Transcript: Weekly Wrap 26 July

It is the end of July, and we are ramping up for reporting season of FY24 which is set to be one of the most highly anticipated yet, as we analyse how ASX listed companies fared the high interest rate, sticky inflationary environment of FY24. So what are we expecting come August as companies start releasing FY24 results?

China’s post-pandemic economic struggles have been a major concern for global markets recently. Companies with exposure to China are feeling the pinch in FY24, with issues ranging from sluggish retail sales to a decline in economic growth.

For retailers, the news isn’t good. China’s retail sales growth has dropped sharply from a high of 34% in 2021 to just 2% in June 2024.

The price of iron ore has also fallen by 1.9% over the past year due to reduced demand from China, affecting Australian mining companies.

Heading into FY24 reporting season, all eyes are on large-cap stocks to see if they can maintain their high valuations amid slowing economic activity and rising global uncertainty.

Locally, the tech sector has been booming thanks to advances in AI. However, with valuations soaring, analysts are cautious. Investors will be closely watching earnings growth and profitability indicators during this reporting season for local tech stocks.

Looking back, the February 2024 reporting season saw varied results, with 42% of companies beating expectations. The upcoming August season may see shifts due to higher costs and tough economic conditions in the latter half of FY24.

Some companies have introduced price increases which could boost their financials in the August reports. For instance, James Hardie (ASX:JHG), Boral (ASX:BLD), and Ansell (ASX:ANN) have implemented price hikes.

Healthcare stocks are rebounding strongly in 2024, driven by commercialisation efforts post-pandemic. Telix Pharmaceuticals (ASX:TLX), for example, has revised its revenue guidance upwards.

Consumer discretionary stocks might face challenges with slowing retail spending. Inventory levels will be critical for retailers, impacting their ability to manage costs effectively.

The rise of AI could drive demand for tech-related products. JB Hi-Fi (ASX:JBH) will be closely watched to gauge this demand.

In commodities, diversification into copper and other metals might offset losses among other commodity assets. Uranium miners are looking strong due to increased global demand for nuclear power.

Gold miners are benefiting from a strong rally in the price of gold, driven by global geopolitical tensions and inflation hedging.

Utilities stocks are poised to benefit from increased demand for energy and water driven by datacentre expansion for AI applications. Origin Energy (ASX:ORG) and AGL Energy (ASX:AGL) are well-positioned in this regard.

In summary, the FY24 reporting season will likely see a mixed bag across sectors, with China’s economic woes, AI advancements, and commodity price fluctuations shaping investor sentiment and company performances.

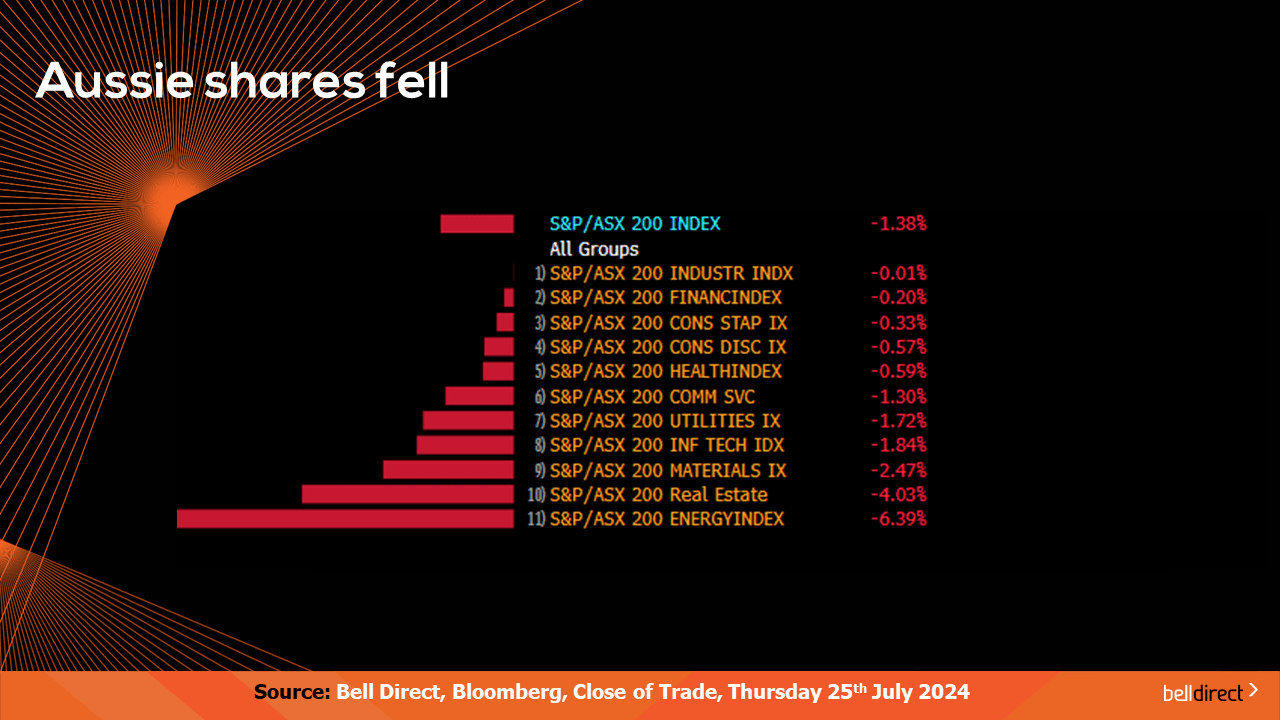

Locally from Monday to Thursday the ASX200 investors were in sell-mode after turbulence on Wall Street dampened investor sentiment locally. The ASX200 fell 1.38% from Monday to Thursday with all 11 sectors ending the week in the red led by energy stocks tumbling 6.4%.

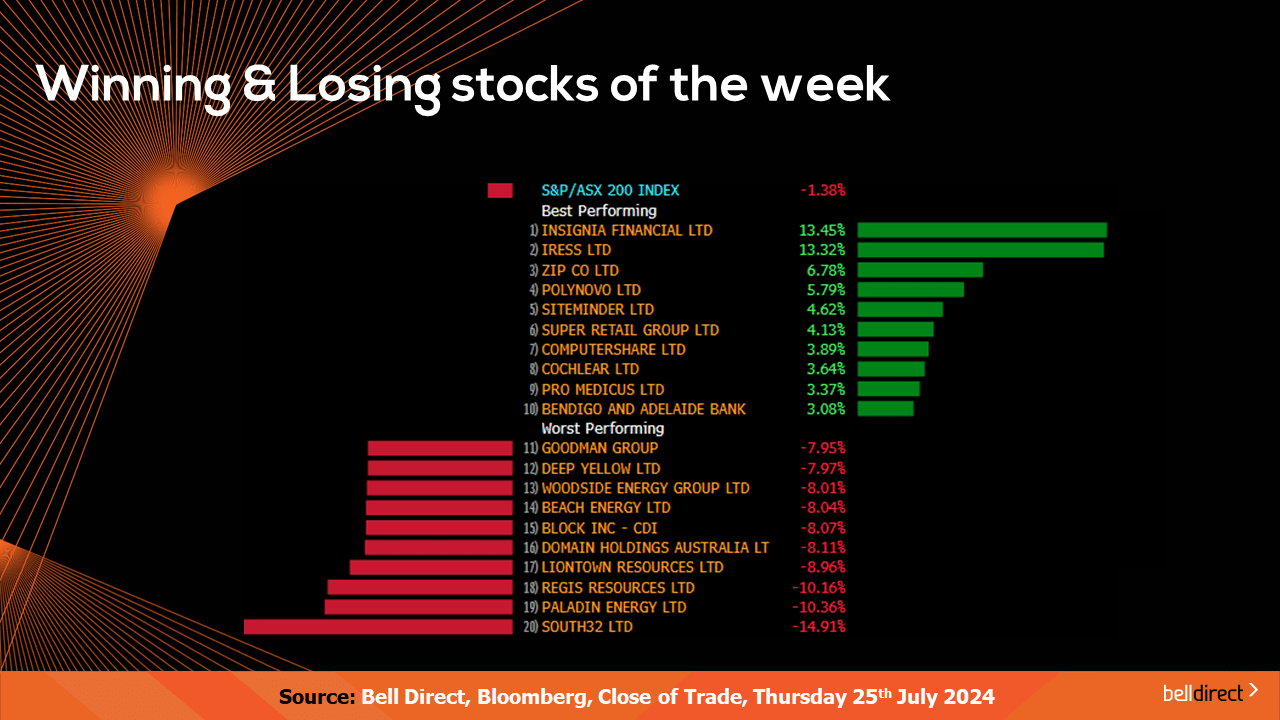

There were some winning stocks on the market this week which were led by Insignia Financial (ASX:IFL) jumping 13.45% while IRESS (ASX:IRE) rose 13.32% and Zip Co (ASX:ZIP) added 6.8% over the four trading days.

And on the losing end it was a tough week for South32 (ASX:S32) which declined just shy of 15%, while Paladin Energy (ASX:PDN) tumbled 10.36% and Regis Resources (ASX:REG) ended the week down 10.16%.

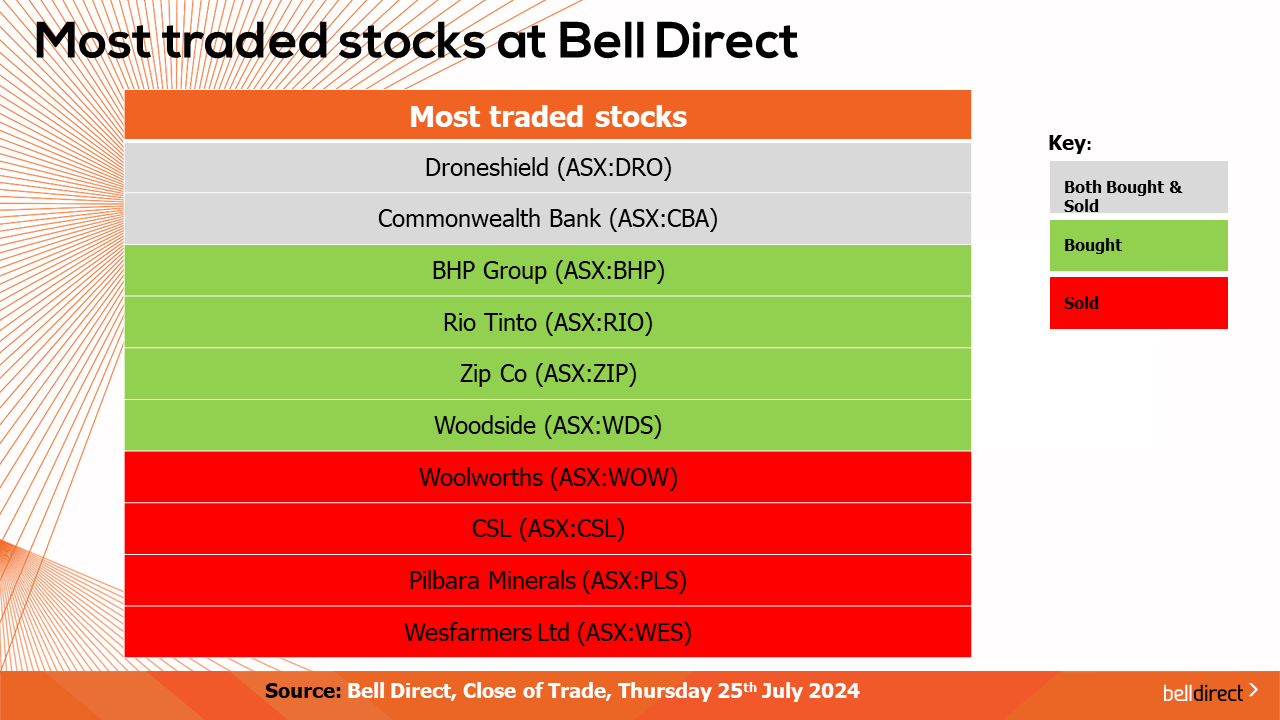

The most traded stocks by Bell Direct clients from Monday to Thursday were DroneShield (ASX:DRO), and CBA (ASX:CBA). Clients also bought into BHP (ASX:BHP), Rio Tinto (ASX:RIO), Zip Co (ASX:ZIP) and Woodside (ASX:WDS), while taking profits from Woolworths (ASX:WOW), CSL (ASX:CSL), Pilbara Minerals (ASX:PLS) and Wesfarmers (ASX:WES).

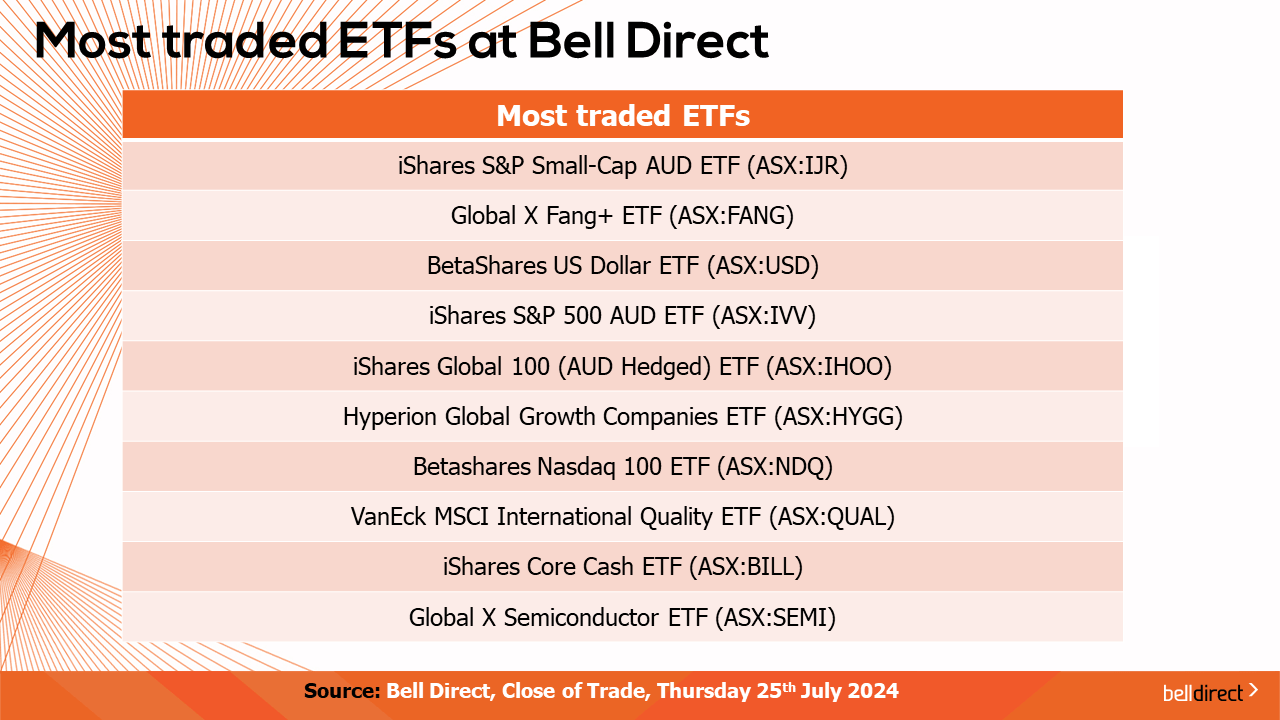

And the most traded ETFs by our clients were led by iShares S&P Small-Cap AUD ETF, Global X Fang+ ETF and BetaShares US Dollar ETF.

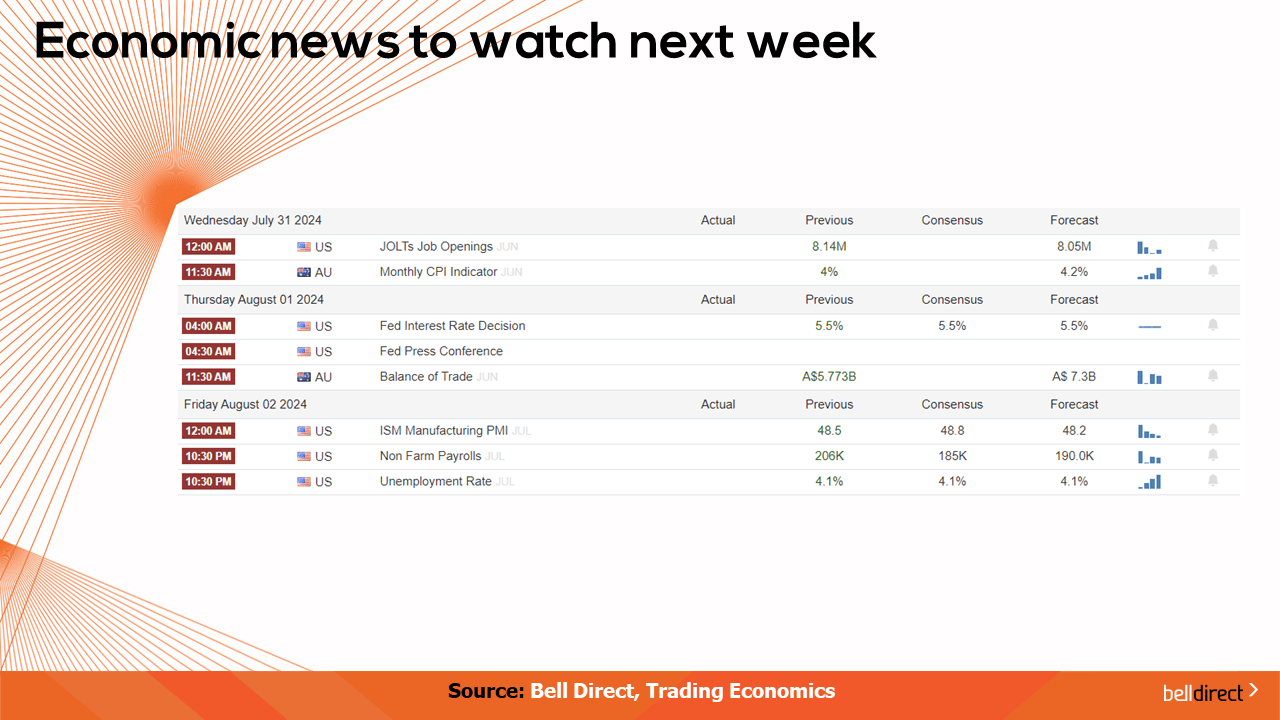

On the economic calendar front next week, we may see investors react to Australia’s monthly CPI data out on Wednesday with the forecast of a slight decline in Australia’s inflation rate to 3.7% in June from 4% in May. Australia’s trade balance data is also out later next week with the expectation of an increase in trade surplus to $7.3bn in June from 5.773bn in May.

Overseas, the European region’s GDP growth rate data for Q2 is out on Tuesday with the expectation of an increase in the yearly GDP rate, but a slight decrease QoQ.

US Jobs data is out on Wednesday with the expectation of 8.35m new jobs having opened in June. And the Fed will hand down the latest rate decision on Thursday with the market expecting the Fed to maintain the current rate of 5.5% for another period.

Throughout this reporting season we will be producing videos every Wednesday and Friday to update you on the corporate earnings results through thematic updates of the winners and losers and provide outlook for FY25. Be sure to tune in throughout the month of August.

And that’s all for today, have a wonderful weekend and happy investing!