Transcript: Weekly Wrap 9 August

So far this reporting season only 12 companies have reported, with 4 beating expectations, 4 missing expectations and 4 meeting earnings season expectations.

Higher costs eating into margins and an uncertain outlook for FY25 were key trends emerging in the reports released this week that had investors reaching for the sell button on key ASX listed companies.

Transurban (ASX:TCL) shares fell on Thursday after the road toll operator released FY24 results. Despite a strong year in FY24, investors analysed key areas of concern which prompted the decline in the TCL share price yesterday. For FY24, Transurban reported proportional toll revenue rose 6.7% while total revenue fell slightly compared to FY23. FY24 profit rose more than quadrupled to $376m thanks to lower construction and finance costs. TCL also increased its dividend by 7% to 62cps. Investors overlooked these positive results amid concerns over the company’s high debt level increasing in FY24 to $25.868bn from $24bn in FY23, and over the outlook for government reform in toll roads to help relieve drivers of the high expense over FY25 which could hurt earnings for Transurban.

The retailers were anticipated to face strong headwinds this reporting season and this trend has certainly prevailed with shares in department store giant Myer (ASX:MYR) diving over 7% on Thursday following the release of a trading update. Amid a reduced consumer spend environment creating headwinds for companies like Myer, the department store giant reported expected total sales for FY24 to be $3.266bn, down 2.9% on FY23, FY24 expected NPAT of between $50 – $54m, down from $71.1m in FY23 due to underperformance, store closures and inflationary pressures, and consistent inventory. The company outlined it is undertaking tight cost management processes and fully leveraging its Myer One loyalty program in a bit to boost sales, however, the outlook for retail spend continues to drive investor sentiment around earnings depreciation for the retail space. On the upside for Myer though, is the company continuing to consider the takeover proposal of retailer Premier Investment’s apparel business.

Mirvac (ASX:MGR) fell victim to the high cost environment of FY24 which had investors selling out on Thursday which saw the Australian property developer’s share price tumble 9% in one session. Mirvac’s FY24 saw many metrics fall on FY23 including operating profit after tax down 5% to $552m, operating earnings per share down 5% to 14cps, statutory loss of $805m, down from FY23 statutory net loss of $165m, and the dividend remained flat at 10.5cps. Higher costs across the company’s apartment projects in NSW are expected to continue into FY25 with Queensland apartment projects also expected to be affected, which paints a tough cost-headwind to remain into the new FY which has the flow on of depleting margins below Mirvac’s target 18% to 22% range. In terms of outlook, Mirvac outlined the expectation of operating earnings to fall to between 12cps to 12.3cps from 14cps in FY24, and distribution of 9cps, down from the 10.5cps paid in FY23 and FY24. The reason for the weaker outlook is due to the expected impact of lower contribution from Mirvac’s development business and higher net interest costs related to development activities.

And that’s a wrap on week 1 of reporting season, as was predicted, the earnings outlook for FY25 is weaker across most sectors given the high cost environment, subdued demand and impacts of higher debt levels on cost appreciation.

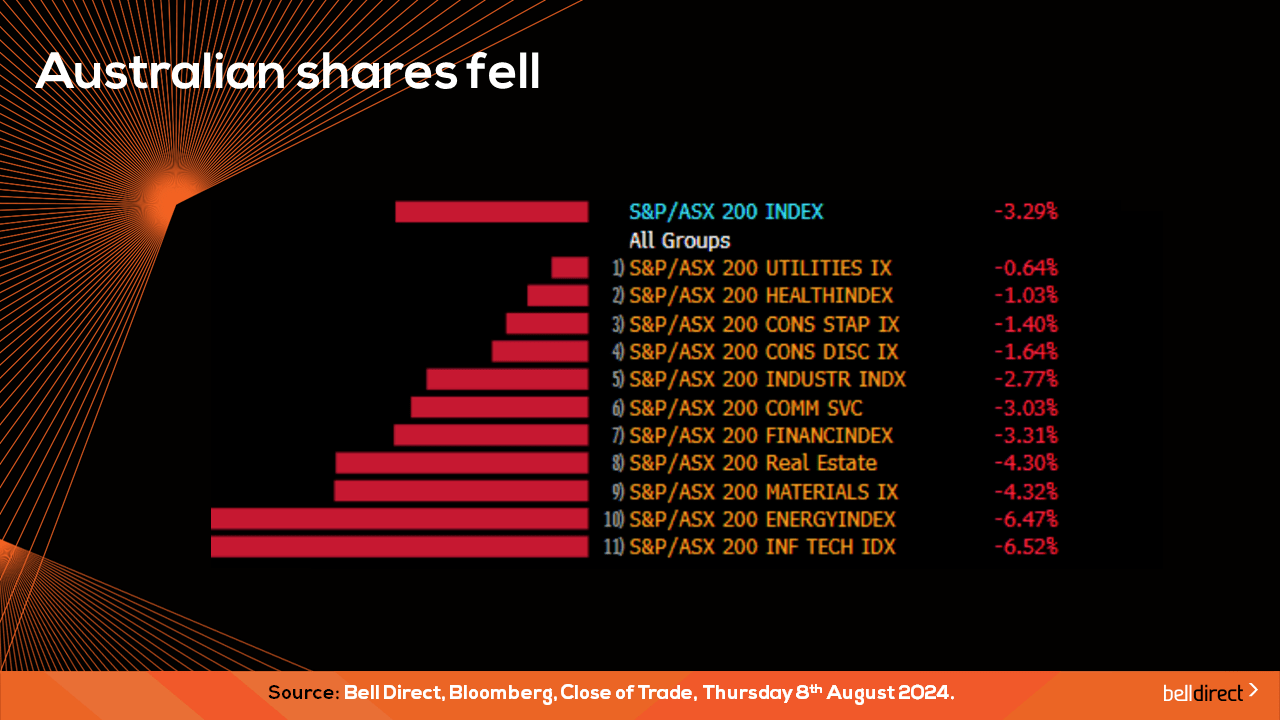

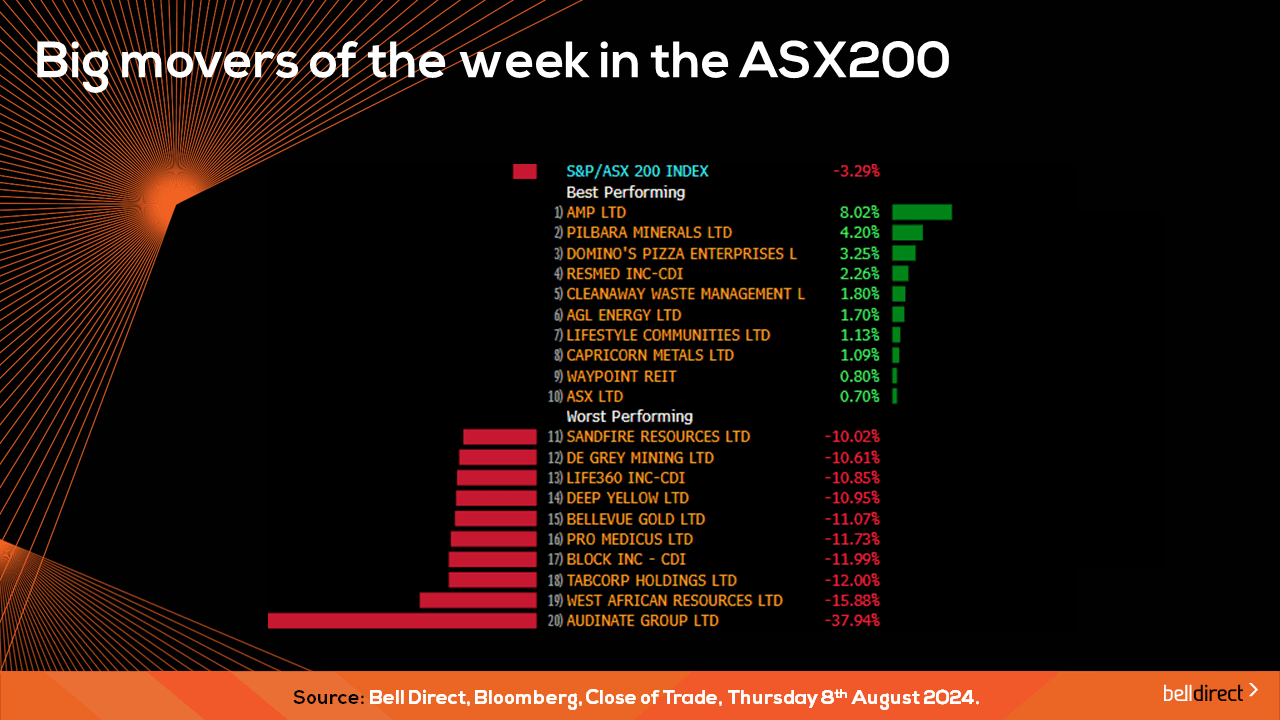

Locally from Monday to Thursday, the ASX200 fell 3.29% as a heavy sell-off on Monday offset the gains experienced later in the week. Every sector posted a loss over the 4-trading days.

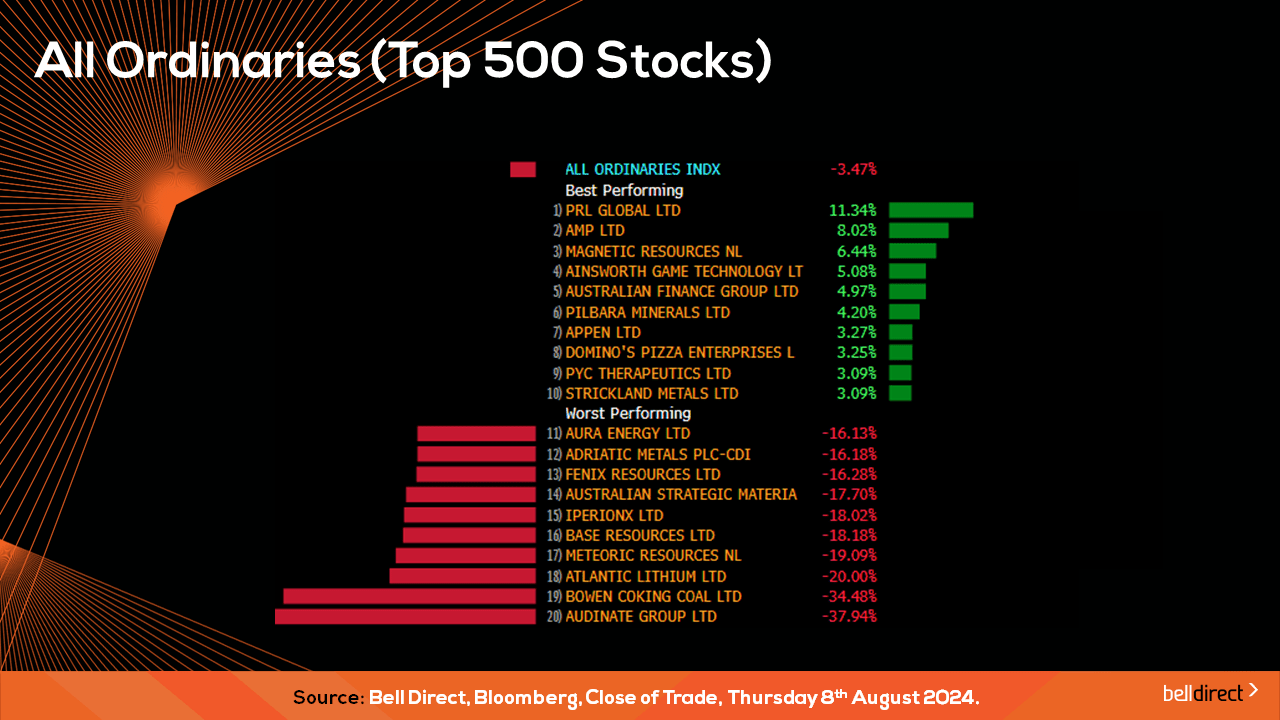

On the broader market the All Ords fell 3.47% this week as Bowen Coking Coal (ASX:BCB) fell 35%, while Atlantic Lithium (ASX:A11) lost 20% and Meteoric Resources (ASX:MEI) ended the 4-trading days down 19%.

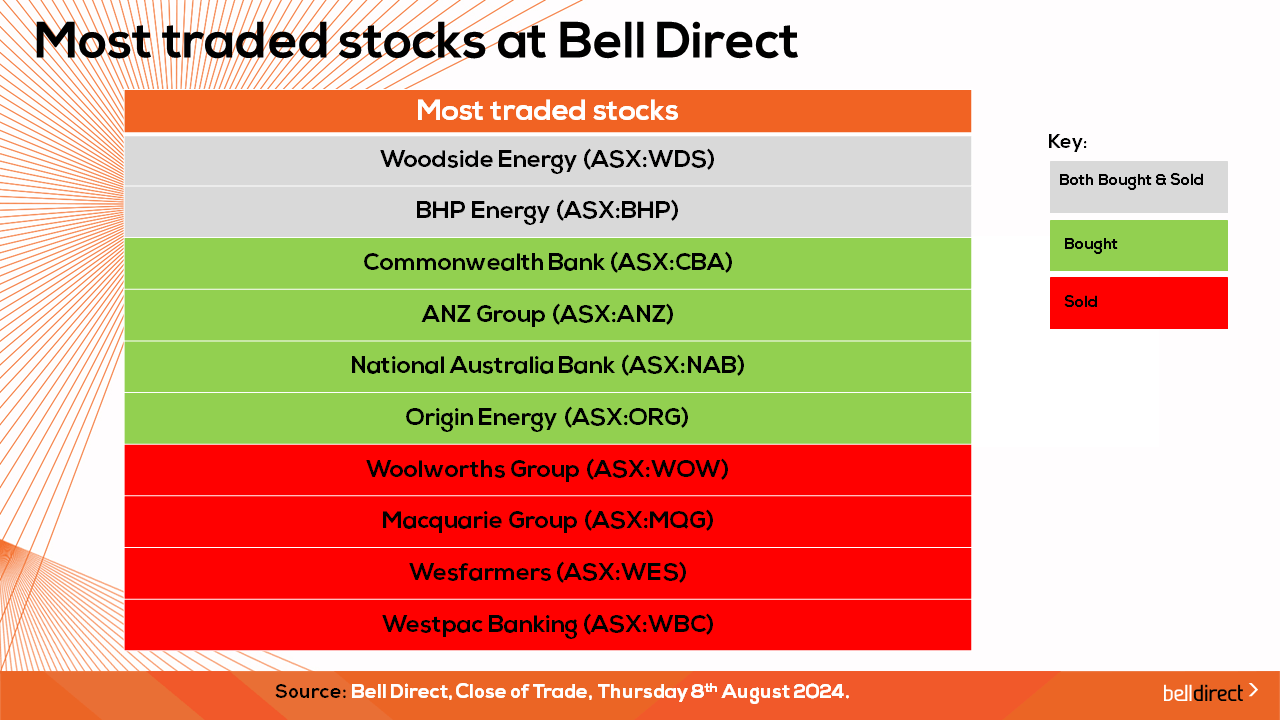

The most traded stocks by Bell Direct clients over the four trading days were CBA (ASX:CBA), and ANZ (ASX:ANZ). Clients also bought into Woodside (ASX:WDS), BHP (ASX:BHP), and Westpac (ASX:WBC), while taking profit from NAB (ASX:NAB), Origin Energy (ASX:ORG), Woolworths (ASX:WOW), Macquarie (ASX:MQG), and Wesfarmers (ASX:WES).

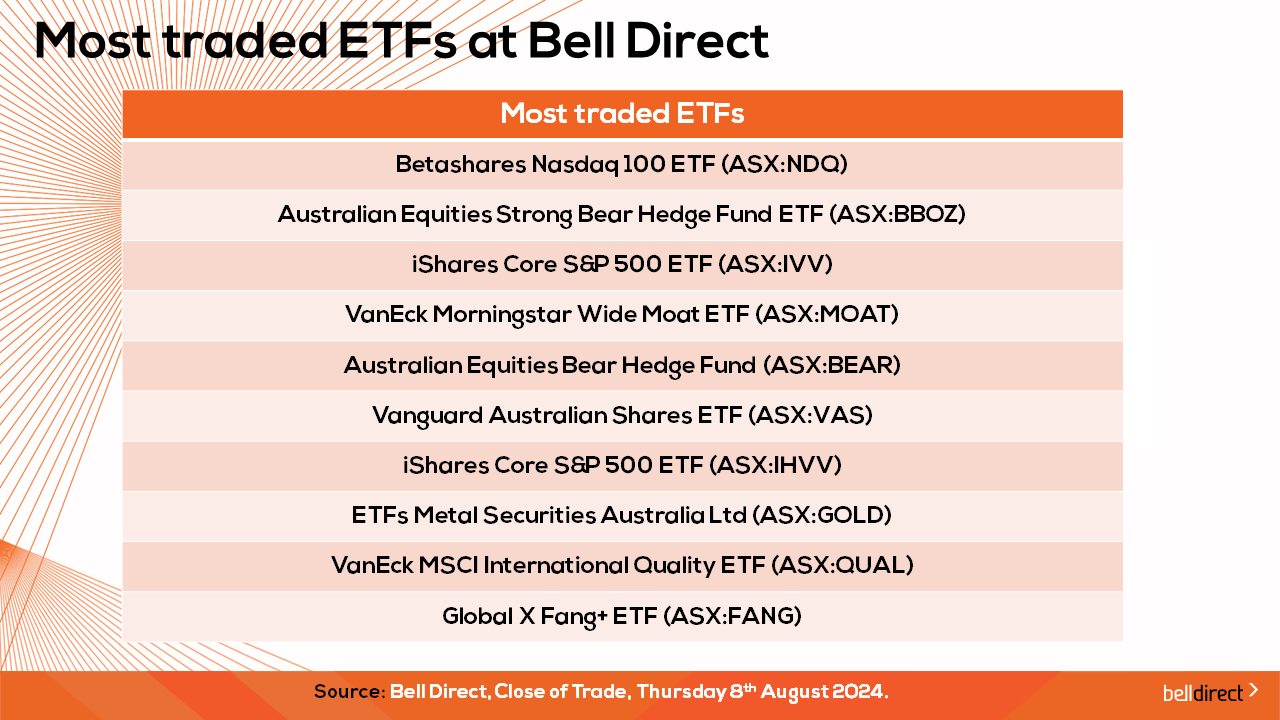

And the most traded ETFs were Betashares Nasdaq 100 ETF, Australian Equities Strong Bear Hedge Fund, and iShares S&P 500 AUD ETF.

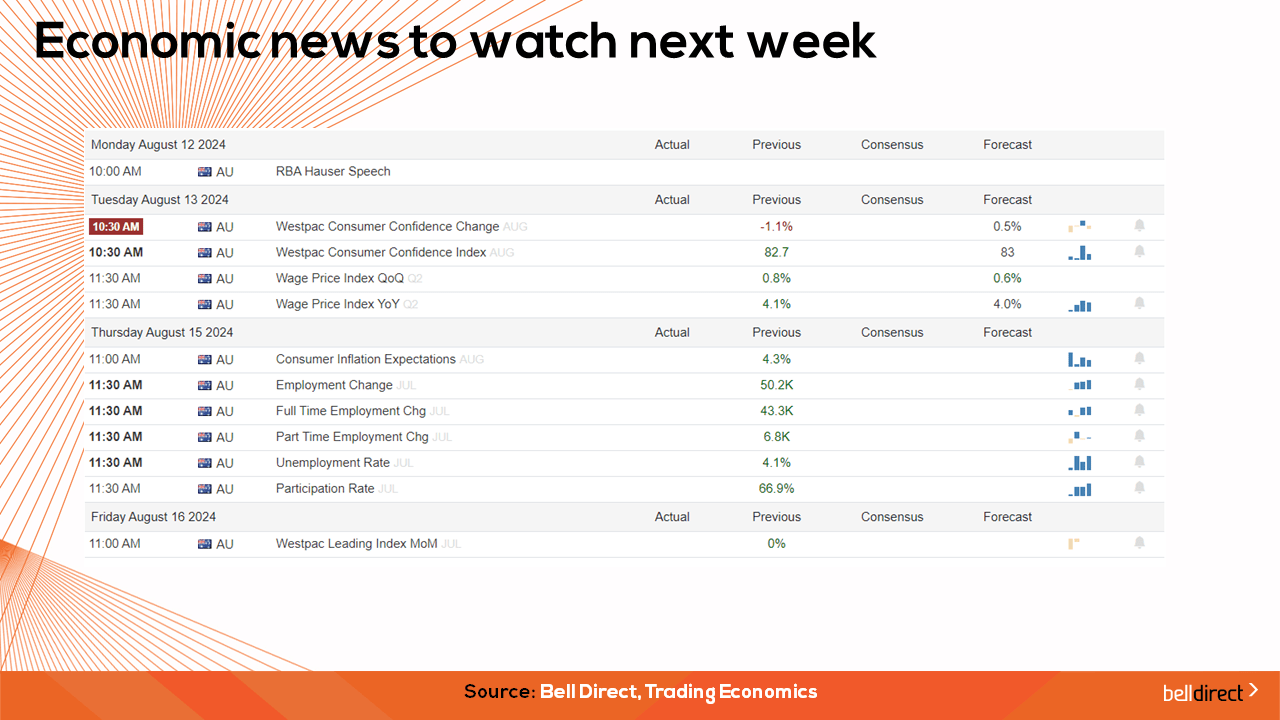

On the economic calendar next week, we can expect market response to Westpac Consumer confidence data out on Tuesday with the expectation of a slight rise in consumer confidence for August.

Overseas, key US inflation data is out on Wednesday with the forecast of a slight rise in the inflation rate MoM but for the overall inflation rate YoY to remain at 3%. Any rise in inflation will likely lead to further sell-off in equities on Wall Street as investor sentiment is already dampened by rising recession fears.

US retail sales and PPI data are also out next week with the expectation of a fall in both areas in the month of July.

And on the reporting season calendar next week we can expect results from JB Hi-Fi, Cochlear, CSL, CBA, James Hardie Industries, and Goodman Group.

And that’s all we have time for this week, happy Friday and happy investing.