Thank you for joining us this Friday 11th April. I’m Sophia Mavridis, a Market Analyst with Bell Direct and this is your weekly market update.

Time in the market, rather than timing the market, is what our strategist team at Bell Potter recommend this week, as the spike in market volatility has prompted some investors to contemplate moving their assets into cash as a perceived save haven during these uncertain times.

On Monday the ASX200 declined more than 4%, posting the largest loss in 5- years after China retaliated with tariffs on US goods. Trading early this week was a sea of red, before rebounding yesterday, after US President Donald Trump announced a 90- day pause on the ‘reciprocal’ tariffs his administration had applied to roughly 60 countries. Many countries will have their tariffs reduced to a universal rate of 10%, except for China, which had tariffs increased from 104% to 125%, then again overnight to 145%. Australia’s tariff of the minimum 10% rate was maintained. Trump has stated that the 90- day pause would allow “more than 75 countries” that had started negotiations with the White House, seeking to reduce its tariffs, to reach a deal. The announcement led to a historical rally on Wall Street, with the S&P500 seeing its third- largest gain in a single day since World War II. Then overnight, 25% tariffs were announced targeting aluminium, auto and goods from Canada and Mexico.

Bell Potter’s equity strategy team released a report this week on timing the market, which you can access exclusively as a Bell Direct client. They recommend against trying to predict the best times to buy and sell. The volatility and investor concerns in markets right now, are influencing how investors feel short term. Whether it’s trade tariffs or tax changes, President Trump has a history of causing unpredictable market reactions, both positive and negative. Because of this, trying to strategically adjust your investments, like increasing your cash holdings in anticipation of a market downturn is generally very challenging.

Staying invested through periods of uncertainty has historically provided more dependable and sustainable long- term returns. This approach allows investors to take full advantage of market rebounds, the power of compounding and helps even out the fluctuations in returns over time.

Looking back at the period of April 2011 to April 2025, investors who held their investments for just one year, would have been their portfolios lose value about 22% of the time. However, those who invested for a much longer period of 10 years would not have experienced any losses at all. For investors with a short- term focus, the best one- year return was a gain of 52%, while the worst was a loss of 25%. This suggests that trying to time the market might lead to bigger gains, but it also comes with much greater risk. Investors with a one- year holding period saw their returns vary significantly (a standard deviation of 15%), compared to the much smaller variation (2%) for those who help their investments for 10 years.

When markets are volatile, investors often reduce their stock holdings or exist the market to avoid further losses. This happened during the COVID sell- off in March 2020, where many investors missed the quick recovery by staying out. As the saying goes, “time in” the market usually beats “timing the market” because many of the best trading days happen during or shirty after a downturn.

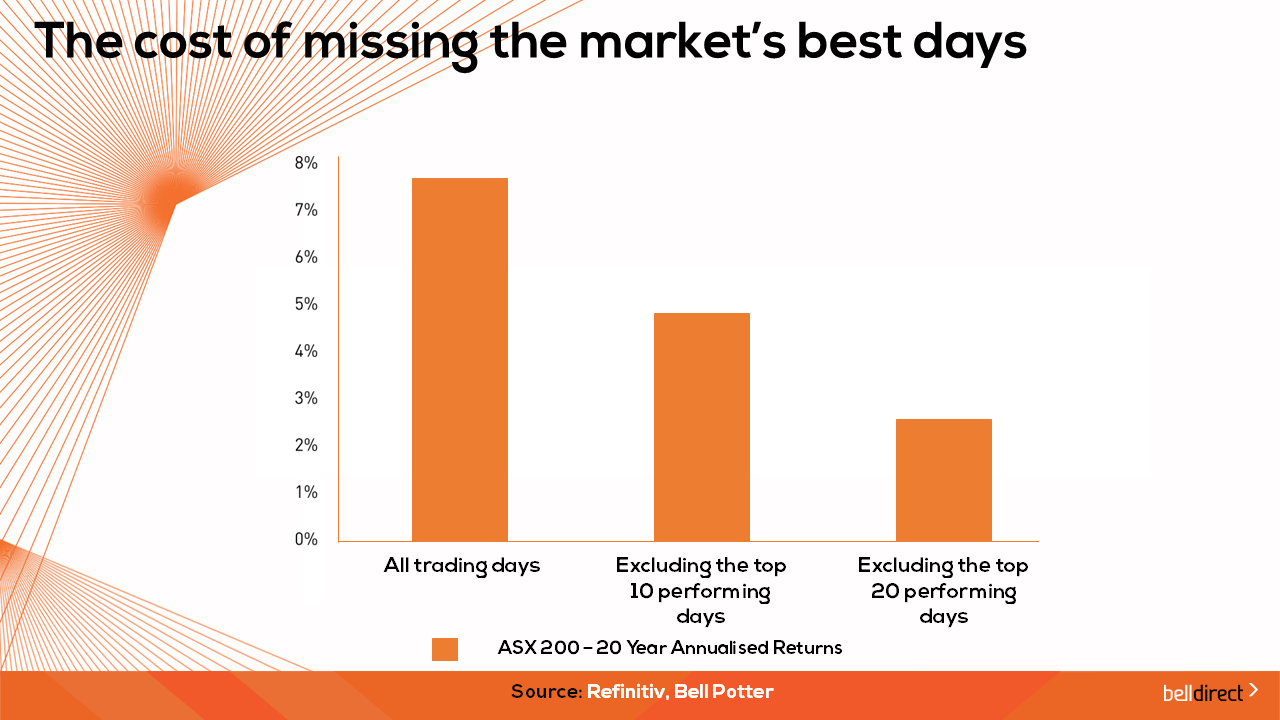

Looking at the last 20 years of daily trading on both the ASX200 and the S&P500, staying invested has been more rewarding. For example, remaining invested in the ASX200 over 20 years delivered an average annual return of 7.6%. However, missing just the top 10 performing days would have reduced that to 4.8%. Notably, the COVID recovery included 4 of the ASX’s top 10 best days in the last two decades. Investors who moved to cash during the downturn would have missed significant gains and then faced the difficult decision of when to reinvest, risking missing the rebound entirely.

Considering this, let’s look at how the ASX200 performed this week so far, Monday to Thursday.

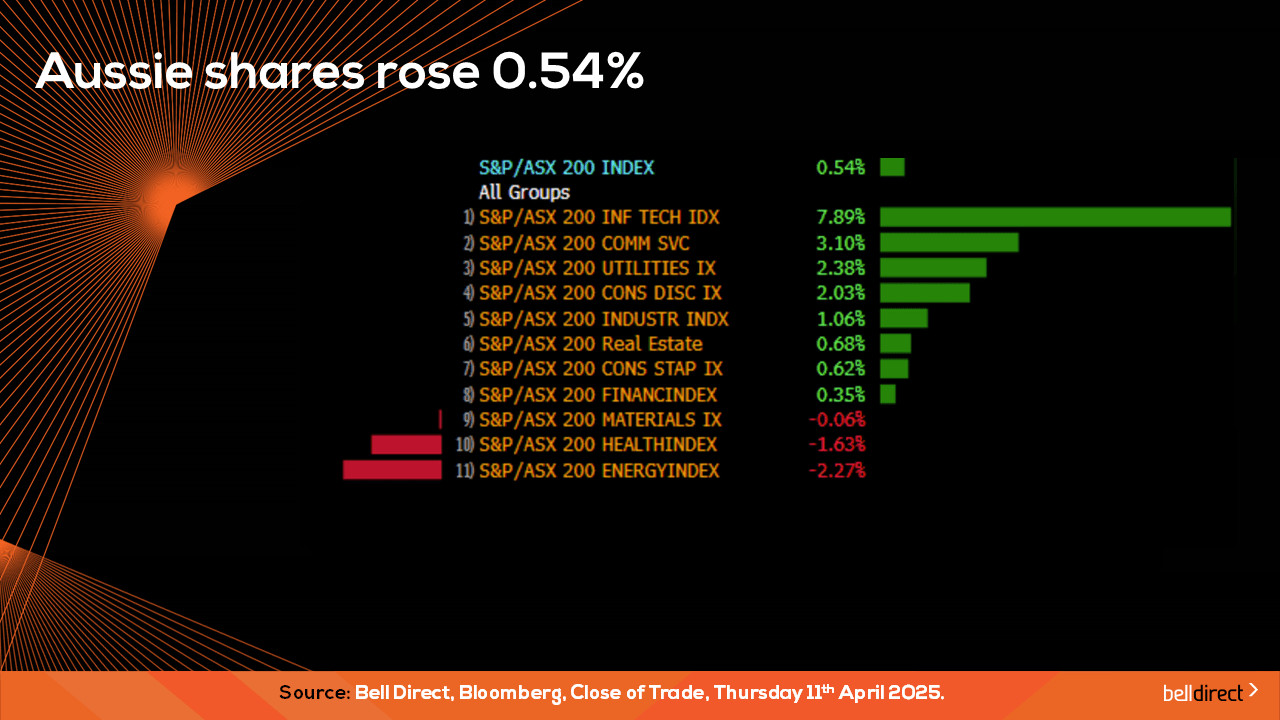

Boosted by yesterday’s rally, the ASX200 advanced 0.54% Monday to Thursday this week, with the information technology sector up the most, an impressive 7.89%. Energy, healthcare and materials were the only sectors to close in the red over the four trading days.

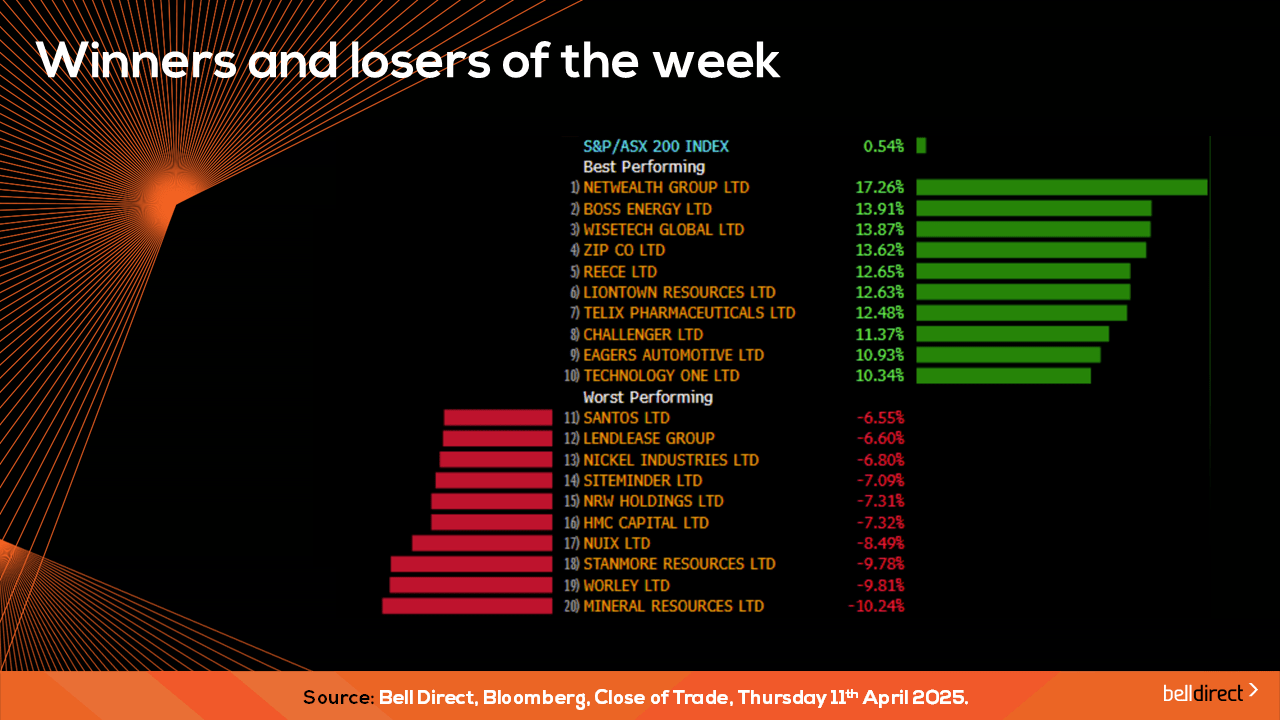

On the ASX200 leaderboard Netwealth Group (ASX:NWL) advanced more than 17%, following the release of the investment company’s quarterly update, reporting $3.5 billion in net flows for the quarter, up 29% on the prior corresponding period. Meanwhile, Mineral Resources (ASX:MIN) decline the most, down over 10% this week and down 80% in the past 12 months. MIN operated in the iron ore and lithium markets, which have experienced fluctuations and volatility in recent months.

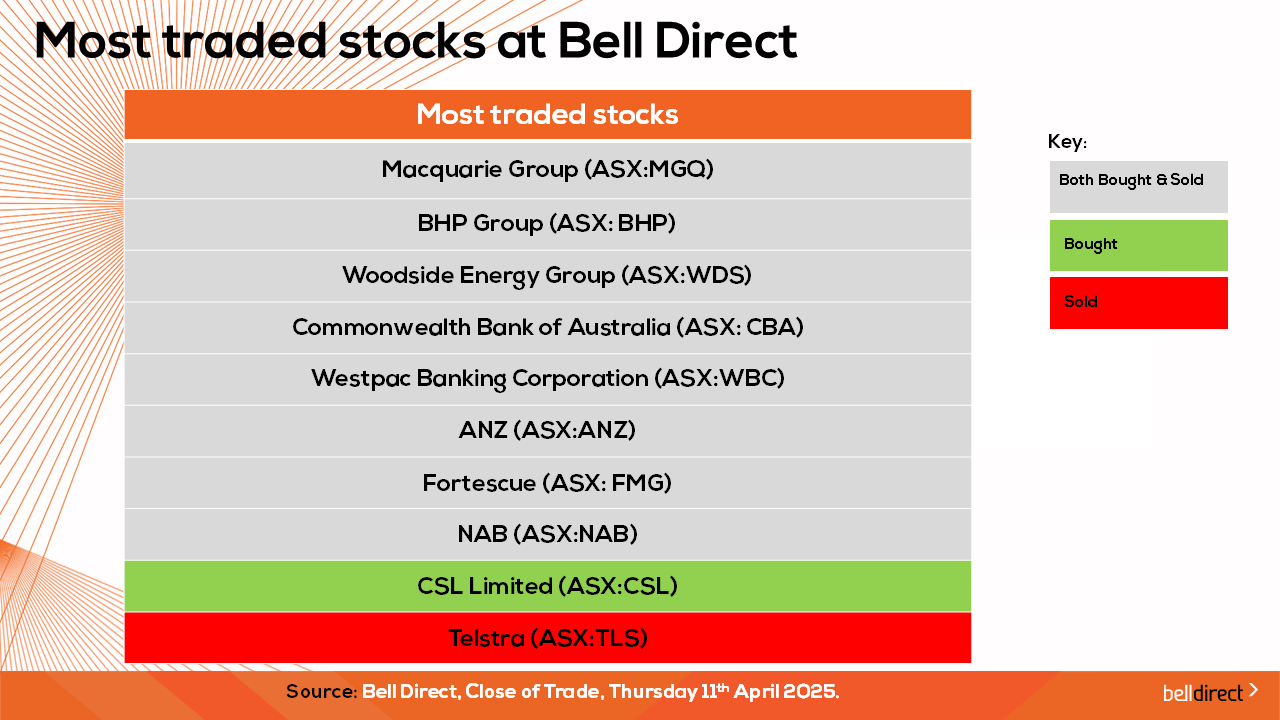

As for the most traded stocks by Bell Direct clients this week, these included Macquarie Group (ASX:MGQ), BHP Group (ASX:BHP), Woodside (ASX:WDS), Commonwealth Bank (ASX:CBA), Westpac (ASX:WBC), ANZ (ASX:ANZ), Fortescue (ASX:FMG) and NAB (ASX:NAB).

Clients also bought into CSL Limited (ASX:CSL), while took profits from Telstra (ASX:TLS).

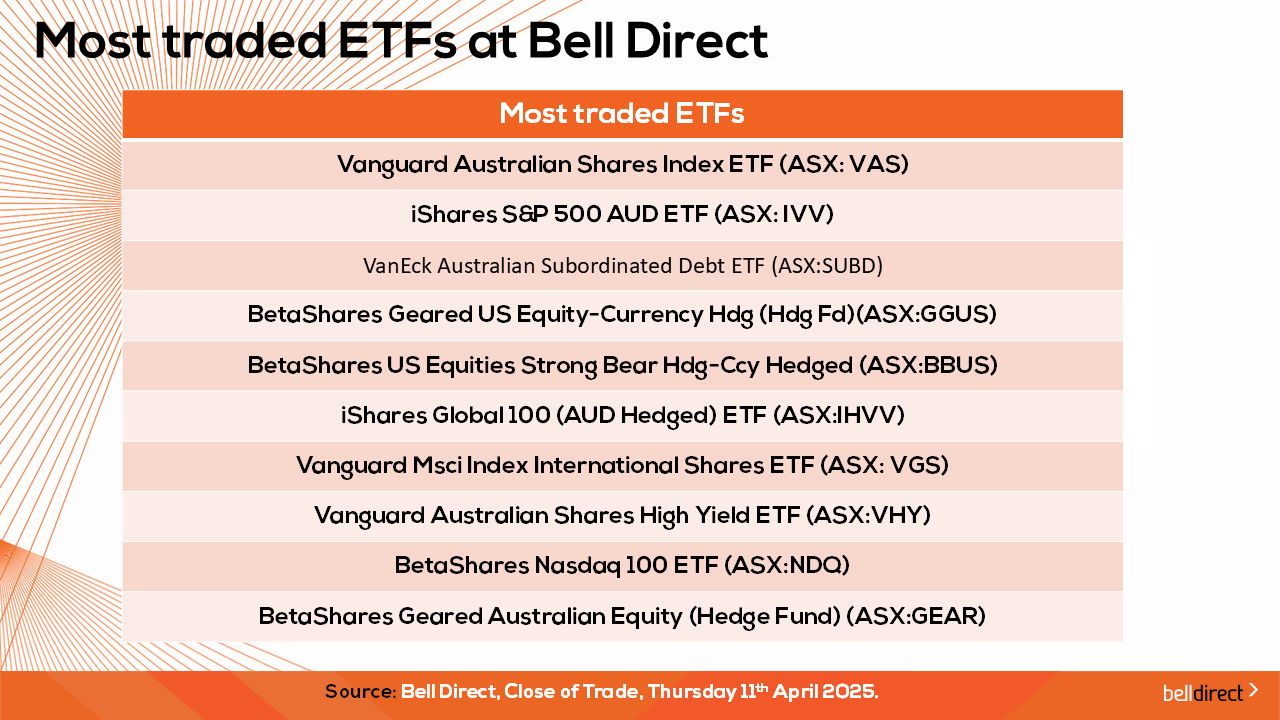

The most traded ETFs Vanguard Australian Shares ETF (ASX:VAS), iShares S&P500 ETF (ASX:IVV) and the VanEck Australian Subordinated Debt ETF (ASX:SUBD).

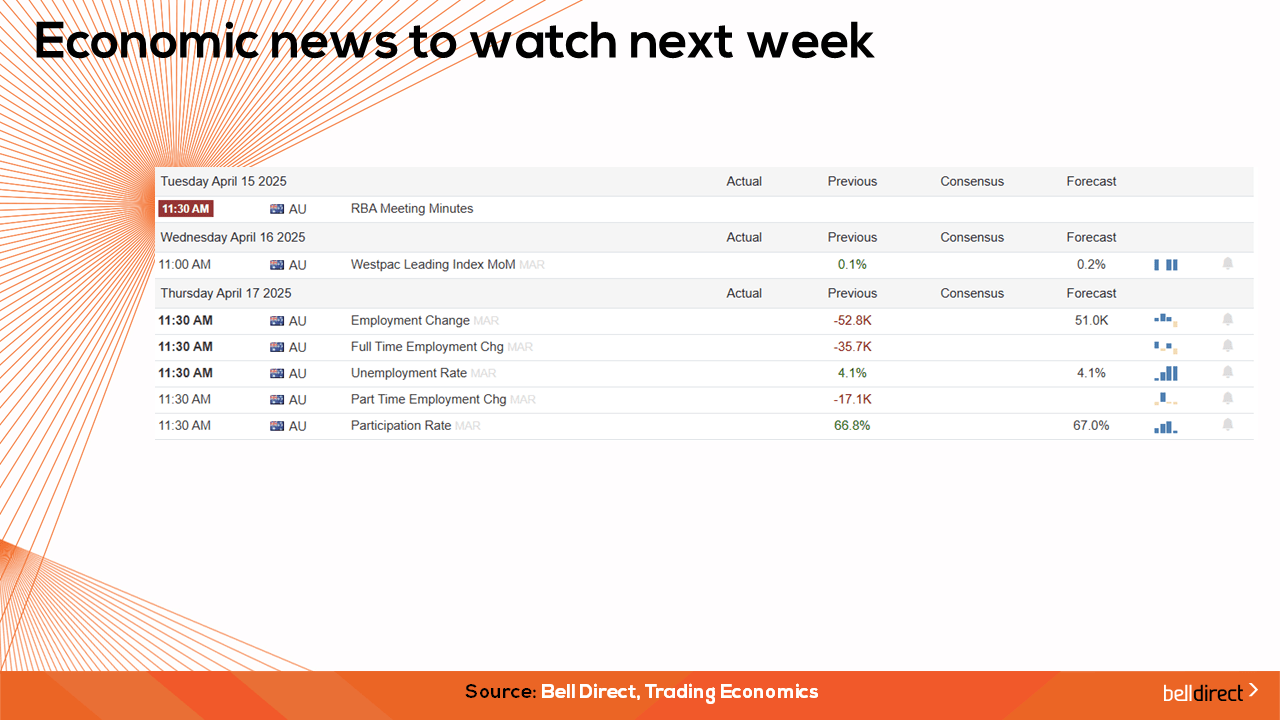

And to end, economic data to watch next week: The RBA will release its latest meeting minutes on Tuesday, and unemployment data for March will be out on Thursday.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great Friday and we’ll see you again on Monday morning.