Transcript: Weekly Wrap 20 December

Well, the end of 2024 is here and the ASX has posted over 10 record closes this year alone signalling the strength in Aussie equities against a challenging macroeconomic backdrop floored with many headwinds. The key index has risen just under 8% through 2024 to 20th December as an over 50% rally for tech stocks led the charge both on the local and global markets while material and energy stocks weighed on the local index gains.

In 2024, we had China’s sluggish recovery post pandemic hit earnings of our big miners and any companies with exposure to the region, Trump elected as the next President of the USA, Gold prices surging to record highs, retailers surprising to the upside despite high cost of living pressures, and inflationary pressures in Australia showing signs of easing.

While a crystal ball would be handy to give some form of certainty amongst the chaos of markets heading into 2025, we have fundamental outlook driven by key catalysts as outlined below.

Moderating inflation will drive the rate cut pathway. With drivers like wage price inflation, retail spend, services inflation, and housing prices, remaining sticky in 2023 and 2024, the outlook for rate cuts was dim as the RBA took a more cautious approach to lowering the nation’s cash rate than the US which also had a more aggressive rate hike strategy. However, in 2025, we expect such key inflation drivers will continue to moderate which will pave the way for the RBA to cut interest rates and ease the cost-of-living pressures for Australians.

China’s growth rate is expected to recover in 2025 which drives tailwinds for trade recovery especially for the Aussie mining sector. Pending the outcome of the stimulus packages, economists expect growth of 4.5% to 5% in China next year, but it will depend on the total amount and impact of the stimulus with some calling for over 100 trillion Yuan to reignite material growth in the region. It is a watch and wait situation on how material China’s recovery is next year, but if and when it comes, our local mining sector will feel the full tailwinds of increasing demand… finally!

As we enter the rate cut cycle, we expect global demand and growth will moderate if not rise and this will fuel earnings growth for our listed companies. In FY25 we project single digit earnings growth due to the higher input and operational cost environment driven by elevated interest rates in the near term, however, with rate cuts near, we expected double digit earnings growth will follow as consumer demand rises and operating costs moderate.

Trump tariffs will impact markets in a short and sharp way early in 2025 as investors digest and position portfolios to minimise exposure to the trade tariffs. Trump called for a 25% tariff on products imported from Mexico and Canada as well as tariffs up to 60% and more on goods imported from China, in a bid to stimulate domestic demand within the US economy. The extent of the tariffs and exact figures will likely be unveiled after Trump takes office late in January 2025 which we expect will have a short and sharp impact on markets as investors digest and shift portfolio positions to adapt to the tariff implications.

The healthcare sector underperformed most of the market this year but there are a few key companies on the horizon next year that have critical read outs, clinical trial conclusions and regulatory approvals to submit as they each near commercialisation including Opthea, Clarity Pharmaceuticals, Telix Pharmaceuticals and Neuren Pharmaceuticals.

So how do we expect the ASX to perform next year? The key index and certain stocks are unlikely to replicate the stellar returns we have seen this year, but never say never. With interest rate cuts on the horizon, earnings growth potential, recovering economic growth and easing inflation, we could see the ASX rise to record territory again next year. But, as we saw in the US just this week, investors are VERY reactive to rate outlook from central banks, so keeping a close eye on economic data is the best strategy heading into the new year to predict how the RBA’s rate outlook changes month on month.

Taking a look at the markets this week, the local index posted a 1.54% loss from Monday to Thursday as industrial stocks were the only sector to end the week in the green while the materials and energy sectors ended the week down 4.3% and 3.45% respectively.

Wall Street’s slide on Wednesday was the key driver of the ASX losing 1.54% this week as investors responded to the Fed’s rate outlook for 2 cuts next year instead of 4.

The winning stocks on the ASX200 were led by Siteminder (ASX:SDR) rising 9.8% while Transurban (ASX:TCL) rose 5.66% and Pexa Group (ASX:PXA) added 5.08%.

And on the losing end Deep Yellow (ASX:DYL) fell over 17.5% while Coronado Global Resources (ASX:CRN) and HMC Capital (ASX:HMC) ended the week down over 14.5% each.

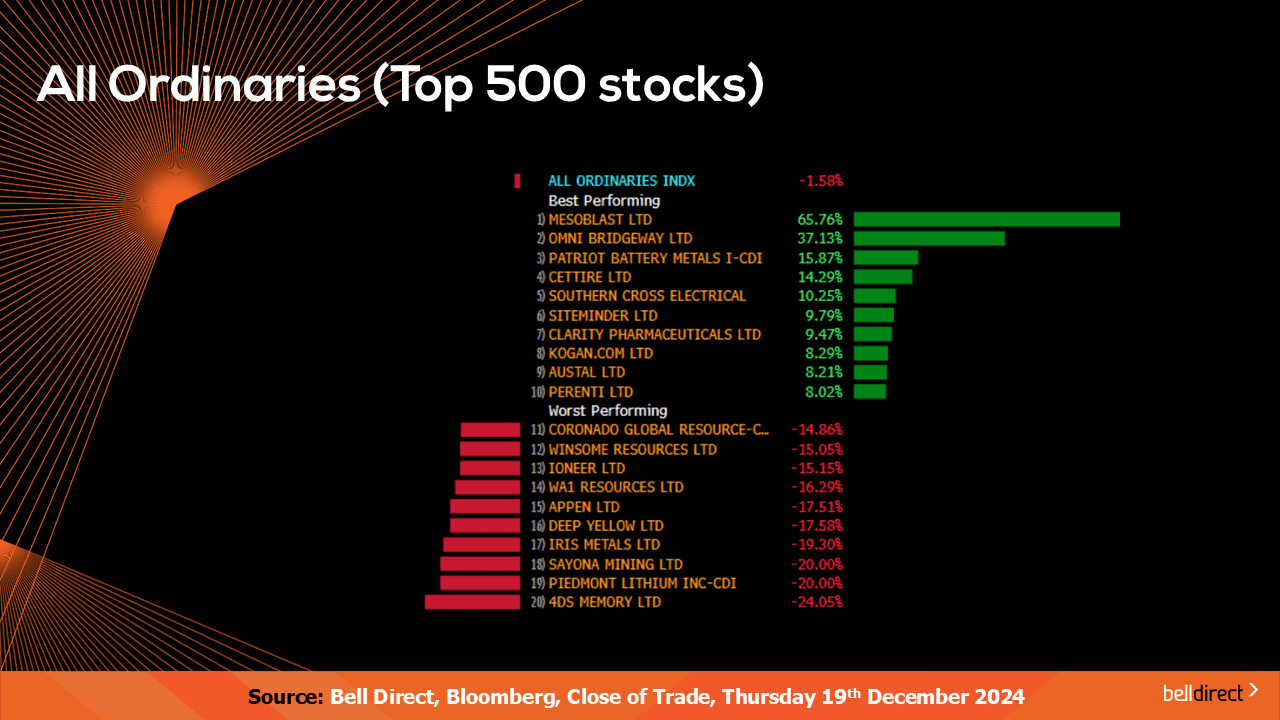

On the broader market index this week, the All Ords fell 1.6% over the 4-trading days as sharp losses for 4DS Memory (ASX:4DS), Piedmont Lithium (ASX:PLL) and Sayona Mining (ASX:SYA) weighed on the index.

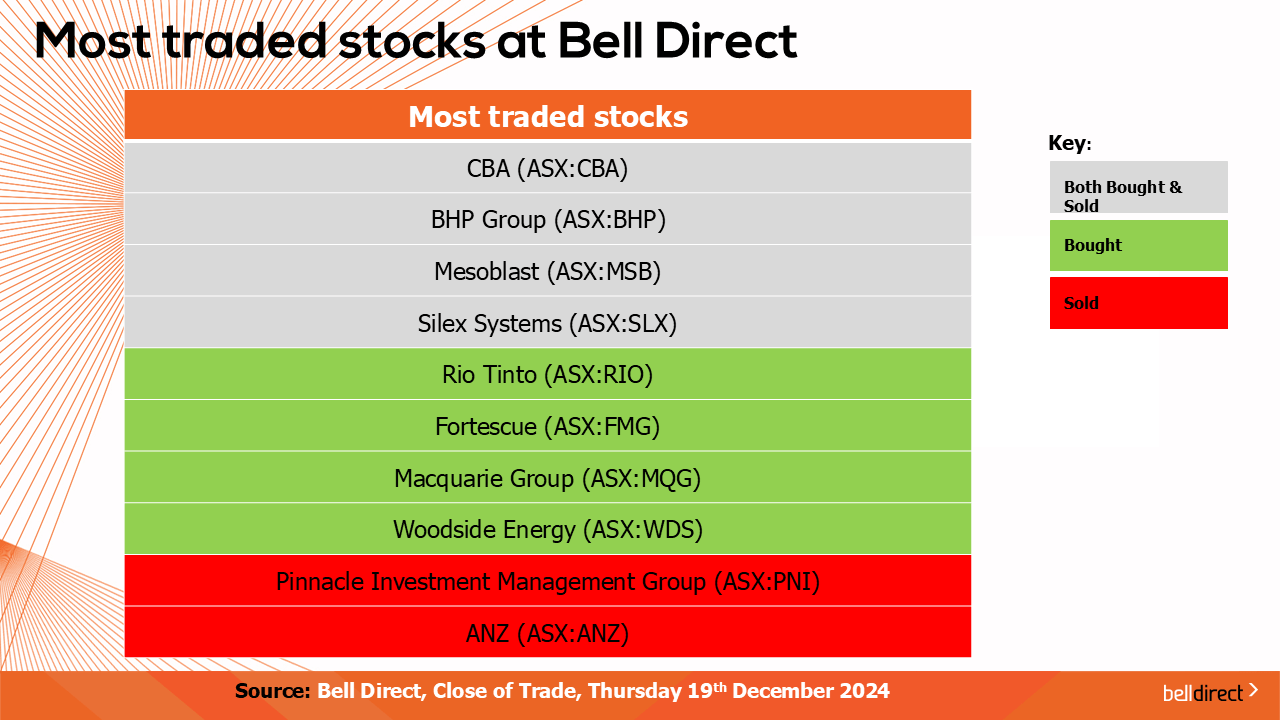

The most traded stocks by Bell Direct clients this week were CBA (ASX:CBA), BHP (ASX:BHP), Mesoblast (ASX:MSB), and Silex Systems (ASX:SLX). Clients also bought into Rio Tinto (ASX:RIO), Fortescue (ASX:FMG), Macquarie Group (ASX:MQG), and Woodside (ASX:FMG) while taking profits from Pinnacle Investment Management Group (ASX:PNI), and ANZ (ASX:ANZ).

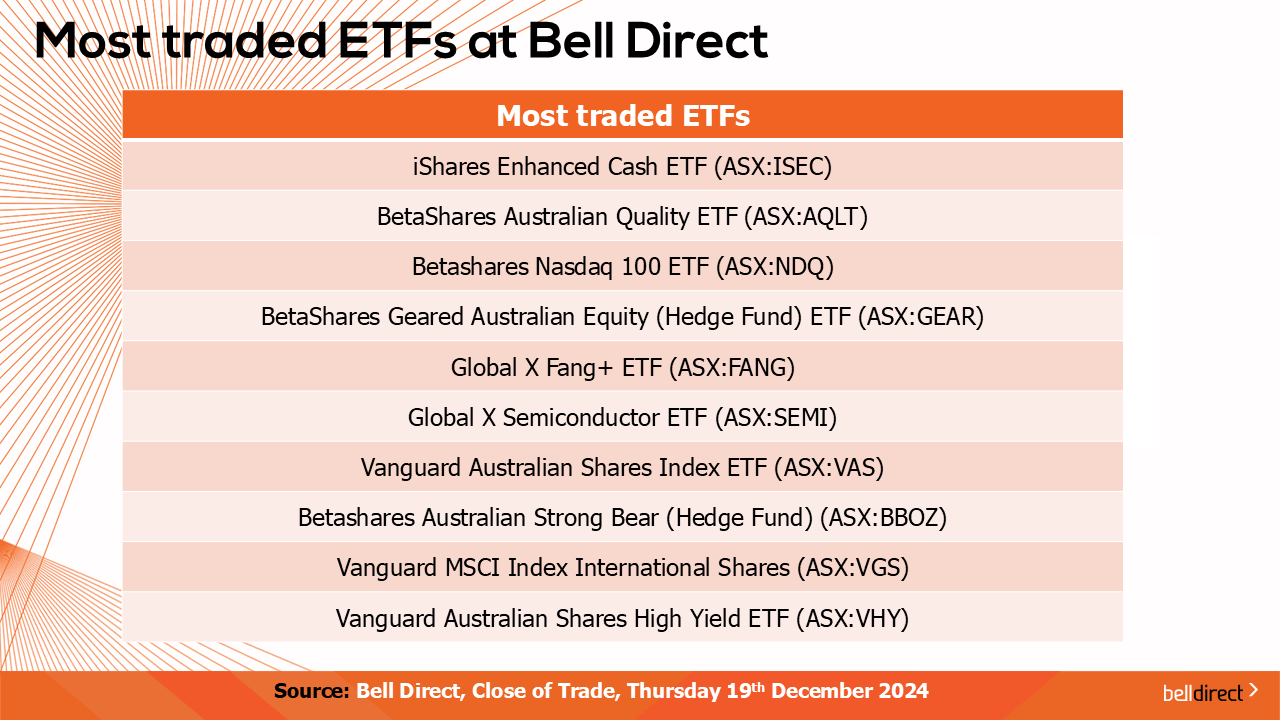

And the most traded ETFs by our clients this week were led by iShares Enhanced Cash ETF, Betashares Australian Quality ETF, and Betashares Nasdaq 100 ETF.

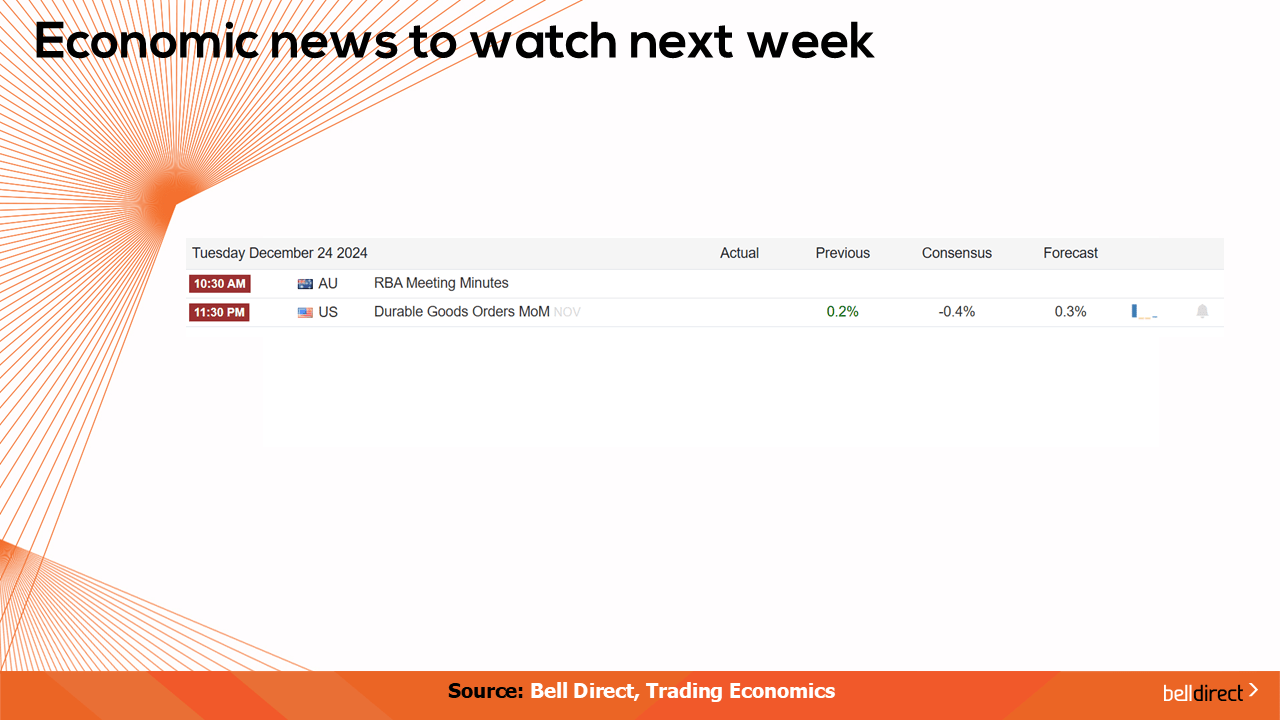

On the economic calendar front next week it is a relatively quiet week as we have the Christmas holiday however we may see investors react to the RBA meeting minutes out on Tuesday which will give investors insight into the rate journey for the RBA heading into 2025.

And that’s all for this Friday and for 2024. We hope you have enjoyed our market coverage for this year and we will be back from January 6th to commence market commentary, insights and exclusive interviews to help you on your investing journey in 2025.