Transcript: Weekly Wrap 25 October

Today, we’re taking a closer look at Bell Potter’s view on the latest inflation data in Australia and its potential impact on interest rates, as well as Bell Potter’s domestic consumer stock picks. Plus, we’ll cover our local market’s performance this week so far, and what to look out for next week.

There are encouraging signs that inflation is on the decline. The August CPI report revealed a decrease in trimmed mean inflation, which is the RBA’s preferred measure. This suggests that prices are rising at a slower rate, which is positive news for consumers and businesses alike.

However, it’s important to remember that monthly figures can be volatile. The upcoming quarterly data out next week, will provide a more comprehensive picture of the inflation trend and guide the RBA’s future decisions.

While many prices are easing, rental inflation remains a concern. However, recent data from CoreLogic offers some relief. Rental growth has slowed significantly indicating a potential turning point in this market.

Several factors are contributing to this slowdown. Population growth is starting to moderate, reducing demand for rentals. Additionally, rising rental costs are making it more challenging for households to afford housing, leading to a moderation in demand.

Based on these developments, Bell Potter believe the RBA may be poised to cut interest rates in early 2025. While the labour market remains strong, several factors suggest that it won’t hinder disinflation. These include transitory factors like global energy prices and pandemic-related imbalances, as well as signs of easing in the labour market.

Lower interest rates are generally positive for consumers. Domestic consumer stocks, particularly mid-cap and small-cap retailers are expected to benefit. These companies may see increased earnings and share price growth as consumers have more disposable income.

With this in mind, Bell Potter’s retail choices include JB Hi-Fi (ASX:JBH) and Eagers Automotive (ASX:APE).

They view JB Hi-Fi as one of the highest quality retailers on the ASX, with consensus earnings forecasts for FY 26 and FY27 looking too conservative, given the outlook of lower interest rates, real wage growth and tac cuts, with earnings growth of 4.3% and 3.9%, respectively. Therefore, they expect earnings updates to provide further share price upside.

Eagers earnings forecasts look conservative in a backdrop of improving consumer confidence and lower rates in CY25. Bell Potter expects earnings upgrades over the course of the next 12-months, driving the share price higher.

Moving onto the market’s performance this week so far,

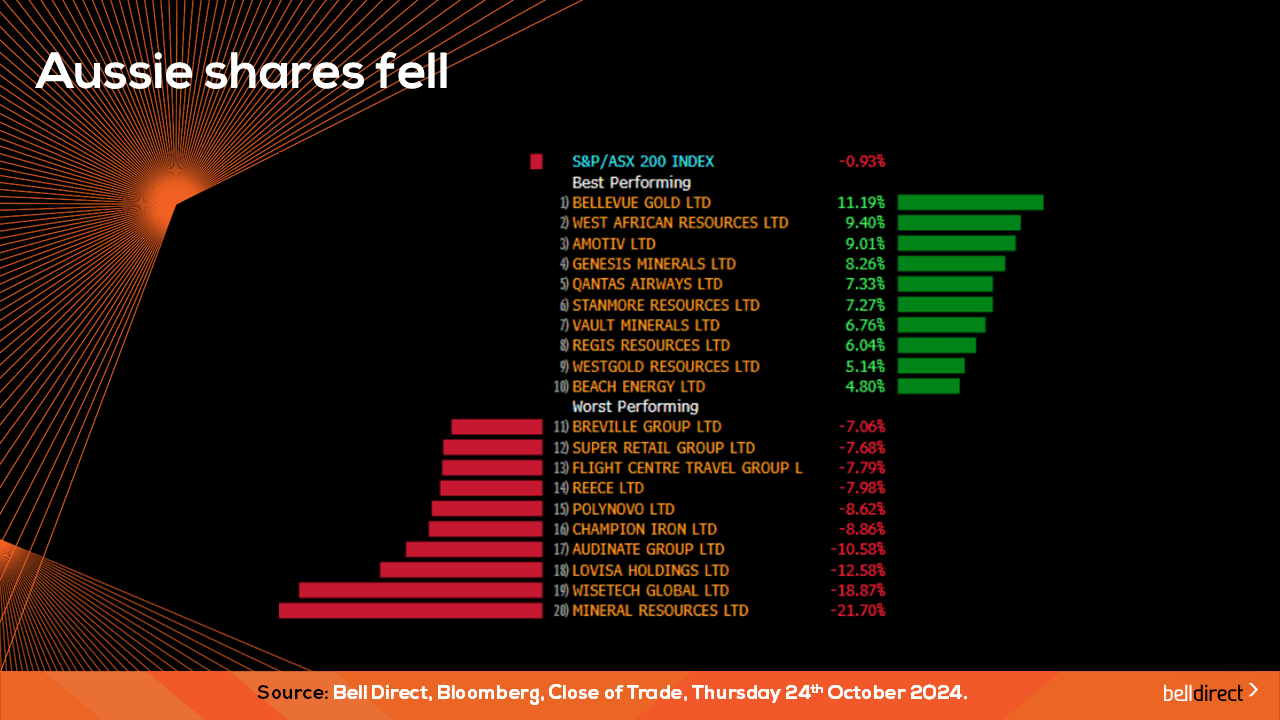

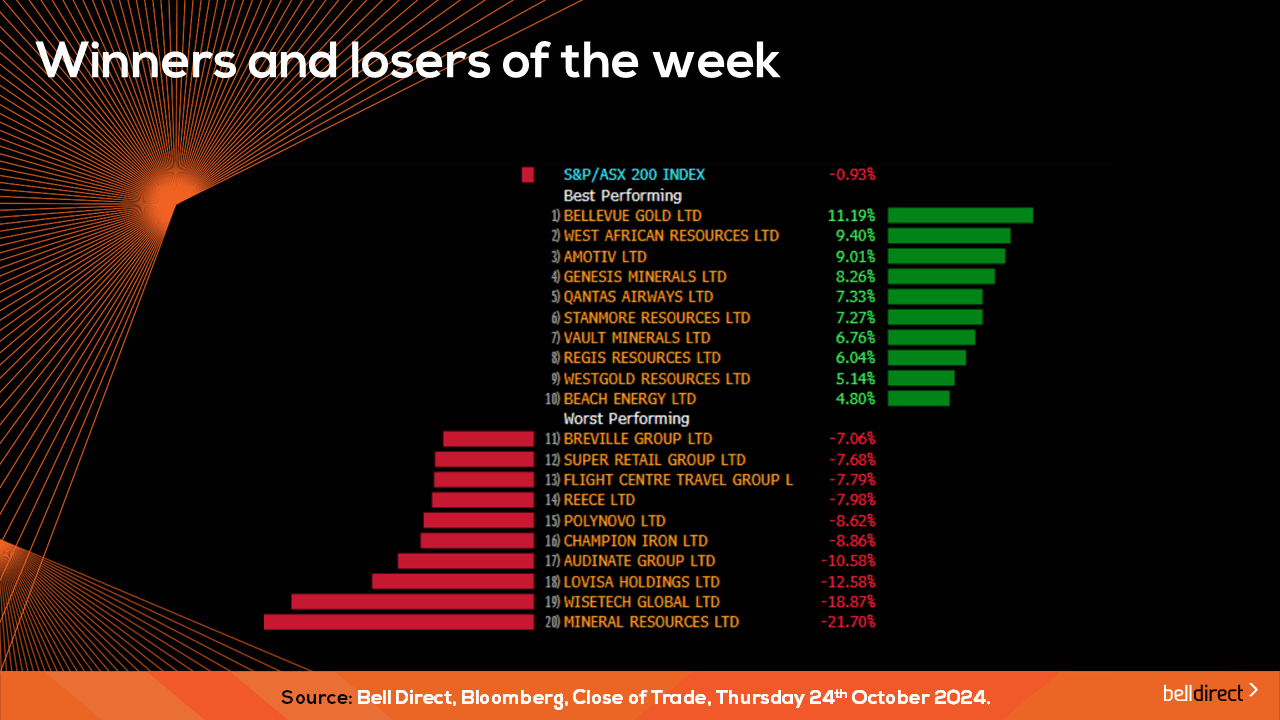

The ASX200 has declined 0.93% Monday to Thursday this week, with the information technology sector, weighing down on the market the most, down more than 7%. Nine of the eleven industry sectors are in the red this week so far.

On the ASX200 leaderboard, Bellevue Gold (ASX:BGL) was the best performer this week, advancing over 11% as gold hit an all time high. BGL is followed by West African Resources (ASX:WAF) and Amotiv Limited (ASX:AOV).

On the other hand, Mineral Resources (ASX:MIN) took a hard hit this week, falling more than 21% this week so far, following news of the companies CEO Chris Ellison’s offshore tax avoidance schemes. Meanwhile, WiseTech (ASX:WTC)’s CEO Richard White’s personal life has also been making headlines this week, and the stock price is down almost 19% this week so far.

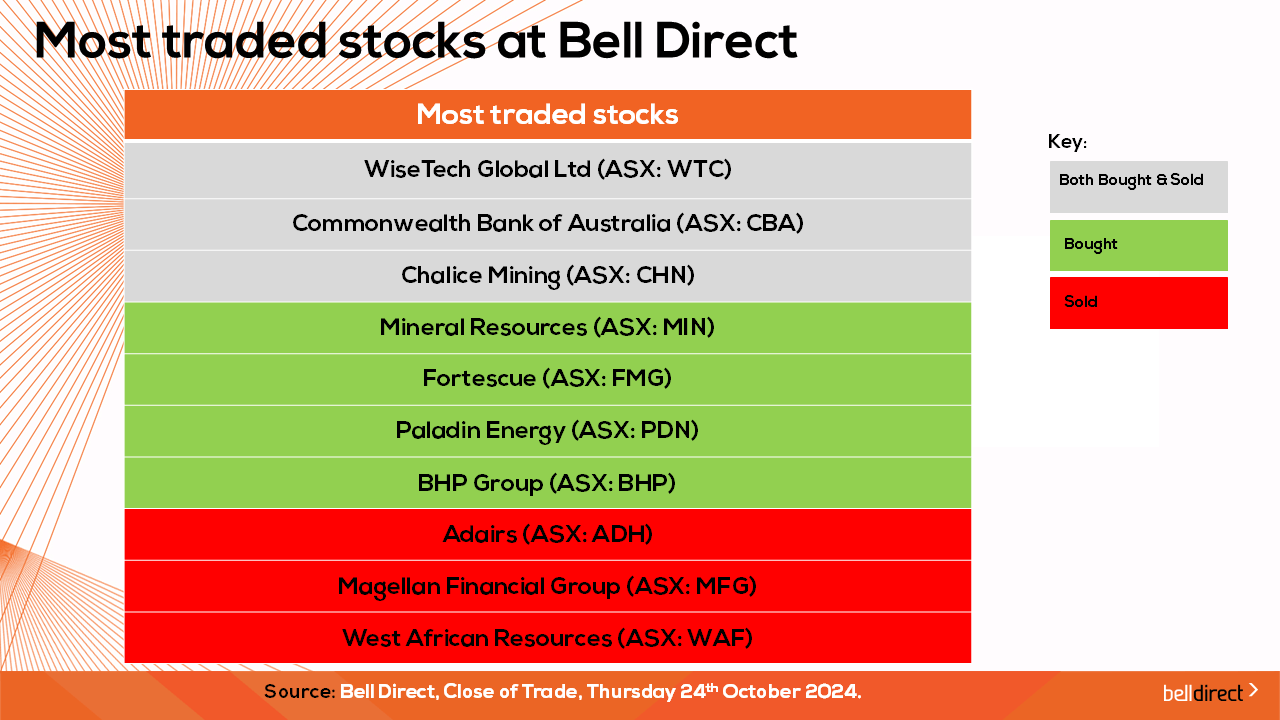

The most traded stocks by Bell Direct clients include WiseTech Global (ASX:WTC), Commonwealth Bank (ASX:CBA) and Chalice Mining (ASX:CHN). Clients also bought into Mineral Resources (ASX:MIN), Fortescue (ASX:FMG), Paladin Energy (ASX:PDN) and BHP Group (ASX:BHP), while took profits from Adairs (ASX:ADH), Magellan Financial Group (ASX:MFG) and West African Resources (ASX:WAF).

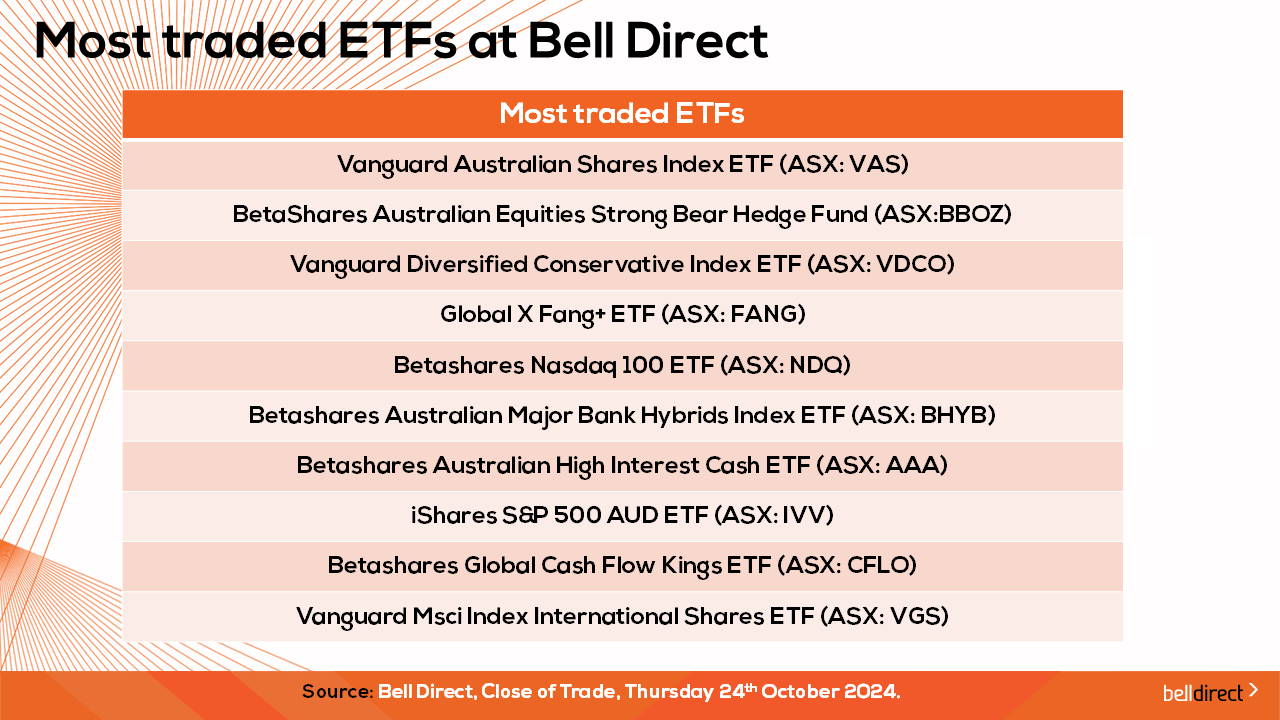

And the most traded ETFs include Vanguard Australian Shares ETF (ASX:VAS), the BetaShares Australian Strong Bear Hedge Fund (ASX:BBOZ) and the Vanguard Diversified Conservative Index ETF (ASX:VDCO).

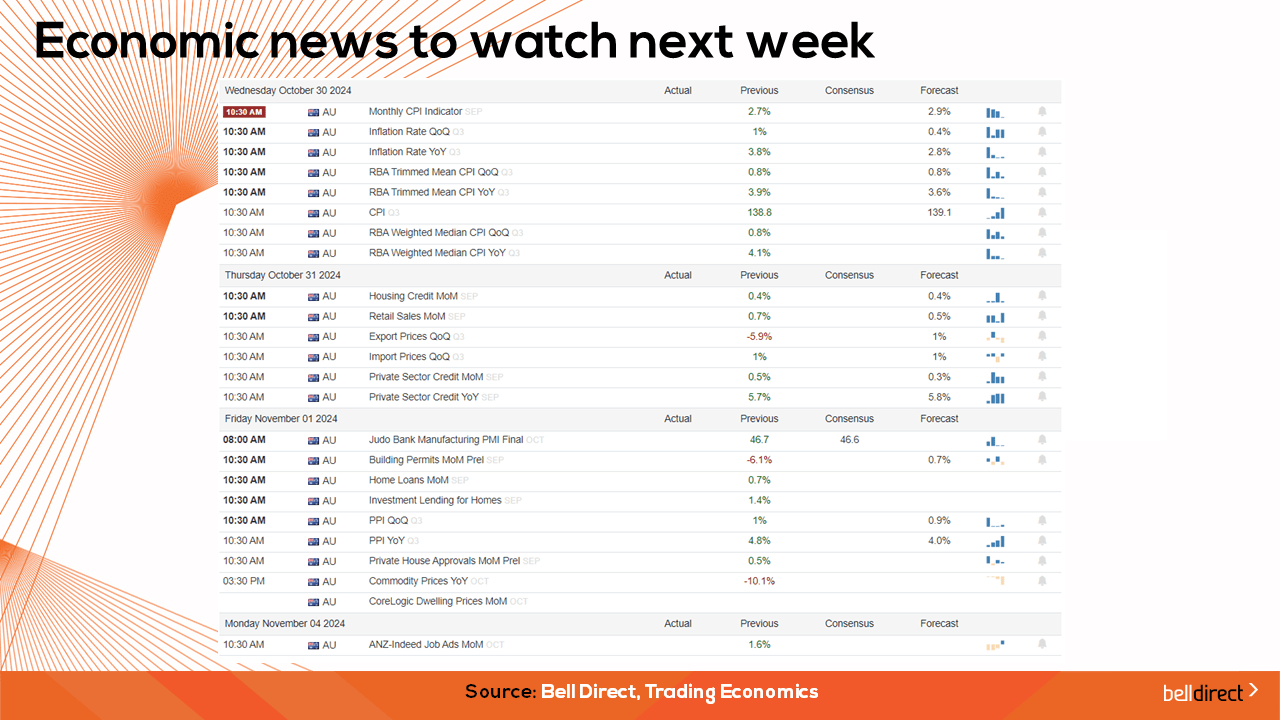

And to end, economic data to watch out for next week.

On Wednesday, the third quarter inflation rate will be released, previously 1% in June and forecast to drop to 0.4%. On Thursday, retail sales data, import and export price data and private sector credit figures will be released, and on Friday, we’ll receive the produce price index report, as well as the Manufacturing final PMI, an indicator of economic trends in the sector.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a good Friday and weekend, and happy investing.