Transcript: Weekly Wrap 8 November

This week saw global markets rally in anticipation of the outcome of the US Presidential Election early in the week and Wall St among other global markets rally in the aftermath of former President Donald Trump regaining the title of President of the United States of America in the early hours of Wednesday US time. The major averages in New York rallied to record highs at the closing bell on Wednesday but let’s take a look at the sectors and stocks that will likely benefit from the Trump presidency outcome and what it means for the local market.

The gold price took a hit in the hours after President Trump won the 2024 US Presidential Election as the USD rebounded from recent lows. Another reason for the gold price fall is concerns over Trump’s policies having the potential to reignite inflation in the US which prompted bond yields to rise which makes gold less attractive to investors. Despite the short-term drop overnight, other tailwinds remain for gold to continue its year-long rally into the new calendar year amid ongoing geopolitical tensions, under supply, global central banks buying up increased bullion and the outlook for rate cuts on the horizon.

EV giant Tesla shares experienced a strong boost, with a rise of 14.75% on Wednesday after Trump was announced as President. The key reason for the Tesla share rally in the aftermath of the election result was driven by Trump’s policies that have the potential to boost demand for Tesla EVs over Chinese and other global competitors. Trump plans to impose extensive tariffs on Chinese imports including EVs which diminishes the likelihood of Chinese EVs holding market share in the US automobile market and drives consumers back to the first mover in the EV space, Tesla. Tesla dominates sales of EVs in the US with just shy of 50% market share in the US as of mid-2024, which will likely grow when Trump’s tariffs begin.

Companies with domestic manufacturing operations in energy, industrials, and other key areas of the economy, will also feel the benefits of Trump’s proposed tariffs on Chinese imports given the focus is on driving demand for domestic goods. This expands into the chip, semiconductor space and further into the AI sector too. For companies like Nvidia and Apple, which rely heavily on China and Taiwan for their respective supply chains, we may see an inflation in the price of chips drive up input costs for the end users of the in-demand technology for years to come.

The tariffs also extend beyond tech and into battery metals and other key commodities which weighed on most commodity prices on Thursday this week with gold falling 3.12% over the week while copper dropped 0.65%. The Trump key focus of the tariffs is to boost domestic demand and output to strengthen the US economy from within.

So how does the US election outcome impact our local market and economy? Firstly, the AUD depreciated against the greenback to buy 66.20 US cents on Thursday, and the ASX recovered early session losses to close almost flat on Thursday after Trump’s victory was announced.

Stock and sector specific beneficiaries of the Trump victory include technology providers, specifically companies in the defence tech space, dual-listed entities and companies with revenue derived in the US. DroneShield, Electro Optic Systems, and Austal could be the beneficiaries of Trump’s promised defence tech spend as each of the companies have existing contracts and relationships with US entities.

On the dual-listed entities front, ResMed, Block Inc, and News Corporation all rallied this week on strengthened outlook for the US economy with Trump at the helm.

And for those companies that derive revenue from America the grass looks greener heading into Trump’s presidency term as his focus to boost domestic spend enhances the earnings outlook for companies operating in the region including James Hardie Industries which derives over 70% of its total revenue from its North American operations.

On the other end of the scale, local oil producers may come under pressure while Trump is at the helm as the President elect promises to ‘drill baby drill’ in a bid to increase US oil production which adds supply to the global oil market and weighs on the price of the commodity.

So with Trump at the helm, “aiming to make America great again”, it’s a watch and wait situation to see how and when the longer term impacts of his election promises play out on the US and global market landscape.

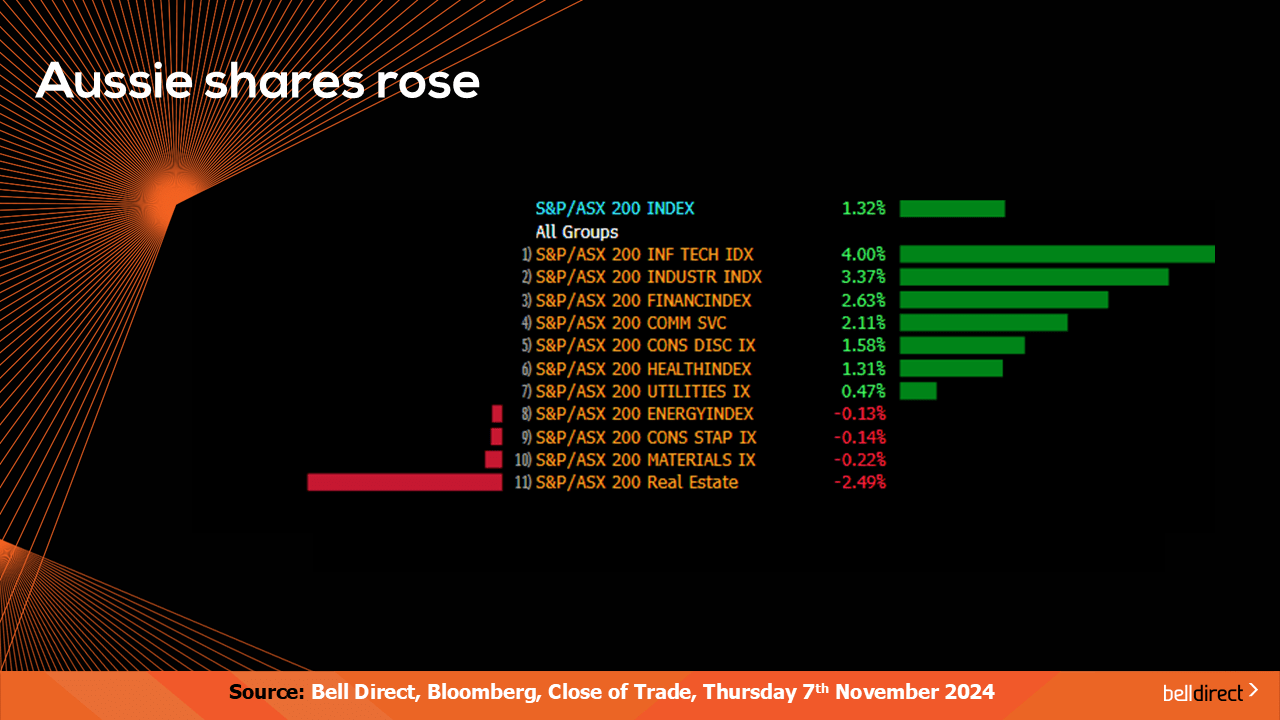

Locally from Monday to Thursday the ASX200 rose 1.32% as a surge in tech stocks boosted the key index higher and offset a 2.5% sell-off for REIT stocks.

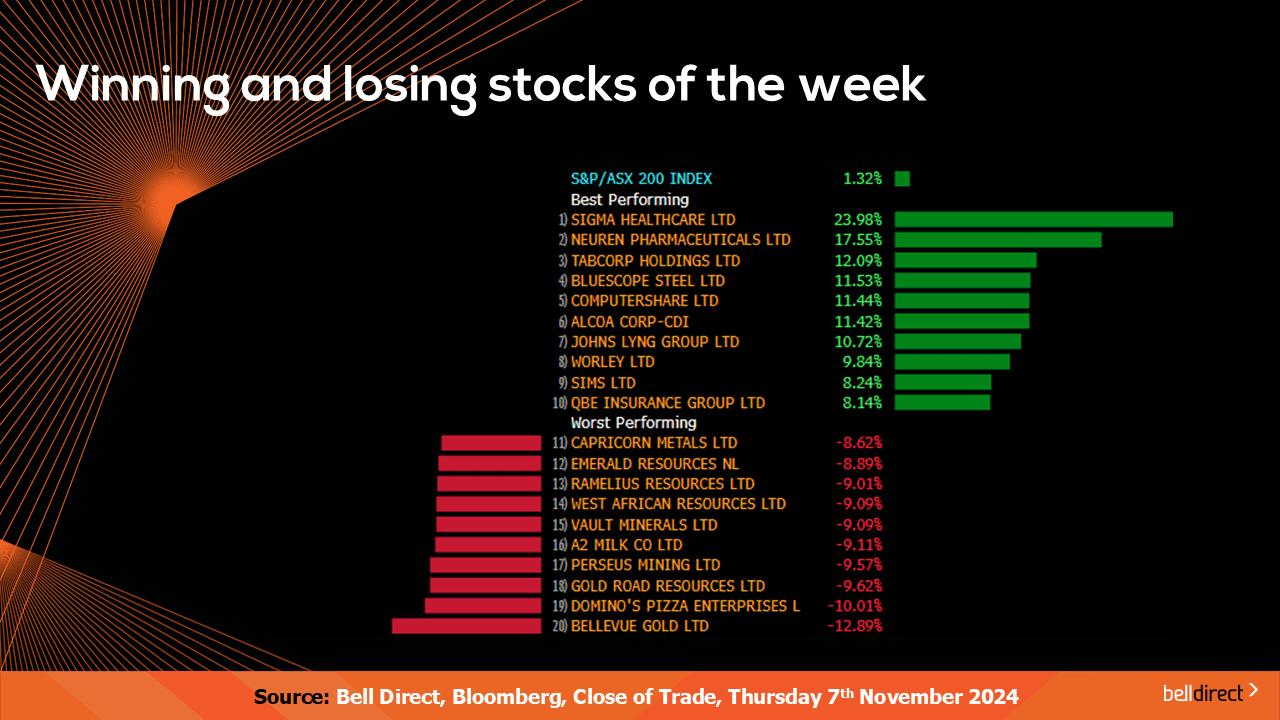

The winning stocks were led by Sigma Healthcare soaring 24% over the week after the ACCC approved the healthcare company’s merger deal with Chemist Warehouse. Neuren Pharmaceuticals also gained 17.55% this week on a positive trading update while Tabcorp rose just over 12%.

And on the losing end Bellevue Gold lost 12.9%, while Domino’s Pizza and Gold Road Resources ended the week down 10% and 9.6% respectively.

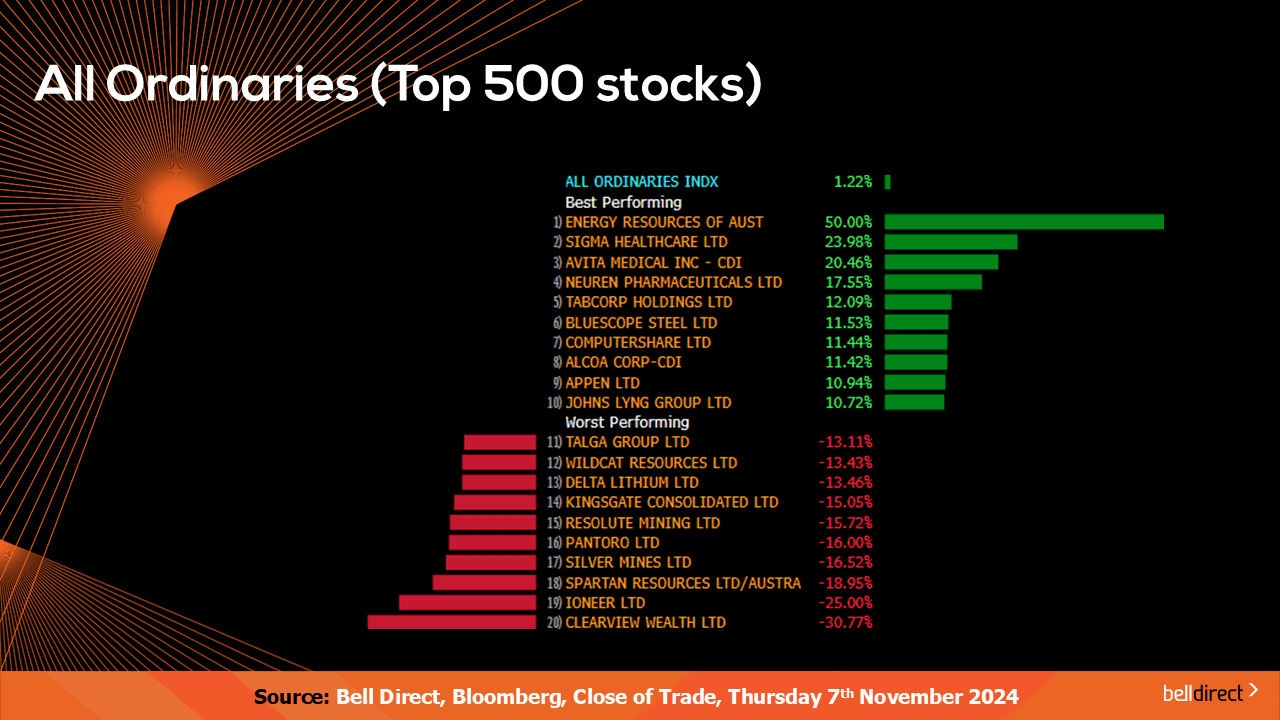

The All Ords posted a 1.22% gain this week as Energy Resources of Australia soared 50% while Clearview Wealth tanked 31%.

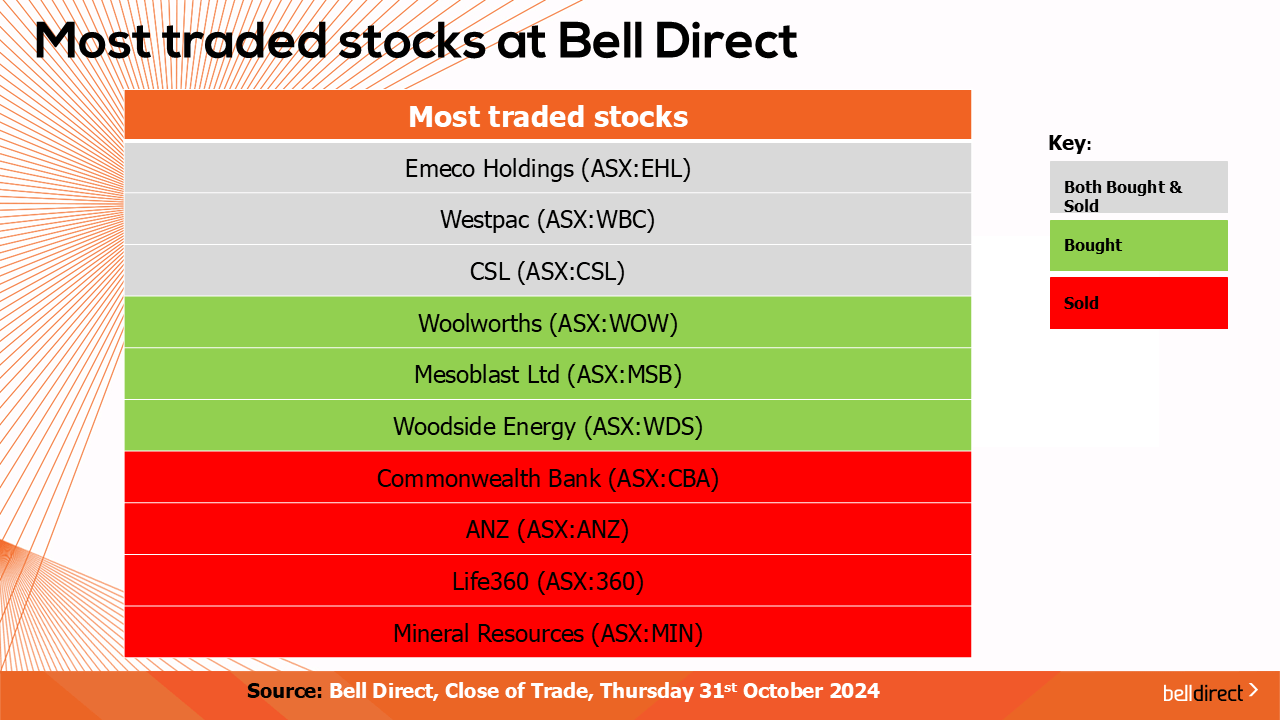

The most traded stocks by Bell Direct clients over the 4-trading days this week were Westpac (ASX:WBC), CSL (ASX:CSL), and Emeco Holdings (ASX:EHL). Clients also bought into Woolworths (ASX:WOW), Mesoblast (ASX:MSB) and Woodside (ASX:WDS) while clients took profits from CBA (ASX:CBA), ANZ (ASX:ANZ), Life 360 (ASX:360) and Mineral Resources (ASX:MIN).

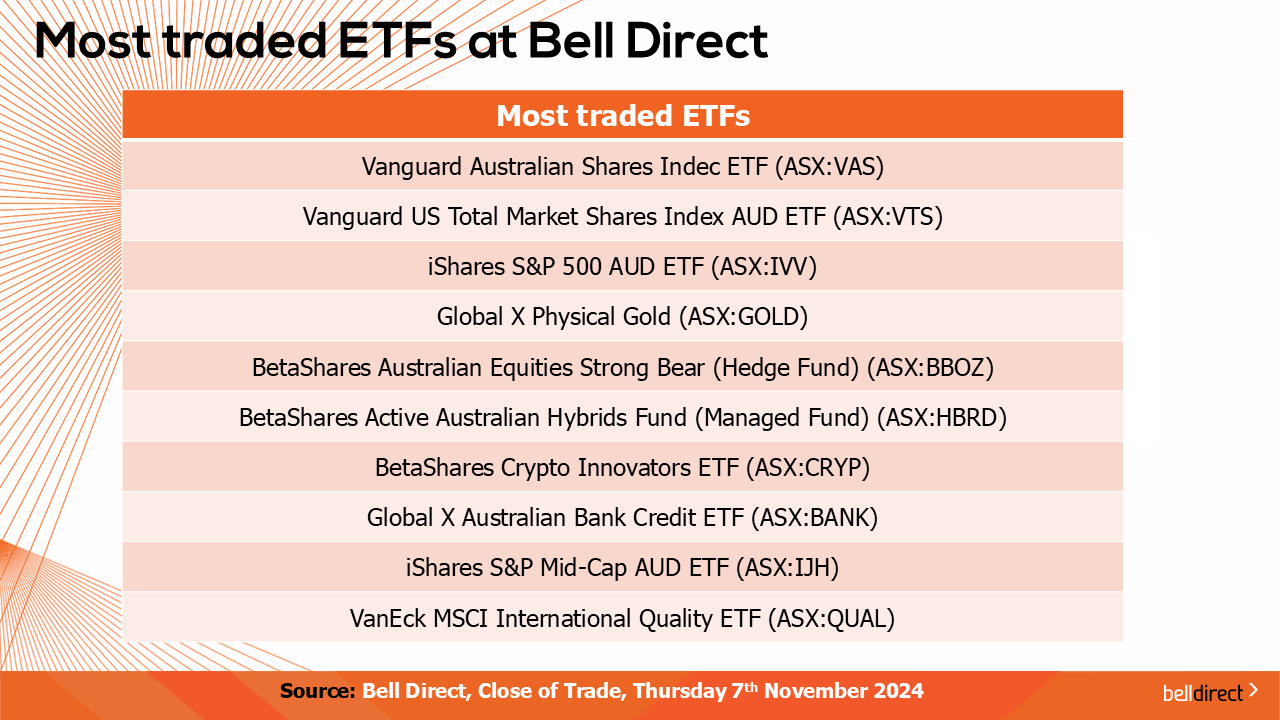

And the most traded ETFs by our clients were led by Vanguard Australian Shares Index ETF, Vanguard US Total Market Shares Index AUD ETF and iShares S&P 500 AUD ETF.

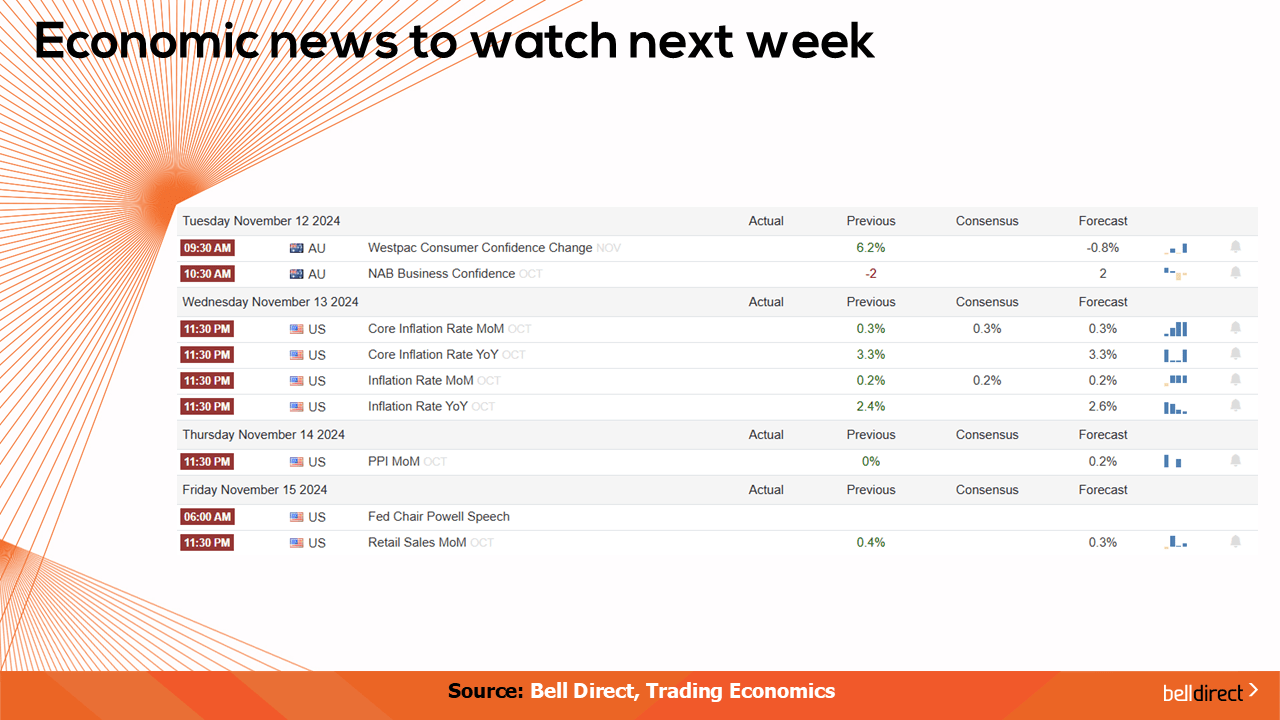

Taking a look at the week ahead on the economic calendar front, we may see local investors react to Westpac Consumer Confidence and Nab Business Confidence data both out on Tuesday with the forecast of a sharp decline in consumer confidence while business confidence is expected to remain flat.

Overseas, key US inflation data out on Wednesday will outline the effect of Fed’s rate strategy and first rate cut had on the inflation taming campaign, while US PPI data for October and retail sales for October are also out on Thursday and Friday next week.

In China, industrial production and retail sales for October are both released on Thursday which will give a key insight into how the world’s second largest economy is recovering post pandemic.

And that’s all for this Friday, have a wonderful day and happy investing!