Many savers are moving from term deposits into diversified share portfolios in an attempt to capture higher returns.

3. Keep costs low

With an array of low-cost investment options now on the market, it pays to shop around for the right investment product for you.

Of course, if you are looking to access professional management, it can be worth paying more but it’s important to understand the fees you are paying and the reasons you are paying them.

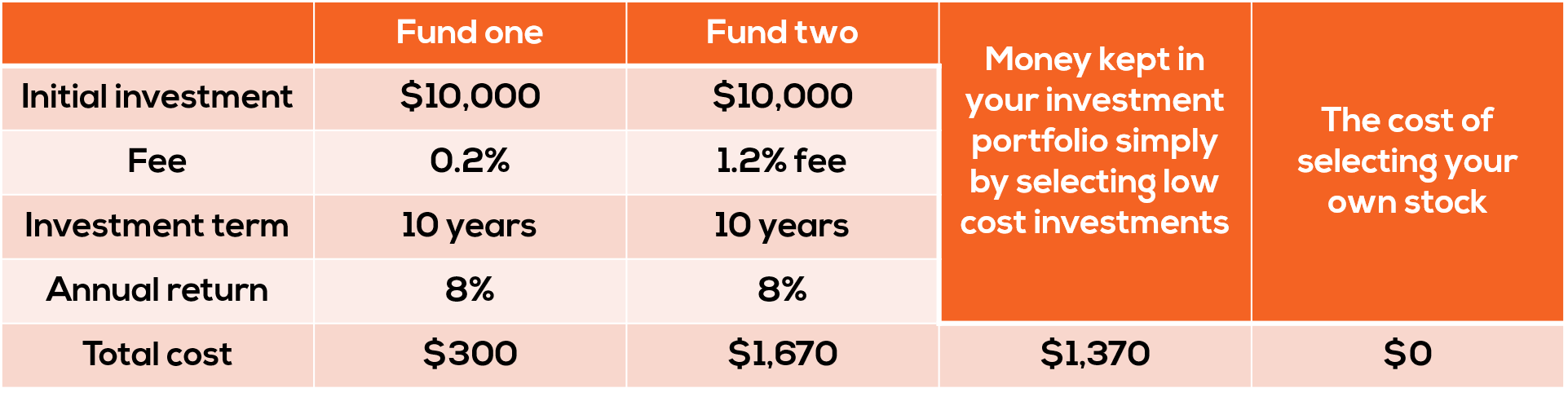

For example, you can invest in a managed fund or ETF offered by U.S. companies such as Vanguard or BlackRock and they will invest your money for you. However, these U.S. fund managers will also charge you money (a fee) to do that. Typically, they charge you a percentage of the money you invest. Say you invested in a managed fund costing 0.2%, then a $10,000 investment that returns 8% p.a. over 10 years would cost around $300. The same $10,000 investment at 1.2% would cost about $1,670. So if you selected the low cost investment that’s $1,370 you keep in your pocket from that one decision alone as shown on the table below.

The U.S. fund managers charge you this fee every year regardless of how your investment performs.

Another option is to invest in the stocks directly, which means you could save even more. This is because unlike managed funds and ETFs, if you select your own stocks you do not incur ongoing or annual fees.

Later in this educational series, we will be analysing portfolios investors are constructing using a combination of U.S. fund managers and their own expertise.

4. Diversify to minimize risk

How you choose to invest across different asset classes is known as your strategic asset allocation.

Most investors have a mix of growth assets such as shares in their portfolio, along with more defensive assets like fixed income and cash.

Growth assets are named as such because they are expected to grow in value. For example, just say you bought Woolworths for $30. In 10 years’ time you may expect the share price to be worth more as Woolworth’s management implement their competitive strategy to grow the company.

Defensive assets are named as such because they are expected to provide an income stream. For example, if I put my money in a bank the value of the deposit doesn’t go up and down however, I receive an income stream in the form of interest.

As the price of my Woolworth’s share will go up and down more than my bank deposit, we can say that an investment in Woolworths shares is more volatile than a deposit in the bank.

Different asset classes perform well at different times in the market cycle, so a diversified portfolio investing in a combination of growth assets and defensive assets can help to lower volatility in your portfolio returns over the long term. Basically it’s a smoother ride.

Let’s say Charlotte, a young investor, wants to save for a house deposit and gives herself a five-year timeframe to achieve her goal. The most important point here is that time in the market is her friend because share markets go up over the long term.

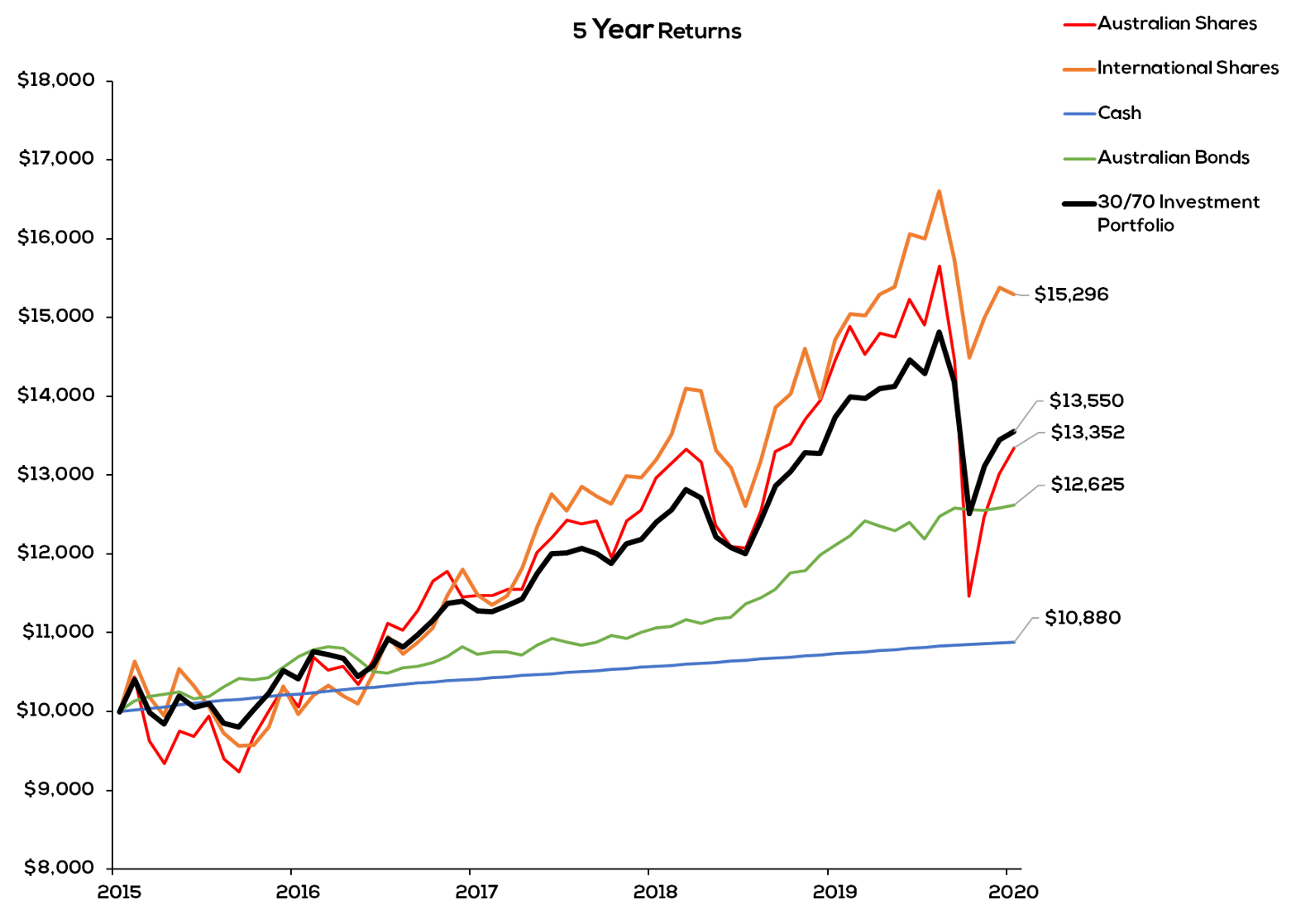

The black line in the chart below shows a diversified investment portfolio made up of 30% defensive assets and 70% growth assets. An investment portfolio weighted this way is commonly referred to as a ‘growth’ portfolio.

We can see that over a five-year investment time frame $10,000 invested has grown to about $13,550 (black line). We can also see the Australian share market (red line) grew about the same in that time. The light blue line shows the investment in cash delivered far lower returns over the period.

As seen in the graph, the nature of the market means there are dips and rises over time. Remaining steady in line with your investment goal and blocking out market noise is imperative – while there were a few negative periods over the five years, the diversified portfolio still grew substantially.

The diversified portfolio had around half the level of risk of the Australian share portfolio, meaning it was less volatile and provided a much smoother path to reaching the intended goal (especially in 2015 and during the COVID-19 crisis, check out the black line verses the red line at those times). This shows the benefits of mixing growth investments with defensive investments. The combined investments generally fall by less when global stock markets are falling, providing income and greater peace of mind as you move towards your investment goal.