Transcript: Weekly Wrap 4 October

It was a week for the commodities with volatility in oil prices, a record high for gold, and iron ore soaring 15% overnight on Thursday in the biggest intraday rise since September 2021. What is driving the commodity price volatility right now, what is the outlook and what does this mean for your portfolio?

Starting with oil, energy stocks rose 4.28% this week amid escalating tensions in the Middle East which is the world’s largest producing region of oil. Israel Defence forces said Iran was firing missiles at the country which prompted further supply concerns out of the region thus driving the price of oil up over 3% to US$70.18/barrel on Wednesday. The tale of the oil price volatility has taken many turns from a strong decline in September amid weak demand out of China, before spiking back up again this week on supply concerns. Rising geopolitical tensions leads to supply constraints and this is occurring at a time that China is recovering from a material stimulus, will likely place even higher pressure on the already weakened supply and will possibly drive up prices of oil, which is the outlook for the commodity in the near term.

How should you approach investing in oil producers? With caution is the short answer given the high spot price volatility. One way to see how an oil producer is likely to fare in FY25 is to analyse the company’s hedging strategy, of which many have increased their hedges to oil to avoid potential losses or missed gains through price fluctuations. Woodside has increased its hedging through FY24 and FY25 for exactly this reason, with some production of oil hedged to US$81.2/barrel for FY25.

Gold’s rally continues to outshine the market with tailwinds in place to extend the rally well into the remainder of FY25. Rising geopolitical tensions, central banks buying up bullion, interest rate cuts, global economic uncertainty, and under supply are just some of the drivers of the gold price rally in the current market environment. This has fuelled investor appetite for gold-related stocks given their safe-haven nature and ongoing rally with the price of the precious commodity up 45.7% YoY to US$2653/ounce.

Iron ore ended the week with an 18.47% rise also in the wake of China’s stimulus announcement late last week that boosted demand outlook for the metal from the world’s largest iron ore consumer. China relaxed rules for home buyers in the region and lowered mortgage rates to prompt a rebound in the dire property sector, which drives the outlook for increased demand of key commodities. The People’s Bank of China also cut reserve requirements by 50bps and lowered key medium to short-term rates to stimulate borrowing. With the outlook for a sustainable rebound in the price of iron ore throughout the coming months, this bodes well for our big iron ore miners who faced earnings depreciation from subdued iron ore prices in FY24. As a result of the boost in the iron ore price this week, BHP climbed 2.41% over the last 5-trading days.

And adding to the China recovery story, local wine makers have felt an extra boost recently amid the removal of tariffs China had on Australian wine exports. Treasury Wine Estates and Endeavour Group have been two beneficiaries of the lifted tariffs with exports of wine to China expected to contribute significantly to earnings in H1FY25. Treasury Wine Estates said it expects higher Penfolds sales after Chinese tariffs were lifted while Endeavour’s Chapel Hill Winery and Paragon Wine Estates will also reap the rewards of stronger sales in FY25.

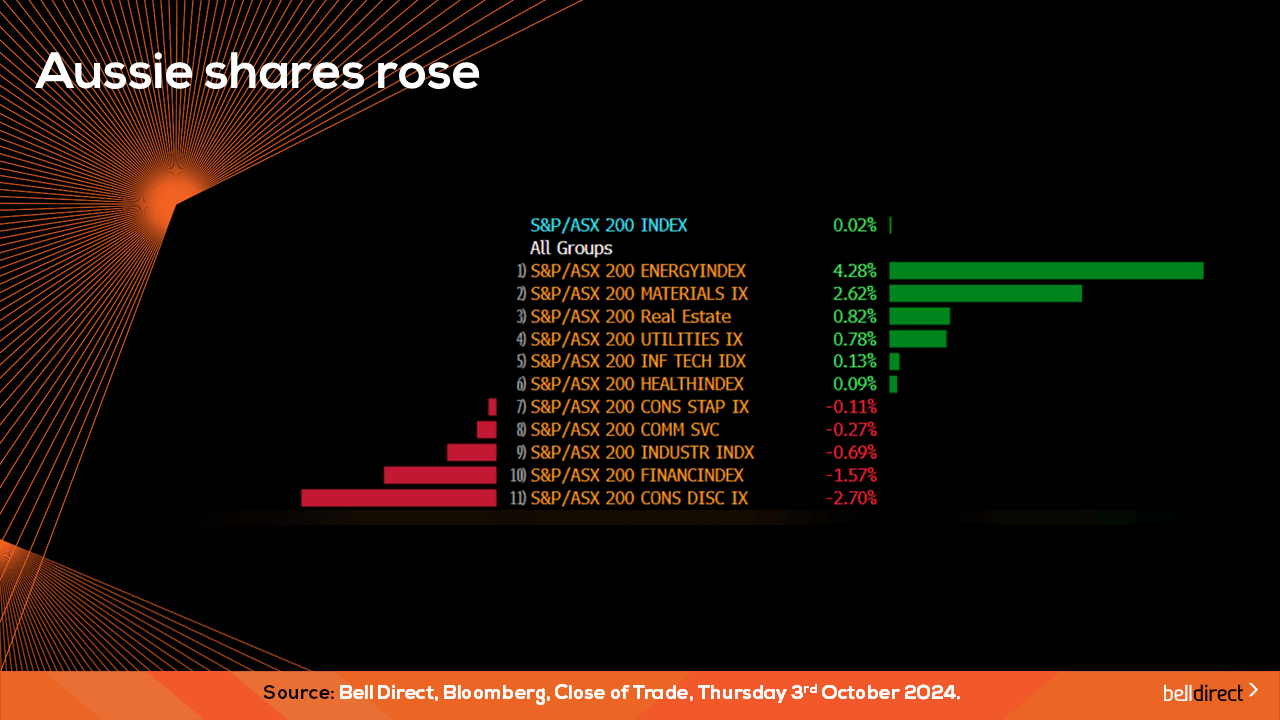

Locally from Monday to Thursday the ASX200 rose 0.02% as 4.3% surge for energy stocks was weighed down by consumer discretionary and financials stocks falling 2.7% and 1.6% respectively.

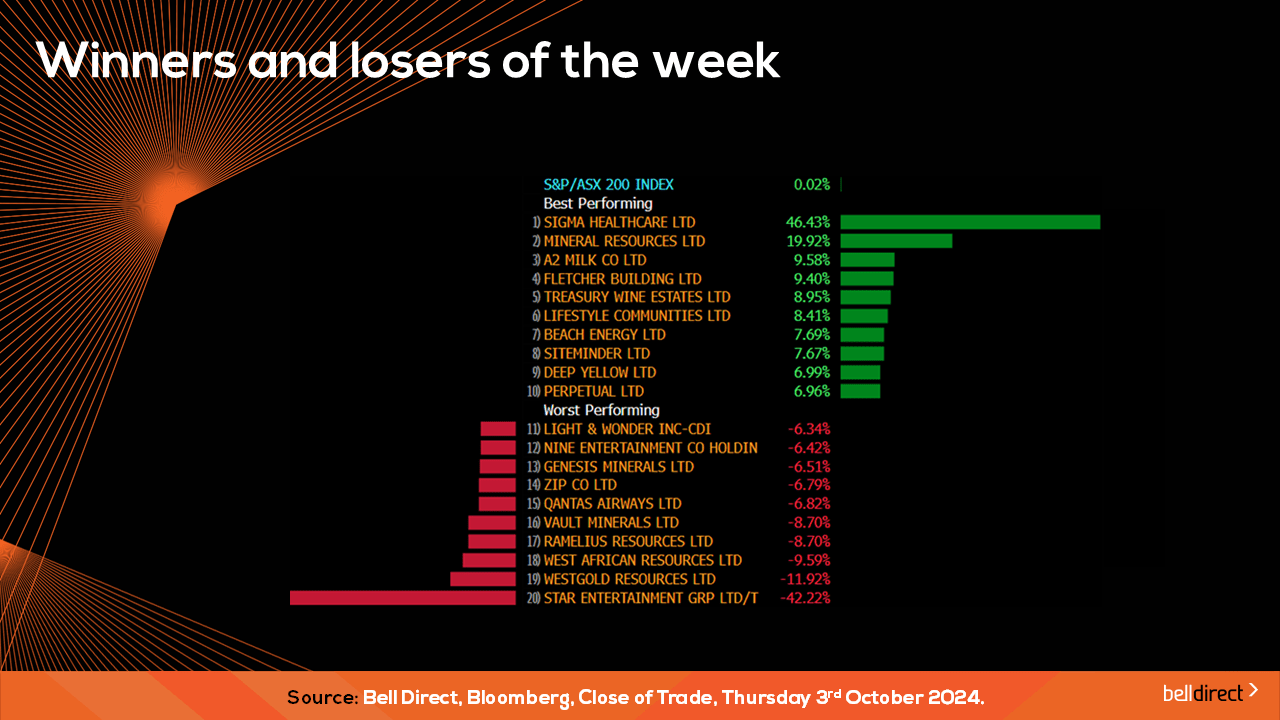

Sigma Healthcare (ASX:SIX) led the ASX200 gains with a 46% after the pharmacy operator offered to make court-enforceable undertakings to satisfy the ACCC concerns over the company’s proposed merger with Chemist Warehouse.

Mineral Resources (ASX:MIN) rebounded almost 20% this week and A2 Milk (ASX:A2M) rallied 9.6%.

On the losing end, Star Entertainment Group (ASX:SGR) fell a further 42% while Westgold Resources (ASX:WGR) and West African Resources (ASX:WAF) lost 11.92% and 9.6% respectively this week.

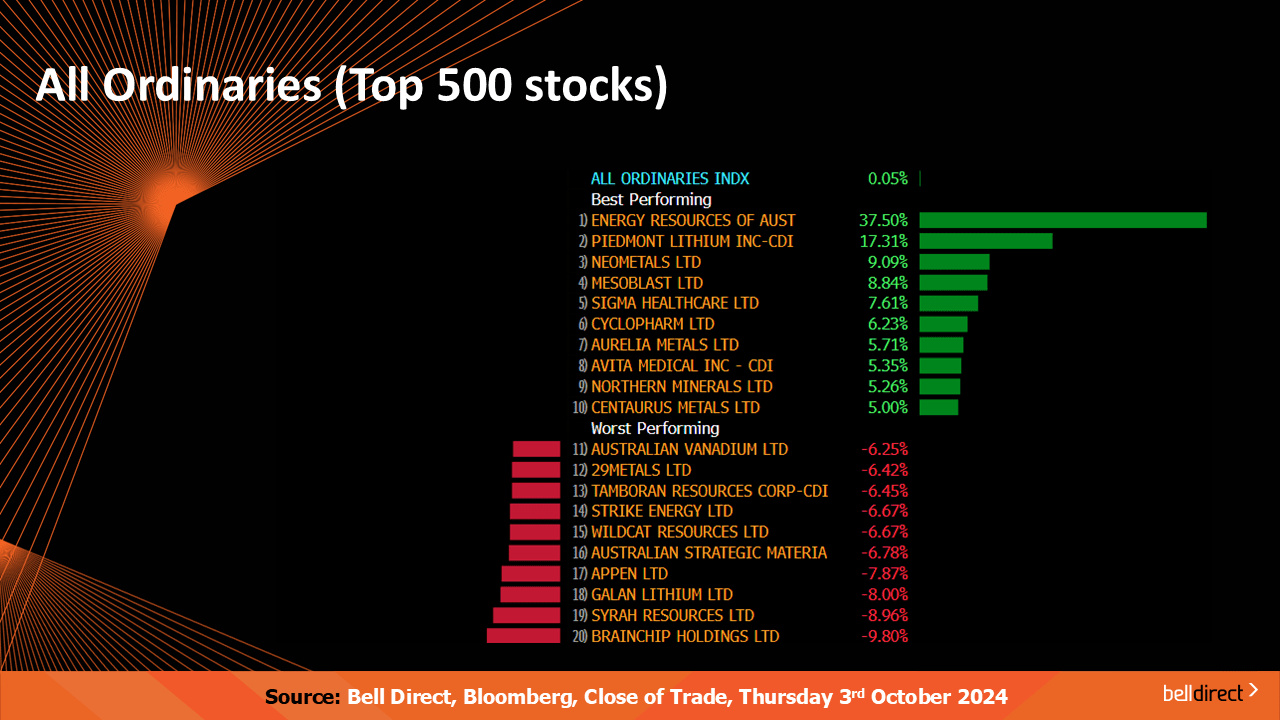

On the broader market index, the All Ords rose 0.05% as Energy Resources of Australia (ASX:ERA) soared 37.5% while BrainChip (ASX:BRN) holdings declined 9.8%.

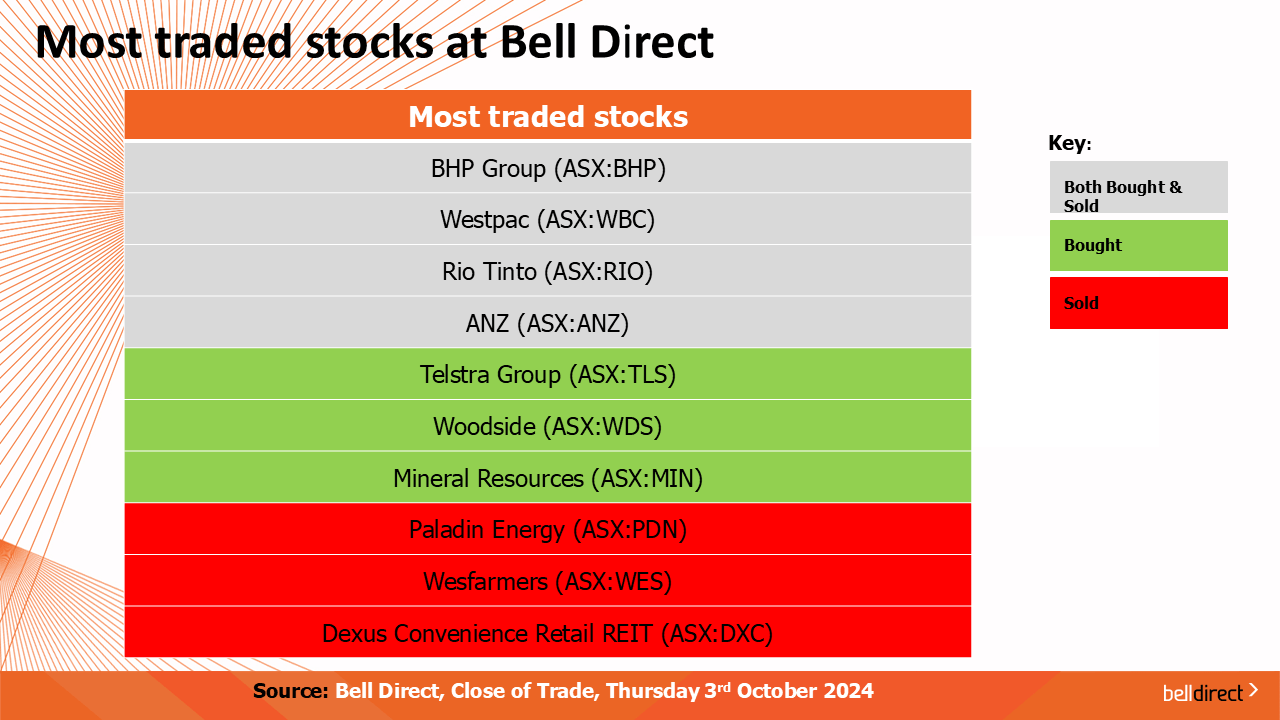

The most traded stocks by Bell Direct clients from Monday to Thursday were BHP (ASX:BHP), Westpac (ASX:WBC), Rio Tinto (ASX:RIO), and ANZ (ASX:ANZ). Clients also bought into Telstra (ASX:TLS), Woodside (ASX:WDS) and Mineral Resources (ASX:MIN) while taking profits from Paladin Energy (ASX:PDN), Wesfarmers (ASX:WES) and Dexus Convenience Retail REIT (ASX:DXS).

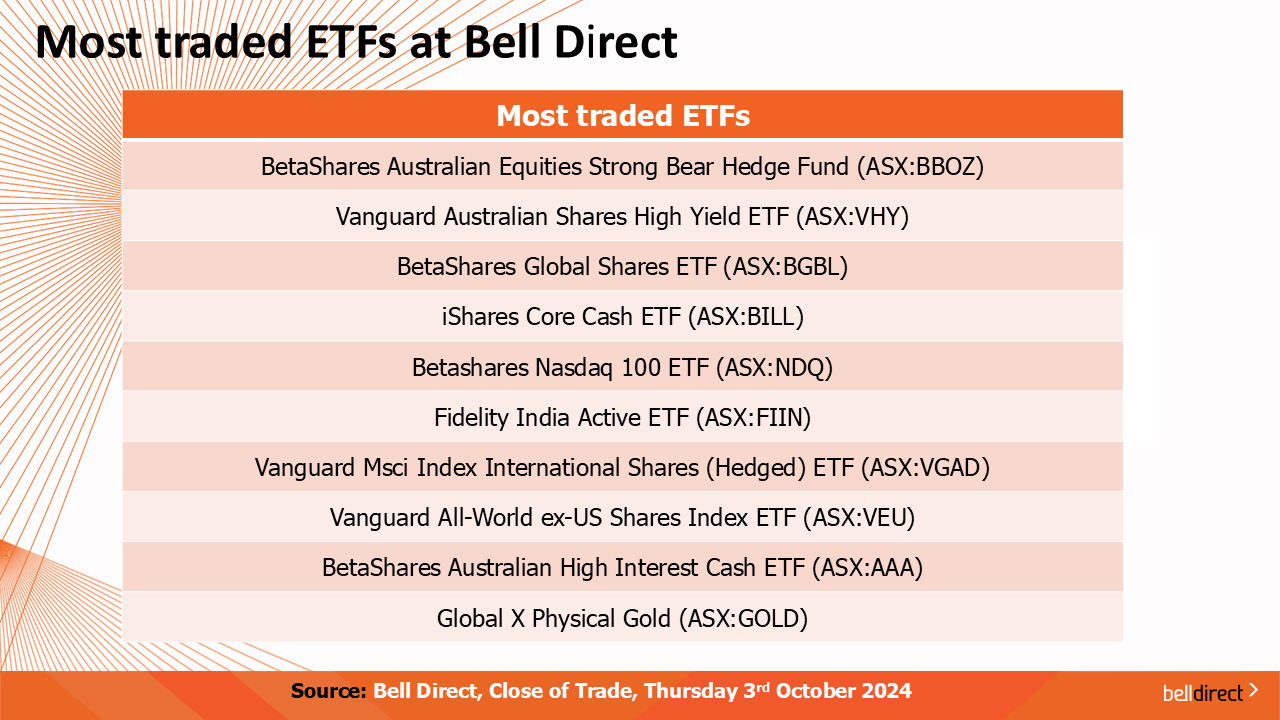

And the most traded ETFs by our clients this week were led by BetaShares Australian Equities Strong Bear Hedge Fund, Vanguard Australian Shares High Yield ETF and Betashares Global Shares ETF.

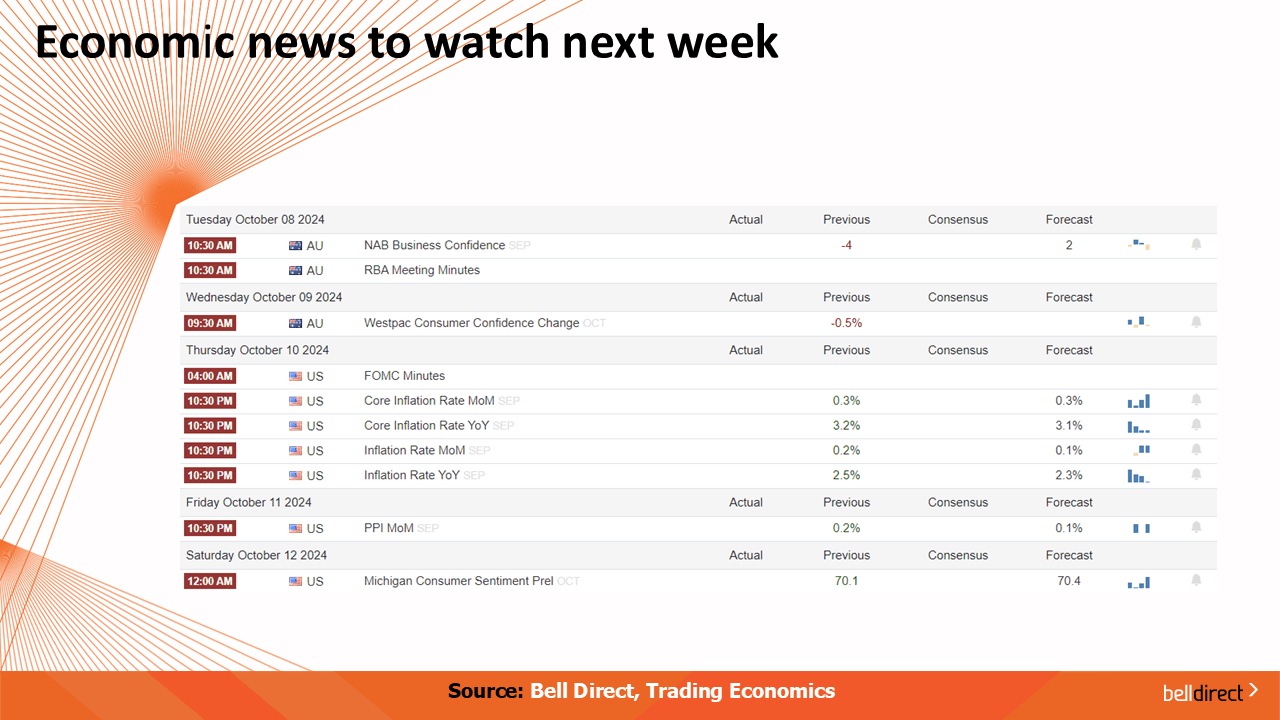

Taking a look at the week ahead on the economic calendar front, we will likely see investor reactions to NAB Business Confidence and Westpac consumer confidence data out early next week with the forecast of a rise in business confidence after periods of declines. The RBA meeting minutes are also out on Tuesday which investors will analyse to determine the rate outlook for the RBA over the coming months.

Overseas key US inflation data is out later next week with the market forecasting a slight decline in the annual inflation rate as the Fed’s inflation taming strategy continues to cool inflation in the world’s largest economy.

And China’s trade balance and inflation rate data closes out the week next week with the forecast of a decline in both metrics as the world’s second largest economy continues to struggle in regaining momentum post-pandemic.

And that’s all for this Friday, have a wonderful day, a great long-weekend and happy investing!