Transcript: Weekly Wrap 6 December

Let’s look at what moved markets this week.

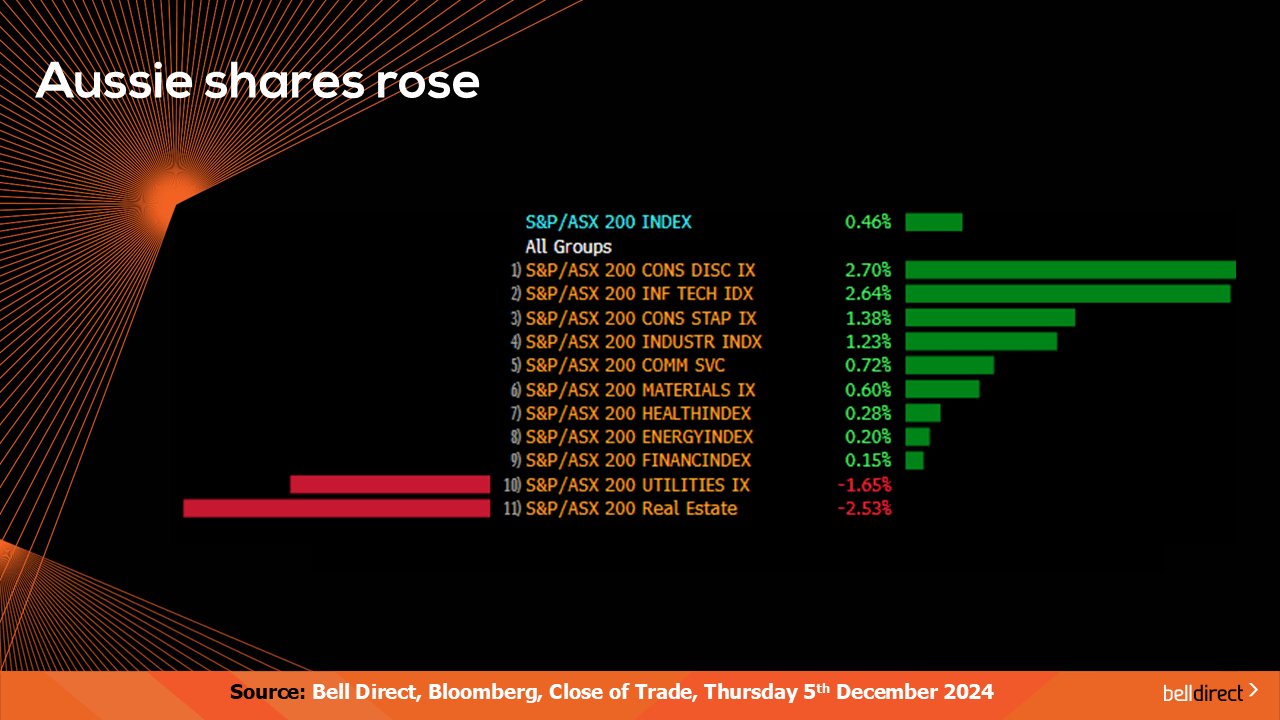

The local market posted a near half a percent gain over the trading week to a fresh record on Tuesday, amid GDP rising slower than economists forecasted and Wall St rising to fresh record highs. Consumer discretionary stocks led the gains this week on the back of the record black Friday sales, while real estate stocks fell out of favour with investors over the trading week.

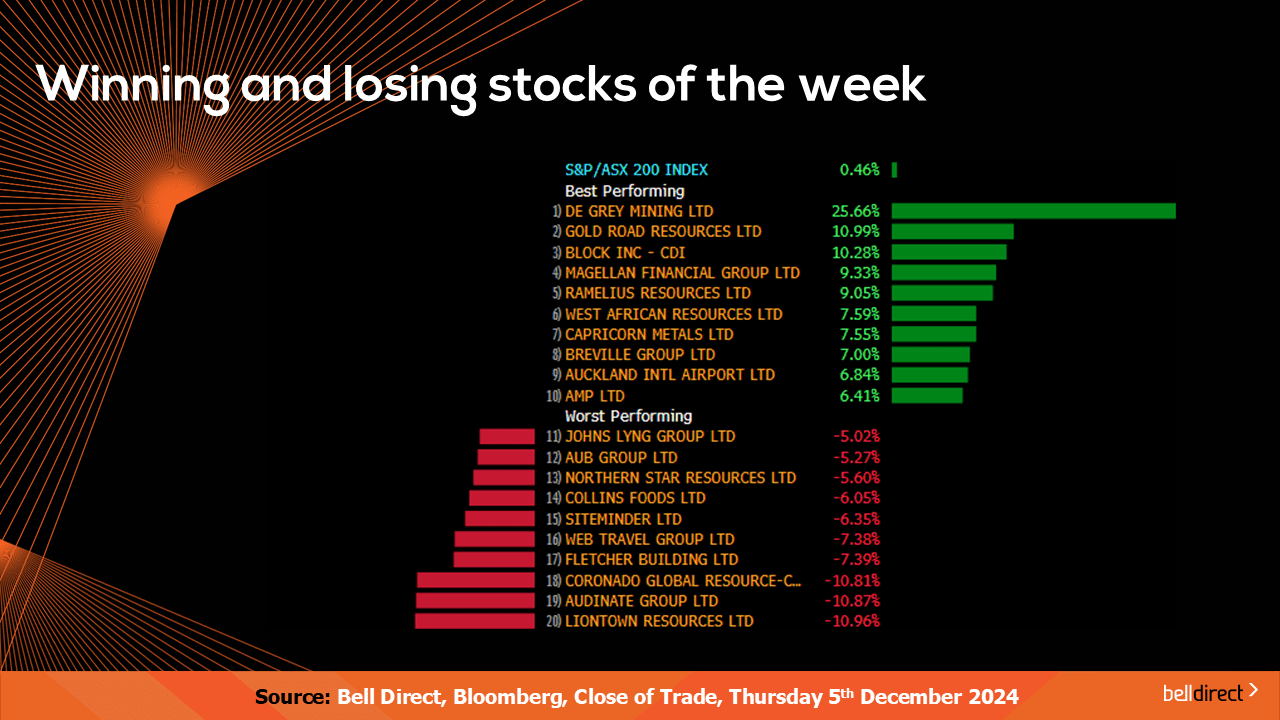

The winning stocks on the ASX200 this week were led by De Grey Mining soaring 26% on a takeover offer from Northern Star Resources worth $3.26bn. Gold Road Resources (ASX:GOR) added 11% over the trading week and Block Inc (ASX:SQ2) rose 10.3%.

On the losing end, Liontown Resources (ASX:LTR) fell 11%, Audinate (ASX:AD8) lost 10.87%, and Coronado Global Resources (ASX:CRN) ended the week down 10.81%.

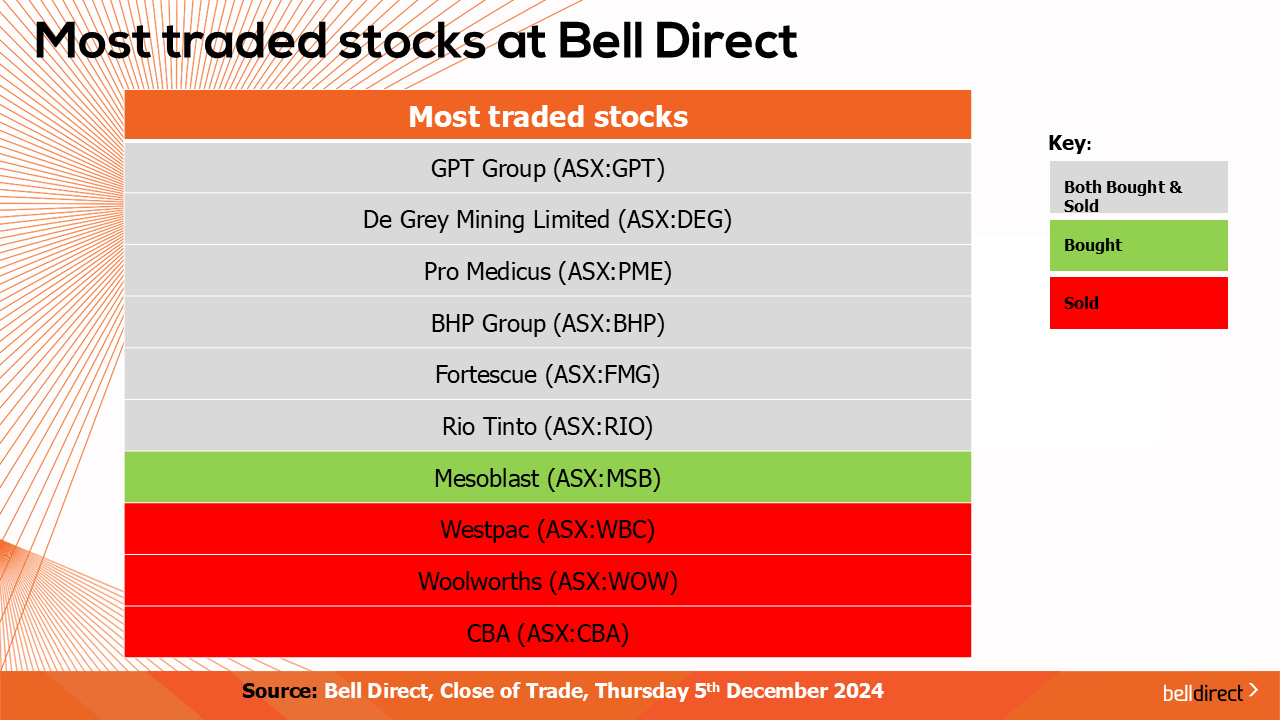

The most traded stocks by our clients this week were led by GPT Group (ASX:GPT), De Grey Mining (ASX:DEG), Pro Medicus (ASX:PME), BHP Group (ASX:BHP), Fortescue (ASX:FMG), and Rio Tinto (ASX:RIO). Clients also bought into Mesoblast (ASX:MSB) while taking profits from Westpac (ASX:WBC), Woolworths (ASX:WOW) and CBA (ASX:CBA).

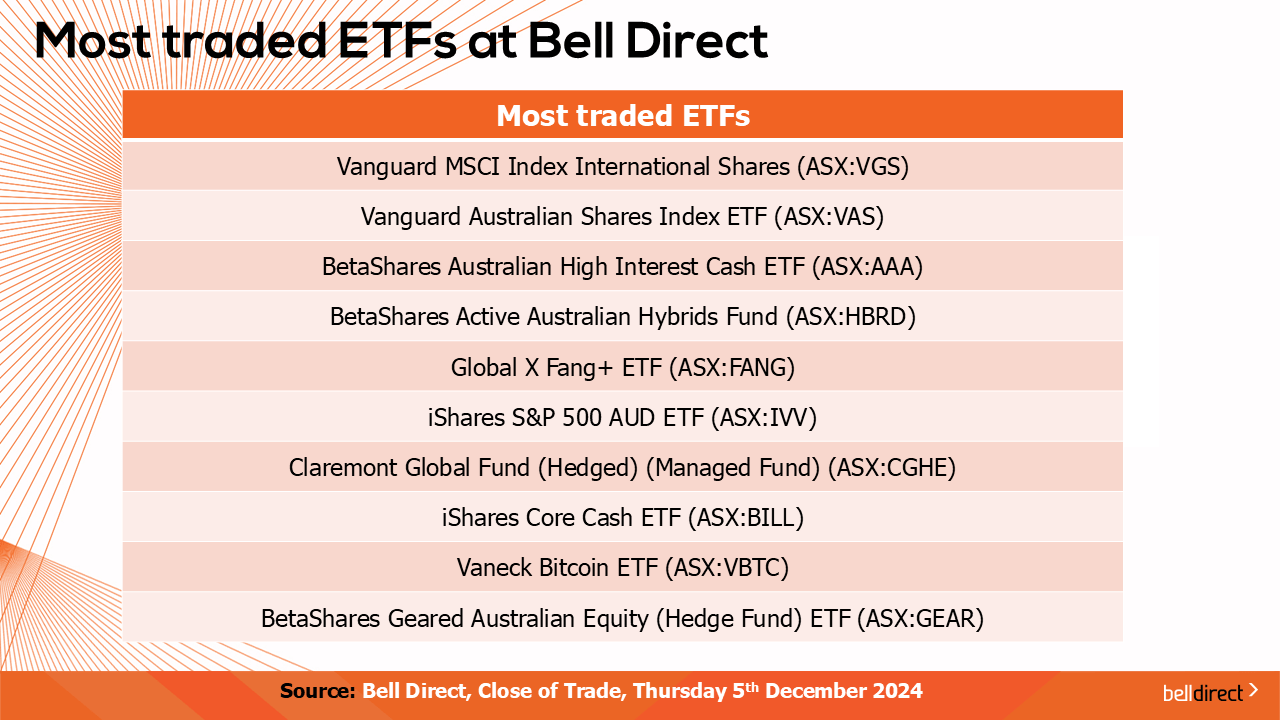

The most traded ETFs by our clients this week were led by Vanguard Msci Index International Shares ETF, Vanguard Australian Shares Index ETF, and Betashares Australian High Interest Cash ETF.

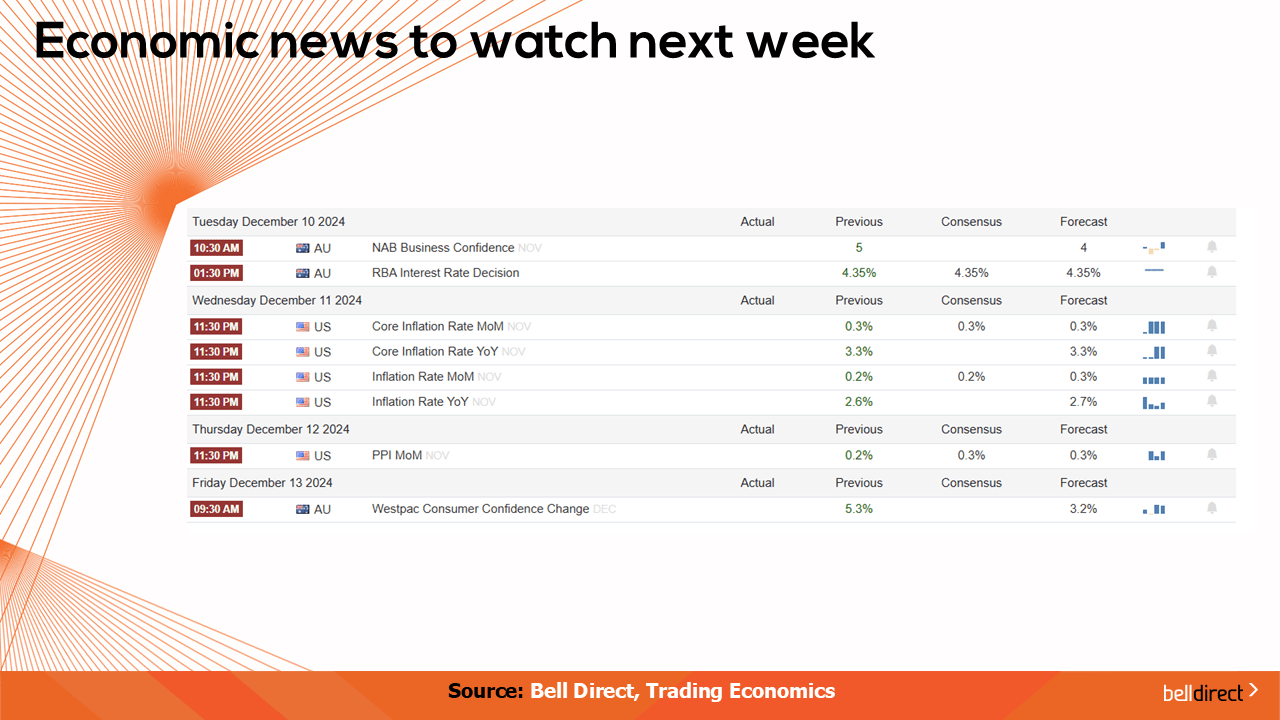

On the economic calendar front next week Australia’s Business confidence data for November is out on Tuesday just before the RBA’s last rate decision for 2024 where it is expected Australia’s central bank will maintain the current cash rate at 4.35%. Westpac consumer confidence data is out later next week.

Overseas, China’s inflation rate data for November is out on Monday with the forecast of slight growth, and China’s trade balance is out on Tuesday with the forecast of a slight decline in the current trade surplus.

In the US, key inflation data is out on Wednesday with economists forecasting the annual inflation rate to rise to 2.7% from 2.6% while core inflation is expected to remain at 3.3%.

And that’s all for this Friday, have a wonderful weekend and happy investing!