Transcript: Weekly Wrap 19 July

As we near the release of FY24 results locally, we have seen markets move over the last week as some companies pre-warn the market of results expectations while others provide trading updates on Q4 and outlook. Which names stood out this week for good and bad reasons and how did this impact the local market heading for the middle trading week of July?

Accent Group (ASX:AX1) soared over 10% this week after the leading Australian footwear and sports clothing retailer provided a trading update outlining the expectation for Group EBIT for FY24 is between $109 to $111m, signalling a pullback on FY23, however, the company also expects total sales to be up 1.7% on FY23. The pullback in EBIT expectation is due to a charge in H2 of around $14.2m relating to Glue Store where the company made a decision to exit 17 underperforming stores. Generally, an update of this kind would spook investors, however, the Accent Group share price rose 8% on the announcement as investors welcomed the strategic decision to cut losses and close 17 Glue stores. While some retailers are winding up operations in the US like City Chic, Accent Group is preparing to launch their Nude Lucy brand into the states for the first overseas expansion of the brand as global demand for affordable athleisure wear ramps up. The company has guidance from one of Australia’s best known and most successful retail entrepreneurs with Brett Blundy standing as a non-executive director on the board, which boosts investor confidence in the retail giant this reporting season. Accent Group is set to release FY24 results on Friday August 23 and Bell Potter currently has a buy rating on the leading fashion retailer.

BHP Group (ASX:BHP) on the other hand didn’t quite have the same warm reception from investors this week as shares in the mining giant fell over 1% following the release of its Q4 update on Wednesday. It was a tough reaction for BHP after the company revealed record monthly and quarterly production at its WA Iron Ore asset. BHP also met guidance expectations for production and unit cost guidance for all commodities. The sell-off may have been due to investor’s tracking the declining price of iron ore this week, or, due to BHP’s report including metallurgical coal and energy coal production declining 18% and 10% respectively in Q4 due to divestments and unfavourable weather. On the outlook front, BHP sees the potential for FY25 to see another record year of iron ore production with the forecast of 255Mt to 265Mt over the new financial year.

Healthcare darling Telix Pharmaceuticals (ASX:TLX) had investors hitting the buy button again this week after the cancer imaging agent and therapy drug developer lifted its sales guidance fo FY24

And pizza giant Domino’s Pizza (ASX:DMP) crumbled this week after providing a business update and outlook for FY25. In June, Domino’s announced the undertaking of a wide-ranging strategic review to deliver cost savings, future forward growth and improved efficiencies. This week, the findings of the strategic review have led Domino’s to announce it will close up to 80 low volume stores in Japan and between 10 to 20 stores in France to mitigate the financial impacts of loss-making stores. On the outlook front, Domino’s advised in the near term the company will be focusing on the positive performance in ANZ, Germany, and Singapore, and recent improved performance in Belgium, Netherlands and Luxembourg with an anticipated gross store openings of around 3% of the network in the near term.

With very mixed results out of listed companies over the last few weeks, we can take this as a signal for what’s to come this reporting season. Cost cutting measures are a high priority across many industries as the high interest rate environment hurts margins, there are key opportunities in the retail space but cutting underperforming assets is a key move to ensure sustainability through the tougher economic conditions, and healthcare providers working in the cancer space are high priority on the investor radar this year.

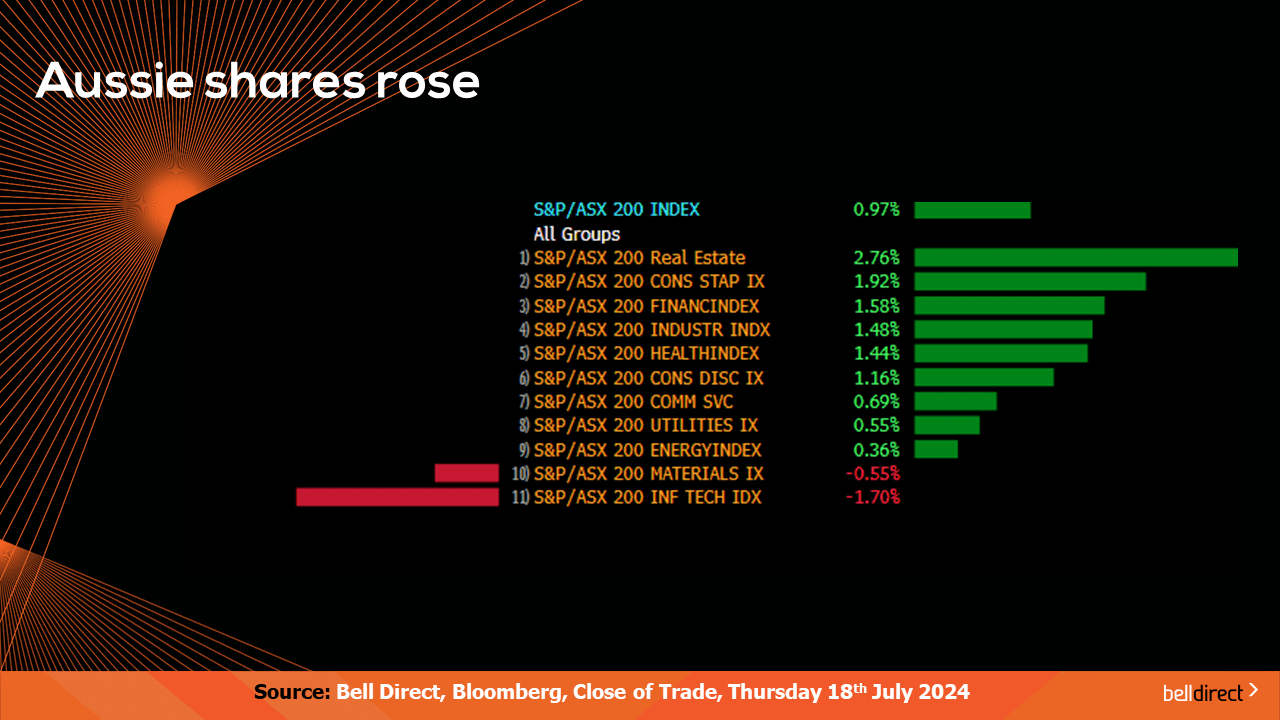

Locally from Monday to Thursday the ASX200 rose 0.97% as the local market took strong lead from the US record rally for the Dow Jones. Tech stocks came under pressure this week amid the Nasdaq’s decline as investors sought equities outside of the 2024 winning sector.

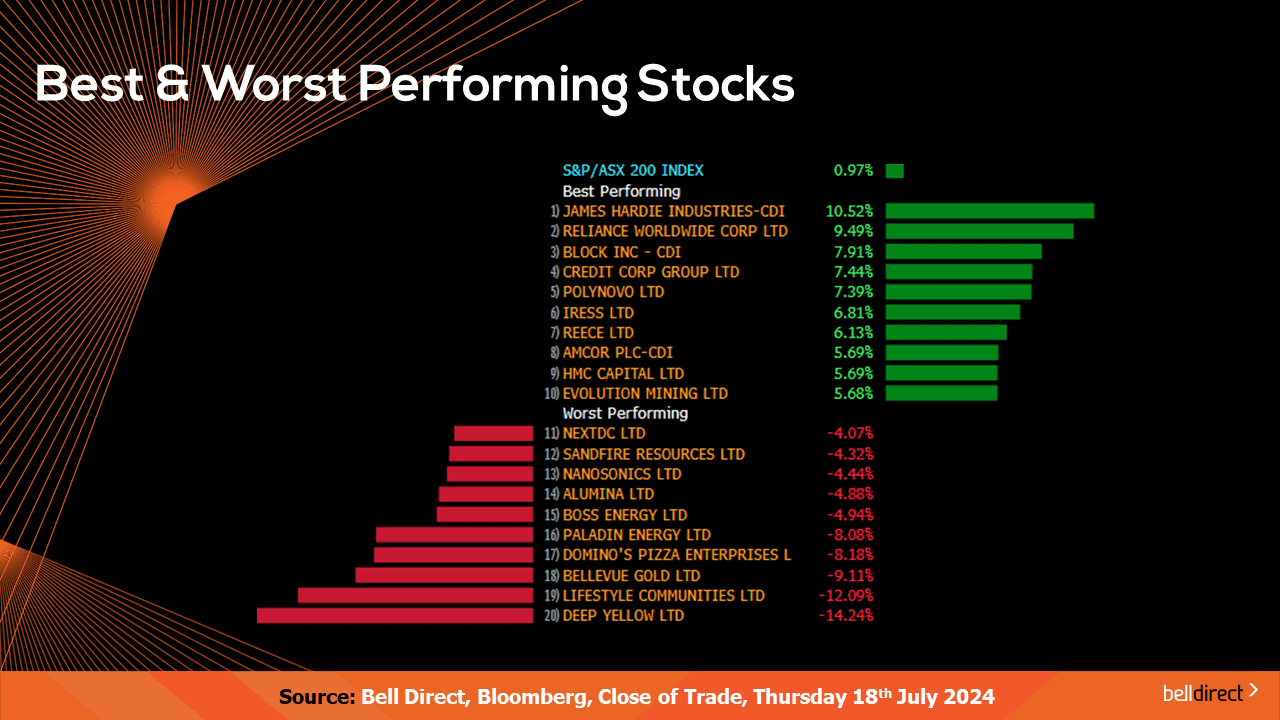

The winning stocks on the ASX200 were led by James Hardie Industries (ASX:JHX) jumping 10.52%, Reliance Worldwide Corp (ASX:RWC) climbing 9.49% and Block Inc (ASX:SQ2) rallying 7.91%.

And on the losing end Deep Yellow (ASX:DYL) fell 14.24% this week amid weakness among uranium miners this week, while Lifestyle Communities (ASX:LIC) and Bellevue Gold (ASX:BGL) each fell 12.09% and 9.11% over the four trading days.

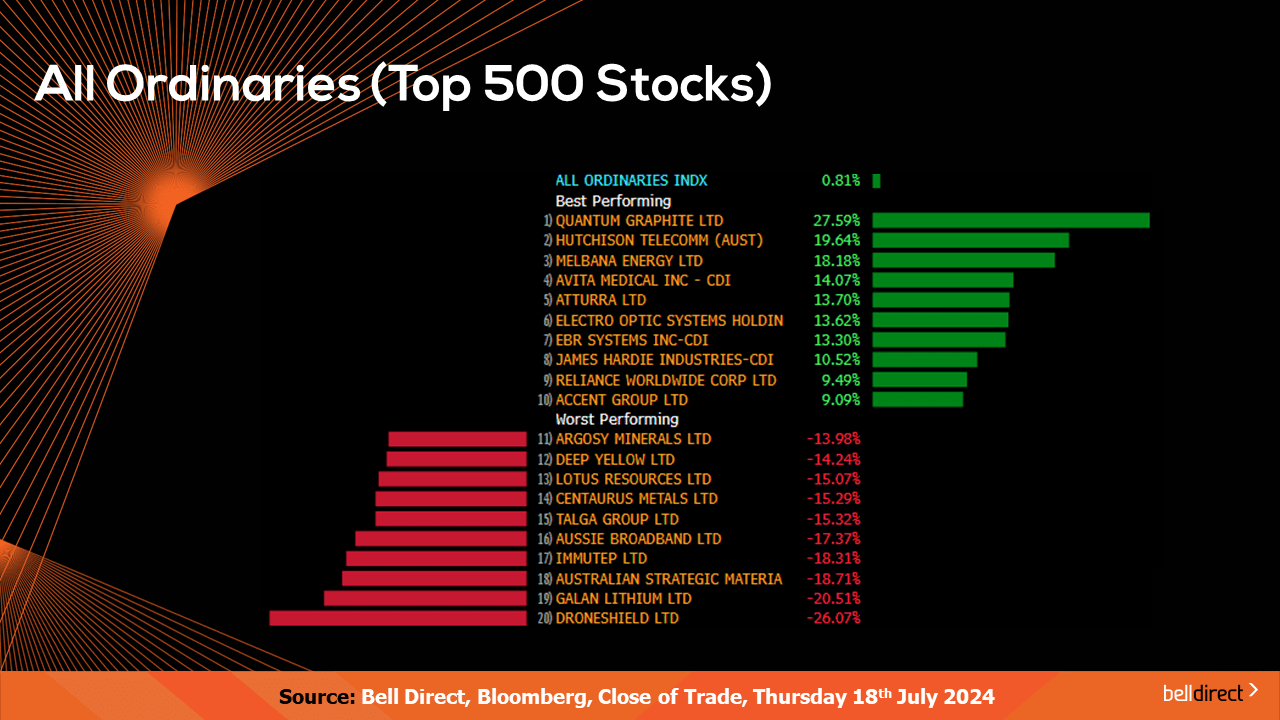

Across the broader market, the All Ords rose 0.81% this week led by Quantum Graphite (ASX:QGL) soaring 27.6%, Hutchison Telecomm (ASX:HTA) rose 19.64% and Melbana Energy (ASX:MAY) rose 18.18% over the four trading days.

DroneShield (ASX:DRO) weighed on the All Ords gains this week as the counter-drone technology company tumbled 26% on speculations around the sustainability of the company’s valuation.

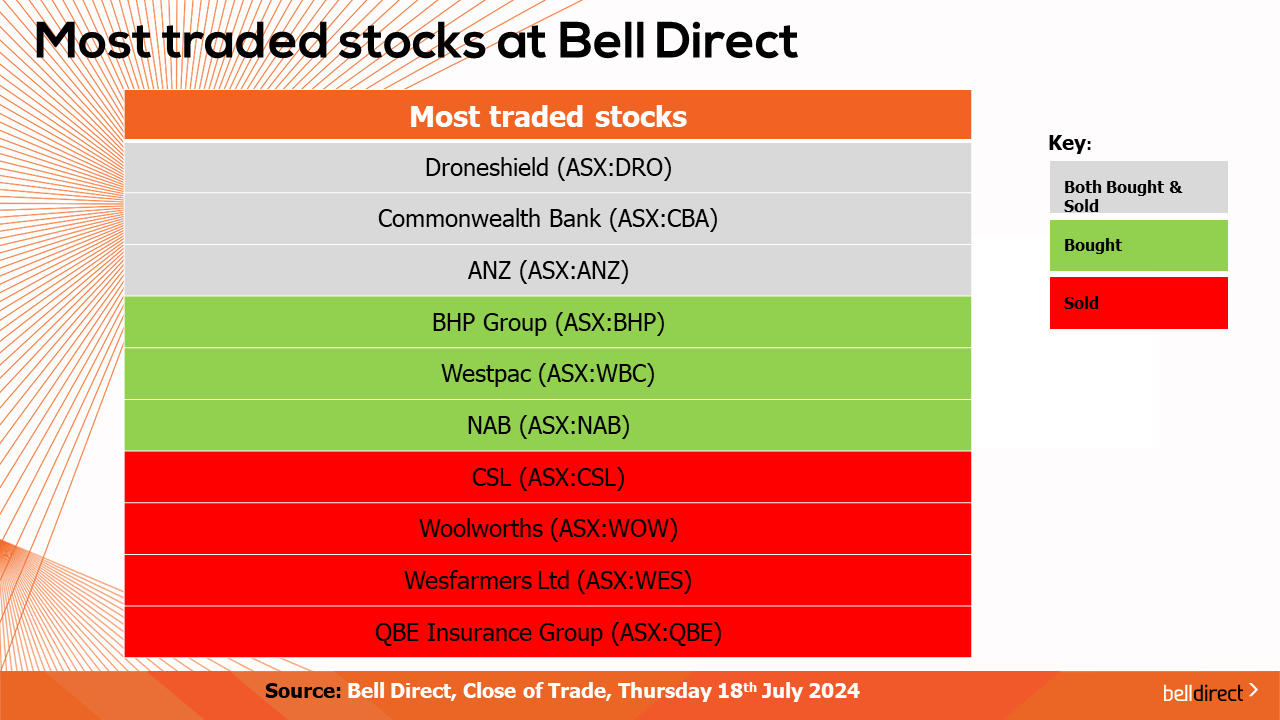

The most traded stocks by Bell Direct clients this week were DroneShield (ASX:DRO), CBA (ASX:CBA), and ANZ (ASX:ANZ). Clients also bought into BHP (ASX:BHP) while taking profits from Westpac (ASX:WBC), NAB (ASX:NAB), CSL (ASX:CSL), Woolworths (ASX:WOW), Wesfarmers (ASX:WES) and QBE Insurance Group (ASX:QBE).

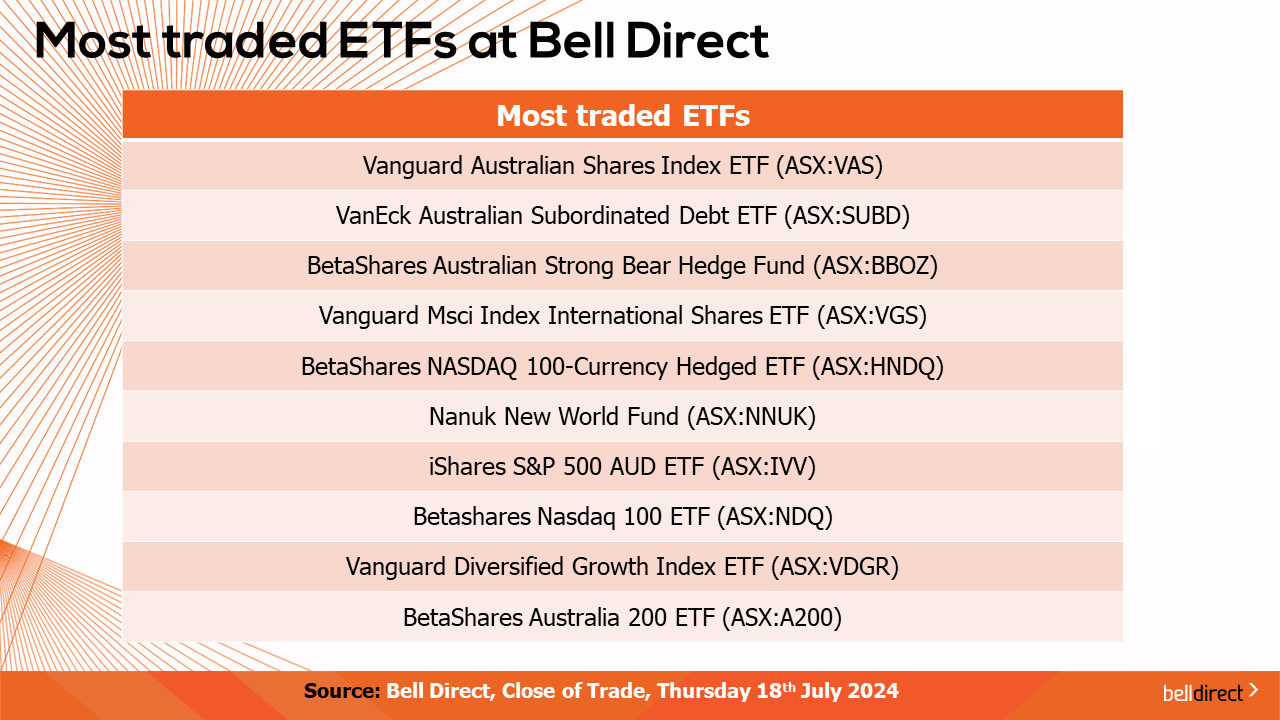

And the most traded ETFs were led by Vanguard Australian Shares Index ETF, VanEck Australian Subordinated Debt ETF, BetaShares Australian Strong Bear Hedge Fund.

On the economic calendar front next week, we may see markets move in response to Australia’s manufacturing PMI data for July which is out on Tuesday which will outline manufacturing sector conditions in the current economic environment. The reading of 47.2 points in June from 49.7 in May led Australian manufacturers to lower employment levels and cut back on purchasing activity.

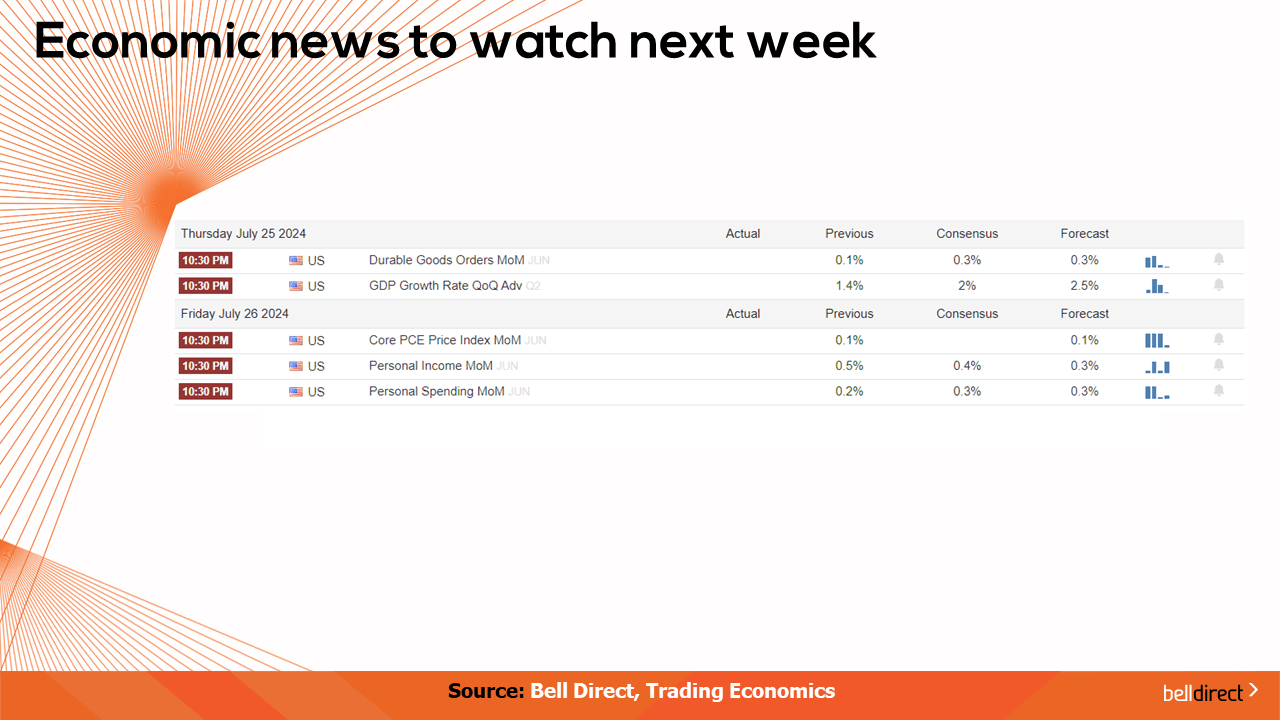

Overseas next week US trade balance data is out on Thursday with the US trade deficit widening every month since December 2023 so another expansion on deficit indicates imports continue to outweigh exports at a growing pace.

The Fed’s preferred measure of inflation data is also out in the US later next week with the expectation of a slight decline in PCE or personal consumption expenditures index data from 2.6% in May to 2.5% in June which if it does come in at the forecast reading, will provide further evidence that inflation is cooling in the US and the Fed’s rate cut outlook can proceed.

And that’s all for this week, have a wonderful weekend and happy investing!