Fixed income is an asset class that is often misunderstood by investors.

In fact, a 2019 survey conducted by a U.S. investment firm found only 8% of investors were able to accurately define the asset class1, while 44% said they don’t buy bonds because they don’t understand them.

However, fixed income is an essential asset class for most investors, given its potential to smooth out portfolio volatility and perform well when growth assets, such as equities and property markets, are falling. So, to get you started, here we outline the basics that you need to know.

What is fixed income?

Fixed income is a broad asset class which encompasses cash, term deposits and bonds. While not technically within the fixed income category, this article will also cover hybrid securities which are a popular way to access an income stream.

There are various types of bonds you can invest in, including:

- Government bonds: These are issued by governments and are typically the lowest risk bonds available. The government secures the funds it needs, and in return, the investor receives interest payments at a pre-determined rate.

- Semi-government bonds: These are much like government bonds, except they are issued by various state and territory governments. Like other bonds, these semi-government bonds come in a variety of maturities and pay different rates of regular interest.

- Corporate bonds: A corporate bond is issued by a company as opposed to a government.

All bonds are rated and reviewed for creditworthiness by a number of ratings agencies, such as Standard & Poor’s (S&P). Each has its own ranking system, but the highest-rated bonds are commonly referred to as ‘Triple-A’ bonds and the lowest-rated bonds are ranked ‘D’ for companies in default.

The S&P ranking system is detailed below. Note that BBB and above is considered ‘investment grade’. BB and below is considered ‘junk’.

| Rating Code | Summarised Definition |

|---|---|

| AAA | The Borrower’s capacity to meet its financial commitments on the obligation is extremely strong. |

| AA | The Borrower’s capacity to meet its financial commitments on the obligation is very strong. |

| A | The Borrower is somewhat more susceptible to the adverse effects of changes in economic conditions, however the capacity to meet its financial commitments is still strong. |

| BBB | Adverse economic conditions are more likely to weaken the borrower’s capacity to meet its financial commitments on the obligation. |

| BB | The Borrower faces major ongoing uncertainties that could lead to the Borrower’s inadequate capacity to meet its financial commitments on the obligation. |

| B | Adverse business, financial, or economic conditions will likely impair the Borrower’s capacity or willingness to meet its financial commitments on the obligation. |

| CCC | In the event of adverse business, financial, or economic conditions, the Borrower is not likely to have the capacity to meet its financial commitments on the obligation. |

| CC | The 'CC' rating is used when a default has not yet occurred, but S&P Global Ratings expects default to be a virtual certainty. |

| C | A Borrower rated 'C' is currently highly vulnerable to nonpayment. |

| D | A Borrower rated 'D' is in default. |

How do bonds work?

A bond is simply a loan that you make to an entity, such as a government, or a company.

You receive interest payments, known as a coupon, for the length of the loan and how often you get paid depends on the terms of the bond. The interest rate is typically higher with long-term bonds, given uncertainty increases the longer into future the maturity date is.

When the bond reaches the date of maturity, the issuer (or borrower) repays the principal, or original amount of the loan. As an example, this is how a four-year bond (which pays a 2% yield) would play out.

| Day 1 | Year 1 | Year 2 | Year 3 | Year 4 |

|---|---|---|---|---|

| Invest $100 | Receive $2.00 | Receive $2.00 | Receive $2.00 | Receive $2.00 Receive $100 |

Like stocks, bonds can be traded. When a bond sells at a price lower than the face value, it’s said to be selling at a discount. If sold at a price higher than the face value, it is selling at a premium.

When you purchase a bond there are two sources of returns:

- Interest from the coupon (interest) payments

- An increase in the bond price

An increase in price occurs when interest rates go down after you have purchased the bond. Bonds have an inverse relationship to interest rates, so generally when interest rates are rising, bonds prices fall, while falling interest rates usually lead to an increase in bond prices.

| Bond Yields | Bond Prices | Explanation of Bond Returns | |

|---|---|---|---|

| Falling Interest Rates | ↓ | ↑ | As interest rates fall, the interest payment on existing bonds becomes more attractive to new investors so the bond price rises to reflect the lower interest rate for the new buyer |

| Rising Interest Rates | ↑ | ↓ | As interest rates rise, the interest payment on existing bonds becomes less attractive to new investors so the bond price falls to reflect the higher interest rate for the new buyer |

If governments are lowering official interest rates, then it is usually in an effort to stimulate the economy. If this is the case, it is likely share prices have performed poorly during the tougher economic conditions.

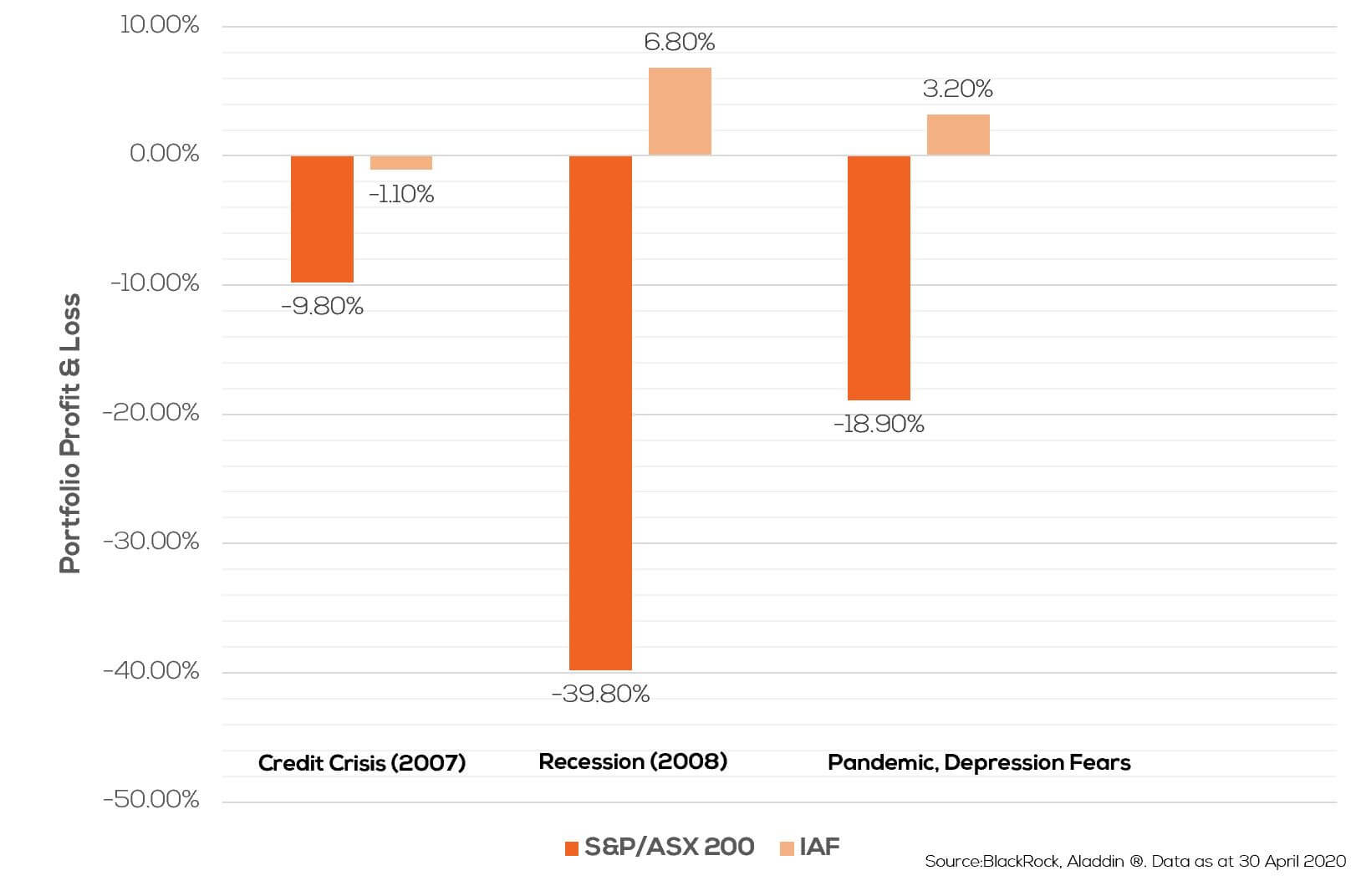

As a result, bonds can be considered a defensive investment as they have the potential to go up when the broader economy, and stock markets, are going down. The below chart shows that investment grade bonds have typically performed well when the stock market falls.

IAF is the ASX stock code for an Exchange Traded Fund or ETF that holds a basket of about 510 different bonds.