Transcript: Weekly Wrap 23 August

So far this reporting season 93 companies have reported with 33 beating expectations, 27 meeting expectations and 33 missing expectations.

This week cemented some key themes paving the outlook for FY25 including:

- upbeat earnings masking investor reactions to results as share prices rallied on strong outlook over sometimes very disappointing FY24 results,

- margin contraction is a common theme across sectors expected for FY25 as the high-cost environment prevails,

- Retailers have surprised to the upside as Aussies kept spending despite high cost of living pressures during the inflationary environment of FY24.

Super Retail Group (ASX:SUL) rallied on Thursday after releasing record FY24 results that further proved the theme of the reporting season – that retailers have remained extremely resilient despite the challenging market conditions. For FY24 Super Retail Group reported a 2% rise in group sales to a record $3.9bn, group gross margin rose 10bps to 46.3%, an 11% decline in normalised NPAT to $242m, expanded store network with 28 new stores opened, no drawn bank debt and $218m in cash, a fully franked final dividend of 37cps and a special dividend of 50cps. Totalling the full year of dividends paid, Super Retail Group is rewarding investors with 119 cps in distribution over FY24. The BCF, Rebel Sports, MacPac and Supercheap Auto owner also had investors excited by the strong start to FY25 with like-for-like sales up 3% and 5% total sales growth for the first 7-trading weeks of FY25.

A similar story was told by Universal Store’s (ASX:UNI) impressive FY24 results as the younger generations continued buying up fashion during the high cost-of-living environment of the last financial year. For FY24, Universal reported 9.7% sales growth, 16.6% growth in underlying EBIT driven by gross margin improvement, cost control and sales momentum building in H2. Universal also reported strong like-for-like sales in the US with growth of 6.6% in H1 turning around the 5.4% decline in sales in H1 and declared a 19cps final dividend which is double that of the PCP. The gross margin expansion was a rise of 110bps suggesting increased pricing efficiency and cost management. Universal’s underlying NPAT also rose 18% to $30.2m and net cash rose to $14.3m from $6.6m in FY23. It’s no wonder investors bought into Universal on Thursday after the release of such impressive results, but it doesn’t stop there as FY25 has started with even greater strength as sales for the first 7 weeks are up 15% in the US, and the company expects 4-6 new US stores to be opened this financial year.

The retail rush wasn’t felt across all retailers though with investors fleeing the Reject Shop (ASX:TRS) and Beacon Lighting (ASX:BLX) as inflationary pressures hit the bottom line results for these retailers this FY24 reporting season.

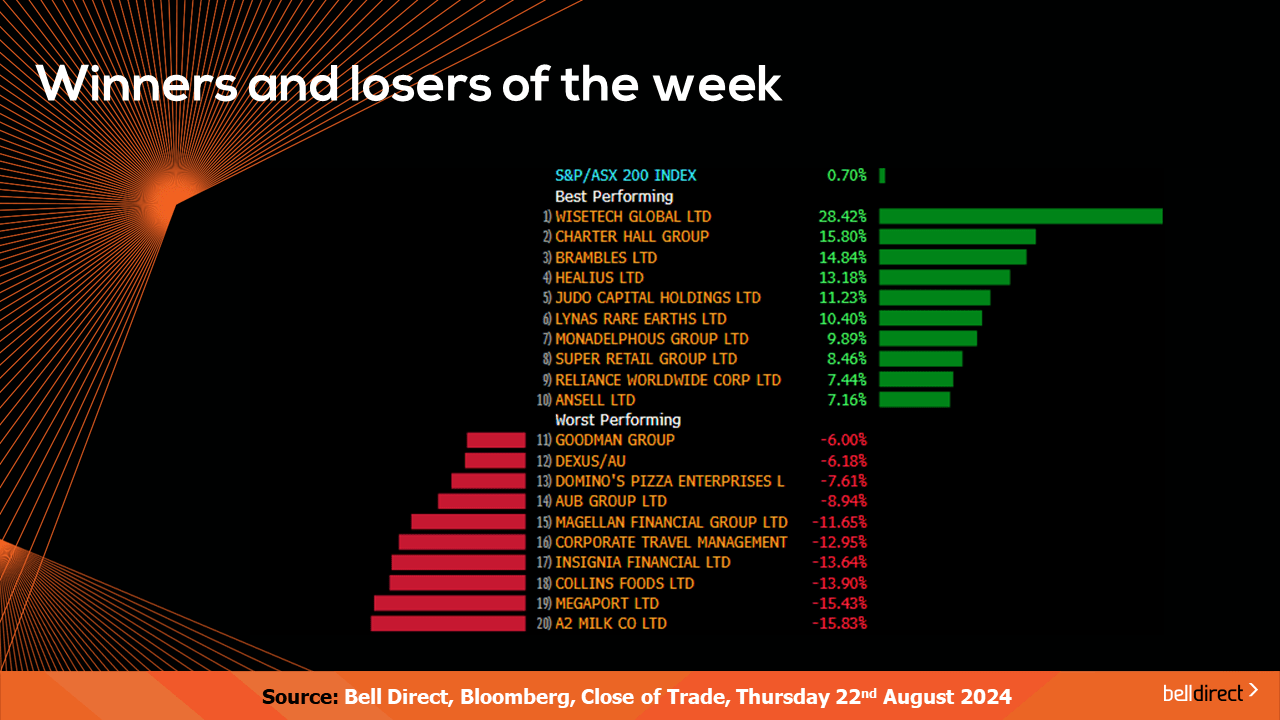

Logistics and technology market darling WiseTech global soared on the day results were released and the following session as investors were impressed by not only the company’s FY24 results, but its outlook for a strong FY25 too. The share price jumped 28% over the trading week as investors welcomed the FY24 results including total revenue increasing 15% organically on FY23 to $1.041bn, CargoWise revenue lifting 19% organically to $880.30m, underlying NPAT rising 15% on FY23 to $283.5m, and the final dividend increased 10% to 9.2cps. WiseTech’s EBITDA margin also improved 40bps to 48% and free cashflow increased by 14% to $333m.

WiseTech’s results were driven by its recent aggressive acquisition strategy flowing through to improved financial results. On an outlook front, WTC reported FY25 guidance including the expectation of 25%-30% revenue growth on FY24 to $1.3bn – $1.35bn, 33%-41% EBITDA growth, and price increases to offset inflationary pressures. Following the release of results the company’s market cap soared to $40.61bn.

The price of gold has been running hot to a record over US$2500/ounce in recent weeks which paved the foundations for a strong second half of FY24 and tailwinds heading into the new financial year. One beneficiary of the strong gold price this reporting season was Northern Star Resources (ASX:NST) which reported record cash earnings of $1.81bn, up 48% on FY23, and annual gold sold up 4% to 1621koz against a rise of 5% in AISC, both of which were in guidance set for FY24. Northern Star’s balance sheet remains strong with net cash of $358m and the record cash earnings enabled the gold miner to deliver an unfranked final dividend of 25cps and a record payout for FY24 of 40cps. On the outlook front, NST is guiding toward gold sales growth to 1650 – 1800koz at AISC of $1850 – $2100/ounce which is slightly above the AISC reported in FY24.

And that wraps our week 3 reporting season coverage, stay tuned for our final week of reporting season coverage next week as we cover key results out of Fortescue, BHP, Coles, Woolworths, Qantas, Mineral Resources, Ramsay Healthcare, Wesfarmers and more.

Now let’s look at what happened on the local bourse this week.

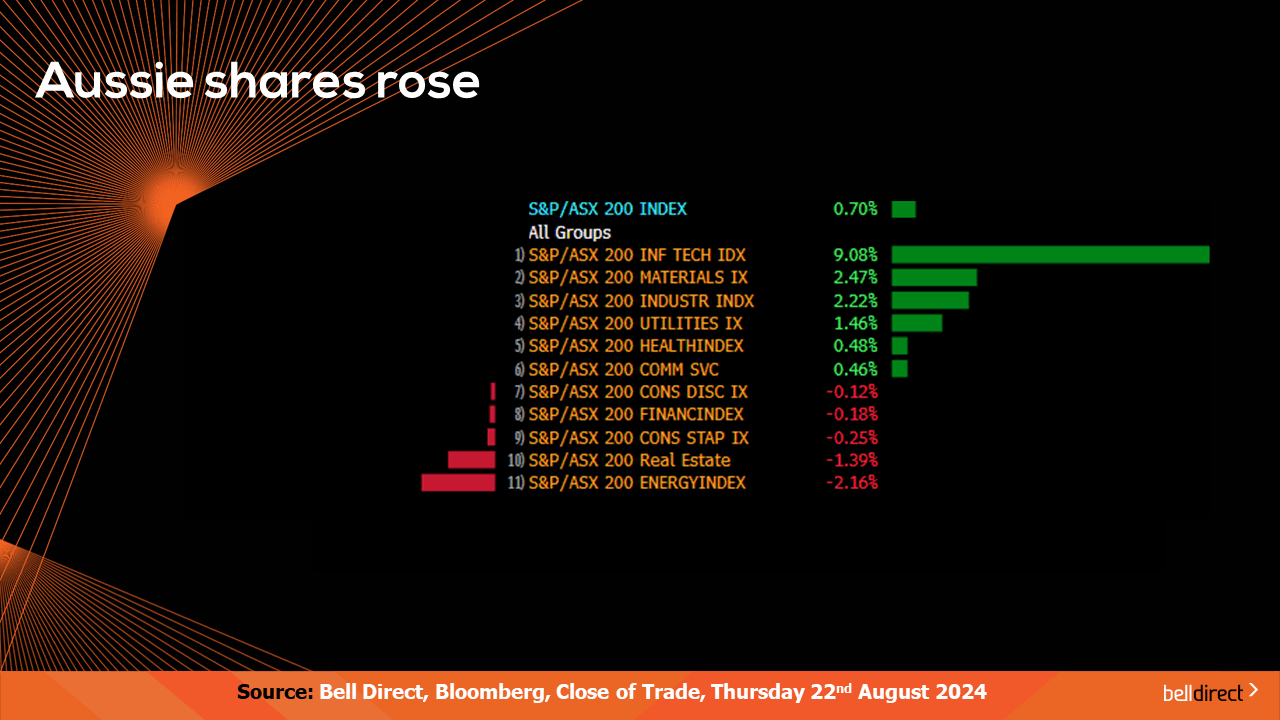

Locally from Monday to Thursday the ASX200 rose 0.7% boosted by the tech sector rocketing 9.08%.

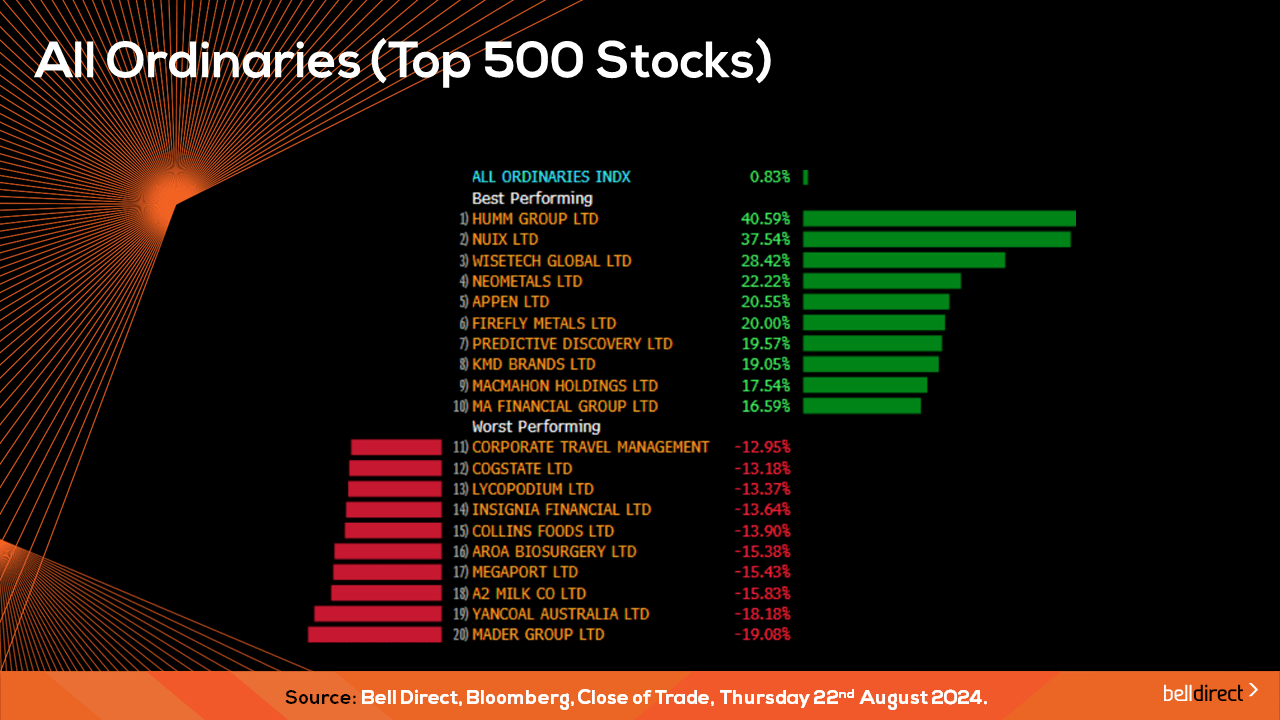

On the broader market, the All Ords rose 0.83% over the 4-trading days led by Humm Group (ASX:HUM) soaring 41% while Mader Group (ASX:MAD) lost 19%.

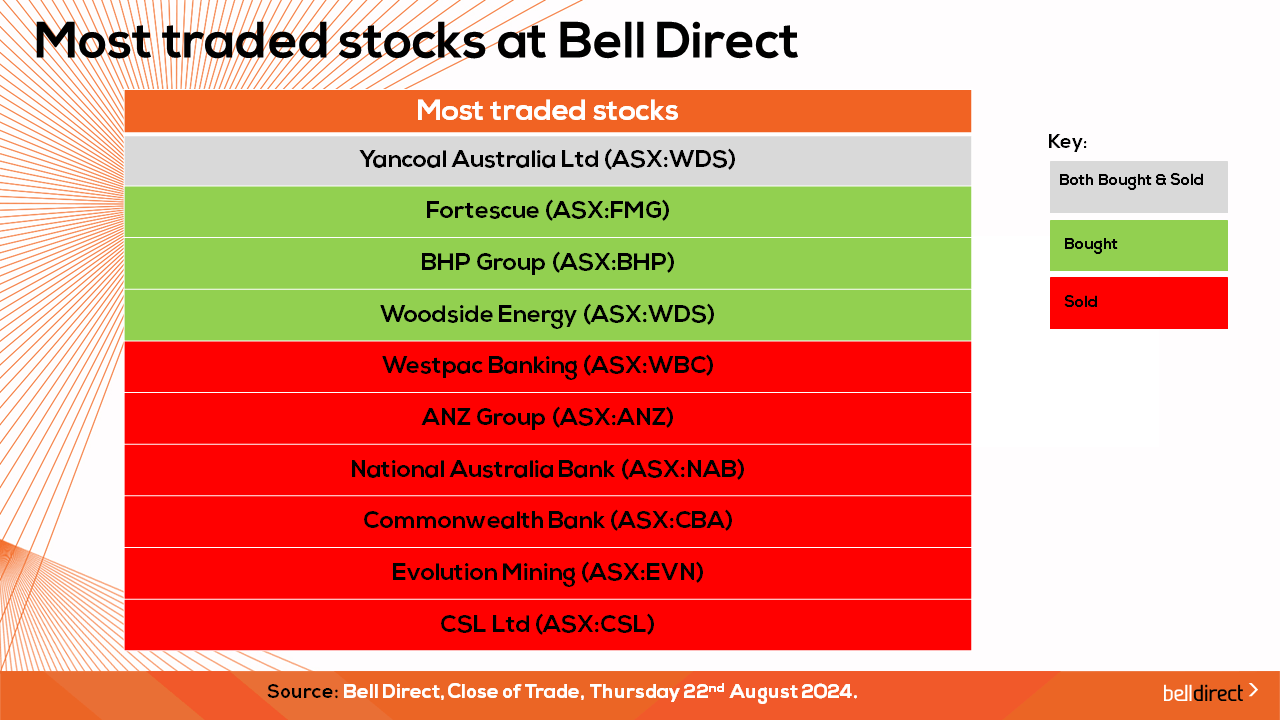

The most traded stocks by Bell Direct clients this week were Yancoal (ASX:YAL), while clients bought into Fortescue (ASX:FMG), BHP (ASX:BHP), and Woodside (ASX:WDS). Clients also took profits from the big banks again this week by selling out of Westpac (ASX:WBC), ANZ (ASX:ANZ), NAB (ASX:NAB) and CBA (ASX:CBA), and our clients also sold out of Evolution Mining (ASX:EVN), and CSL (ASX:CSL) over the 4-trading days.

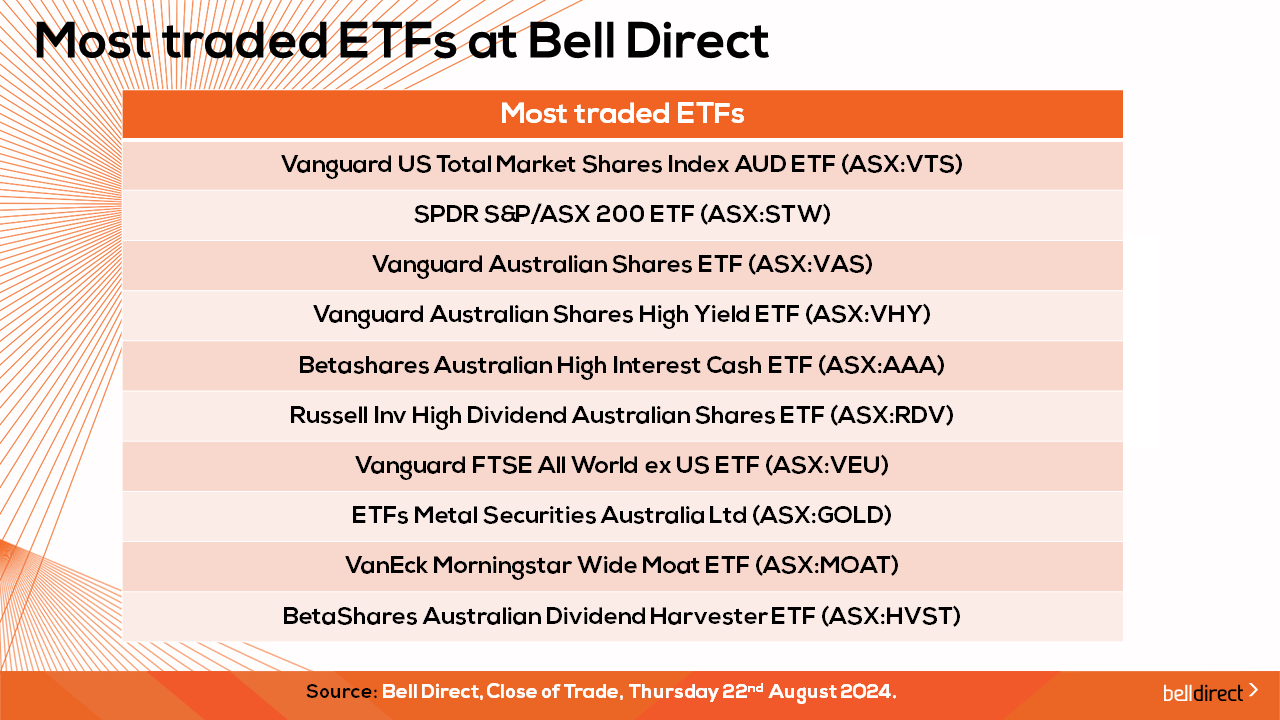

And the most traded ETFs this week by our clients were led by Vanguard US Total Market Shares Index AUD ETF, SPDR S&P/ASX 200 ETF and Vanguard Australian Shares Index ETF.

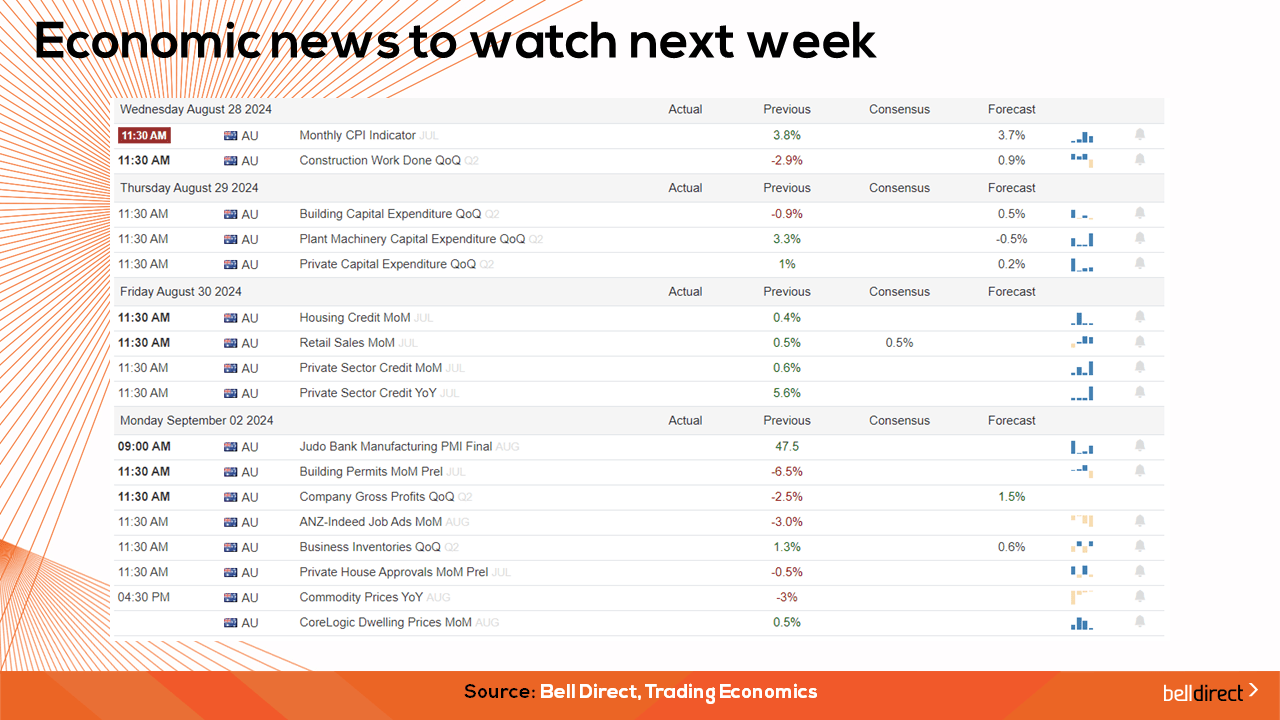

As for what to watch next week, we may see investors respond to Australia’s CPI monthly indicator data out on Wednesday with the forecast of a slight drop to 3.7% in July from 3.8% in June.

Overseas, US GDP Growth Rate data is out on Thursday for Q2 with the market pricing in a rise to an annual rate of 2.8%. Any reading below this could see a sell-off in equities as investors fear a recession is looming over a soft landing. US core personal spending MoM for July is also out on Friday with the forecast of a decline to 0.2% from 0.3% in June.

Over in Europe, the eurozone flash inflation rate data is out for August on Friday while in Asia, China’s manufacturing PMI for August is out on Monday 2nd September with the market forecasting a decline to 49.6 points from 49.8 points in July.

And that’s all for this week, have a fantastic Friday and weekend, and happy investing!