Transcript: Weekly Wrap 13 December

A few key economic data readings, central bank decisions and stimulus talks were the key drivers behind market moves this week. Let’s dive into what happened on the local and global markets in this second trading week of December.

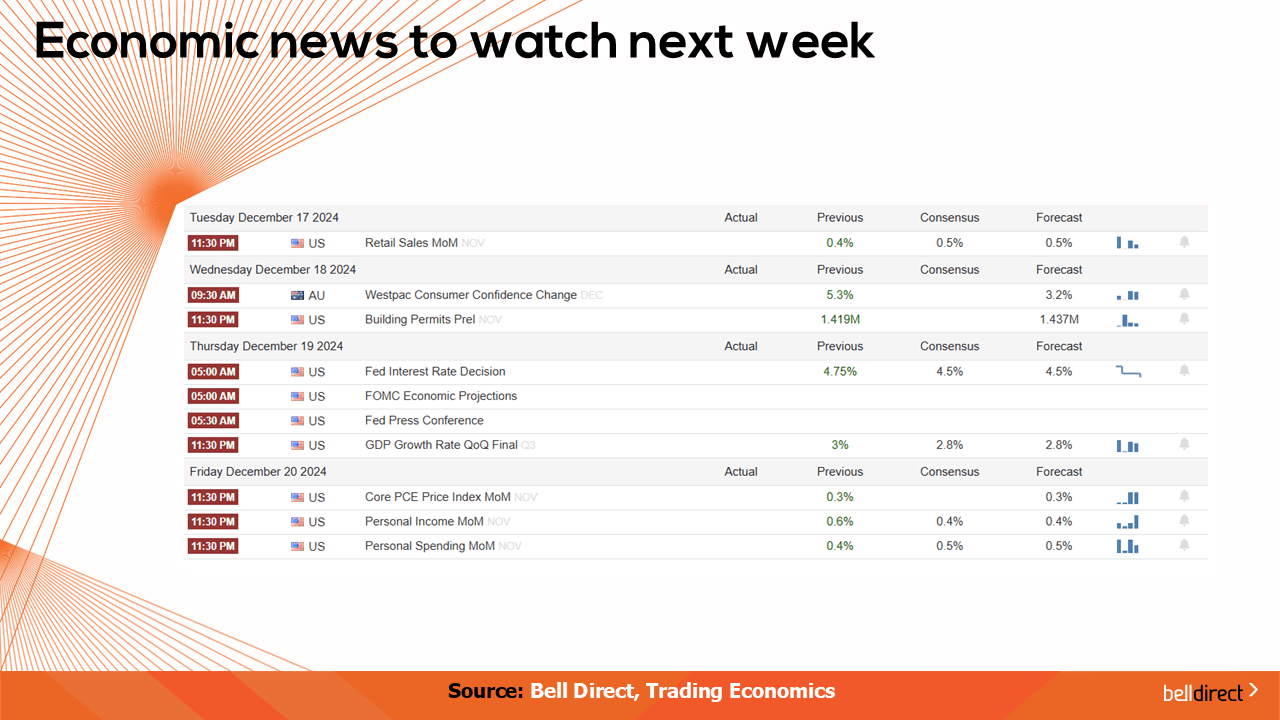

The highly anticipated final US inflation reading for 2024 was released on Wednesday, with the data meeting economists’ expectations and paving the way for the Fed to consider cutting interest rates again at the FOMC meeting on December 17-18. Core inflation, which strips out volatile inflationary drivers like fuel and food prices, rose 0.3% from October to November and 3.3% on an annual basis.

The outlook for lower interest rates boosted the tech-heavy Nasdaq to a record high on Thursday as the high growth sector feels the greatest benefits from a lower interest rate environment compared to other sectors.

At home this week, the RBA maintained Australia’s cash rate at 4.35% at the final meeting for 2024 as some key inflationary pressures remain persistent and inflation is yet to remain within the target 2-3% consistently in Australia.

Our mining companies also felt a boost earlier this week on fresh stimulus talks out of China. Any news and promises out of Chinese officials regarding stimulus packages and boosts to the Chinese economy have led to gains for the local mining sector over the last 12-months. Tuesday was no exception with Chinese leaders on Monday promising more ‘proactive’ fiscal measures and moderately looser monetary policy for 2025.

The timing of the stimulus talks was interesting though as China’s inflation data also out on Monday indicated easing inflation in November from 0.3% growth in October to a 0.2% rise in November, which signals further sluggish economic recovery in the region post pandemic.

While any stimulus out of China to reignite demand of global goods and services is welcomed, caution around buying into a hype rally is required. Until the stimulus flows through to material economic growth and demand increases, investors should be cautious about buying in.

Later in the week we had the all-important Australian jobs data released for November. The jobs data plays a significant role in shaping both inflation and rate outlook expectations for the RBA with a lower unemployment rate signalling strength in the labour market which leads to more money being spent and inflationary pressures rising, while a higher unemployment rate signals weaker economic conditions.

The data showed that the unemployment rate in Australia fell to 3.9% in November from 4.1% in October which was well below economists’ expectations and adds to the RBA’s headache heading into the February rate meeting. Employment in Australia rose by 35,600 in November, which well exceeded the 25,000 markets were expecting, while full time employment soared to an increase of 52,600 last month which also well exceeded the expectations of 10,000 new full-time workers. The data indicates the labour market in Australia remains tight and the RBA will consider this reading and the jobs reading in January before considering a rate cut in February, among other key inflation drivers.

Locally from Monday to Thursday the ASX200 fell 1.08% breaking the traditional santa rally of the December month. Materials stocks rallied 1.88% while tech stocks tumbled 5.3% over the 4-trading days.

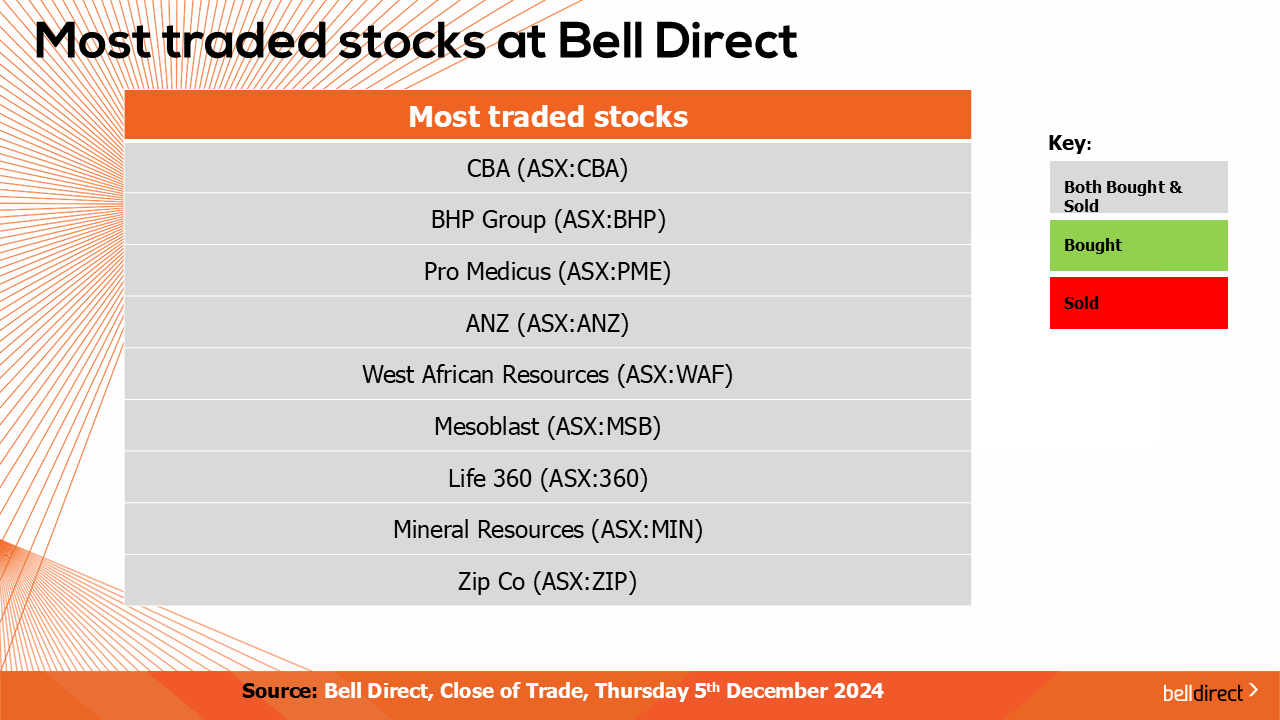

The winning stocks were led by Insignia Financial (ASX: IFL) adding 10.4%, Vault Minerals (ASX:VAU) rallying 8.6% and Coronado Global Resources (ASX:CRN) rising 8.4%.

And on the losing end Ventia Service Group (ASX:VNT) tanked 22%, while Alcoa (ASX:AAI) and Life360 (ASX:360) fell 13.4% and 12.4% respectively.

On the broader market index, the All Ords fell 1.18% as Platinum Asset Management fell 36% while NextEx Group rose 44%.

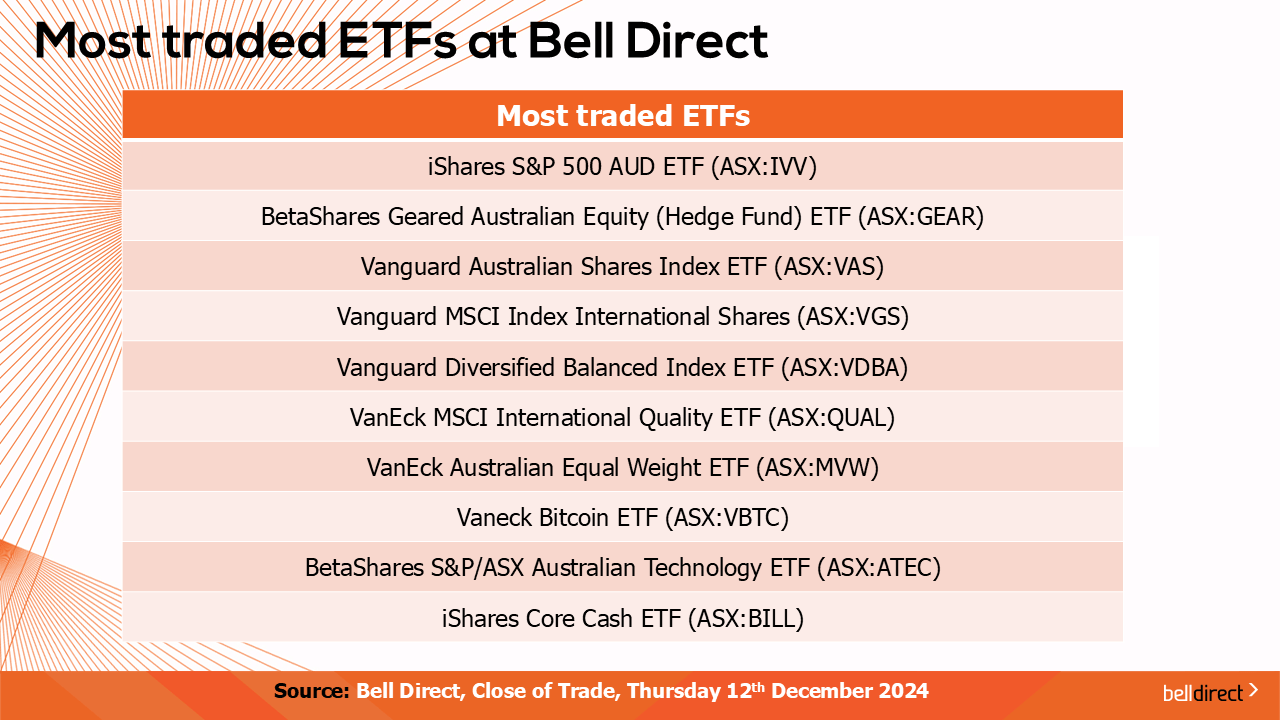

And the most traded ETFs were led by iShares S&P 500 AUD ETF, BetaShares Geared Australian Equity (Hedge Fund) ETF and Vanguard Australian Shares Index ETF.