The utilities sector is up 13.01% as investors seek out diversified exposure to the AI revolution. The utilities sector encompasses listed companies that provide basic everyday amenities including gas, electricity, water, and power.

Through the rise of the AI revolution the need for power and water have risen astronomically. Natural water is one of the world’s scarcest natural resources, and the AI revolution threatens to diminish remaining supplies even faster. Firstly, AI servers that are run in data warehouses require massive energy consumption thus generating excessive levels of heat. In order to maintain operations of the servers, data centres commonly use cooling towers which require a vast amount of clean, fresh water.

Secondly, generating the electricity required to power AI servers consumes a lot of water through cooling at thermal and nuclear power plants, thus enhancing consumption of water off-site too.

Finally, the AI revolution water consumption is also increased throughout the AI supply chain with approximately 2,200 gallons of Ultra-Pure Water (UPW) required to produce a microchip according to OECD.AI. Water withdrawal is the amount of fresh water taken from the ground or surface water sources, while water consumption is the amount of water evaporated, transpired and incorporated into products or crops says the OECD AI. Estimates of water withdrawal result in approximately 4.2 – 6.6 billion cubic meters of water withdrawal in 2027 which is more than the total annual water withdrawal of Denmark alone. Water consumption estimates point to the need for around 0.38 – 0.6 billion cubic meters of water needed for AI annually. Together, these estimates indicate the need for over 7 billion cubic meters of water required for the AI revolution to work per year.

With this in mind, which stocks may see increased demand through the growing need for water in the AI revolution?

Duxton Water (ASX:D2O) is Australia’s only listed ASX vehicle providing investors with direct exposure to the Australian water market through its portfolio of water entitlements in the Southern Murray Darling Basin. With analysts expecting water utilities stocks to have annual earnings appreciation of 36% over the next 5-years, this puts Duxton Water in a favourable position in the market landscape.

Elsewhere in the utilities sector, electricity and energy are also required to power the AI revolution. A recent study by Goldman Sachs outlined that US utilities will need to invest around $50bn in new generation capacity just to support data centres alone, while AI is set to drive 160% increase in data centres by 2030. The World Economic Forum also outlined that the energy required to run AI tasks is already rising at an annual growth rate between 26% and 36%, meaning by 2028 AI could be using more power than the whole of Iceland used in 2021. In Australia, Morgan Stanley Research expects data warehouse uninterruptible power supply requirements to increase from 1050 MW in 2024 to nearly 2500 MW in 2030 with the surging demand expected to place further pressure on nuclear energy and renewable power purchase agreements.

Australian electricity and gas giants AGL Energy (ASX:AGL) and Origin Energy (ASX:ORG) are poised to benefit from the rising demand for energy from AI data centres, with both companies posting strong gains over the last 12-months.

On the data centre side, NextDC (ASX:NXT) is developing major data centres under its $1bn commitment to service the growing demand for the AI boom. Earlier this year the company’s Chief Executive Craig Scroggie said Australia should be considering nuclear energy to supply the growing power needs of the AI revolution. From here, investors looking for exposure to the AI revolution can consider direct exposure through providers like Nvidia, data centre exposure through Goodman Group or NextDC, or utilities exposure through AGL, Origin or Duxton water.

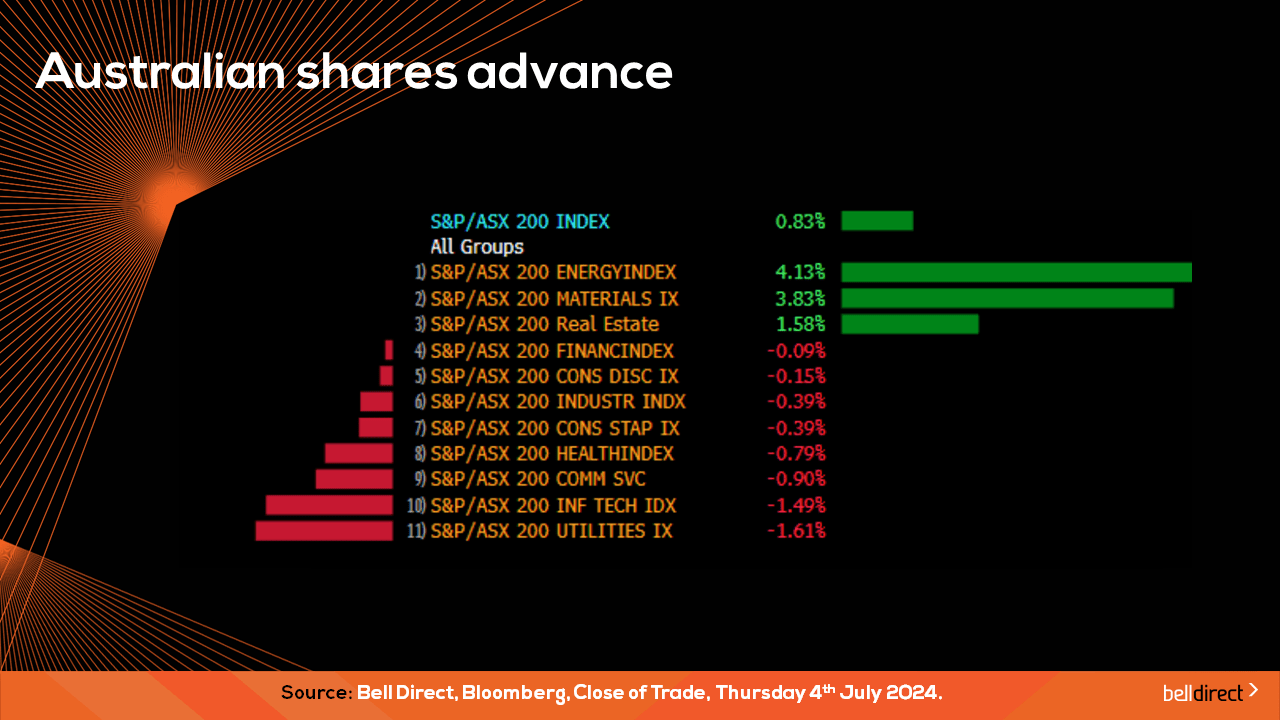

Locally from Monday to Thursday the ASX200 recovered from a sell-off early in the week to post a 0.83% gain across the four trading days primarily driven by the US hitting record highs across the Nasdaq and S&P500. Energy stocks led the charge this week with a gain of 4.13% amid the rising price of oil while materials stocks rose 3.83% over the week.

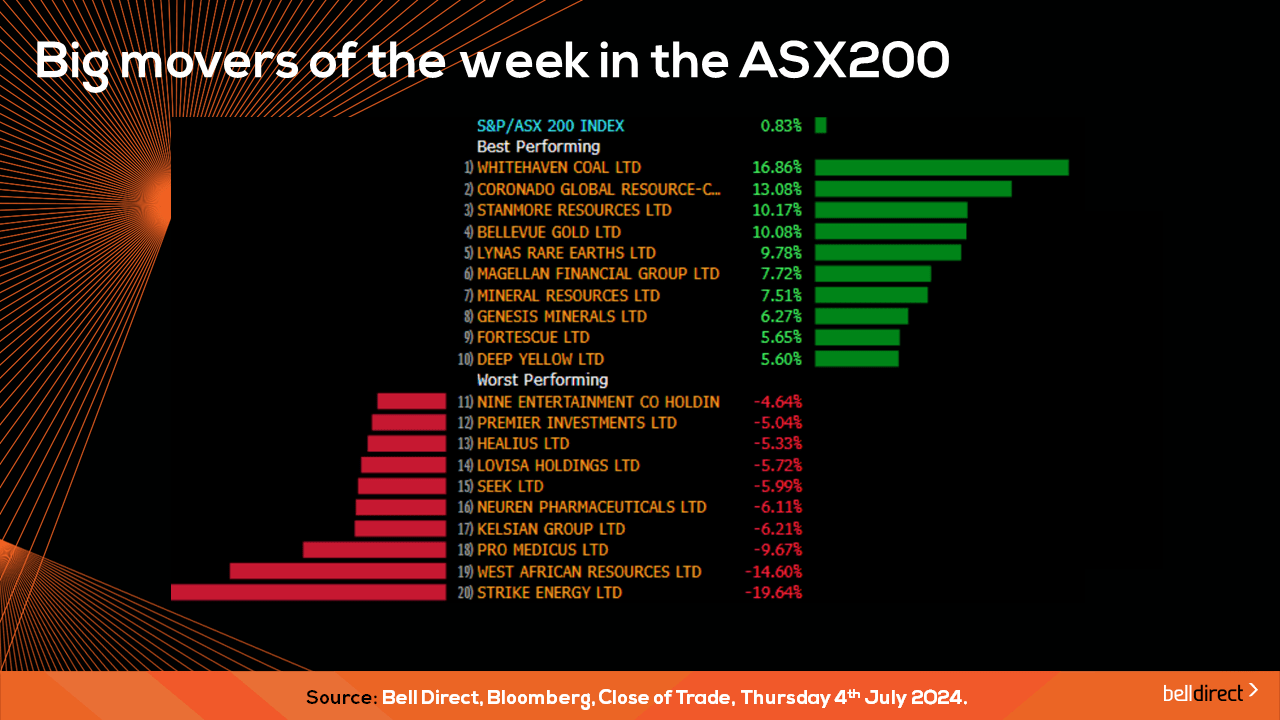

The winning stocks on the key index this week were led by Whitehaven Coal (ASX:WHC) jumping 16.86%, Coronado Global Resources (ASX:CRN) rising 13.08% and Stanmore Resources (ASX:SMR) adding 10.17%.

And on the losing end Strike Energy (ASX:STX) tumbled 19.64%, West African Resources (ASX:WAF) fell 14.6% and Pro Medicus (ASX:PME) lost 9.67%.

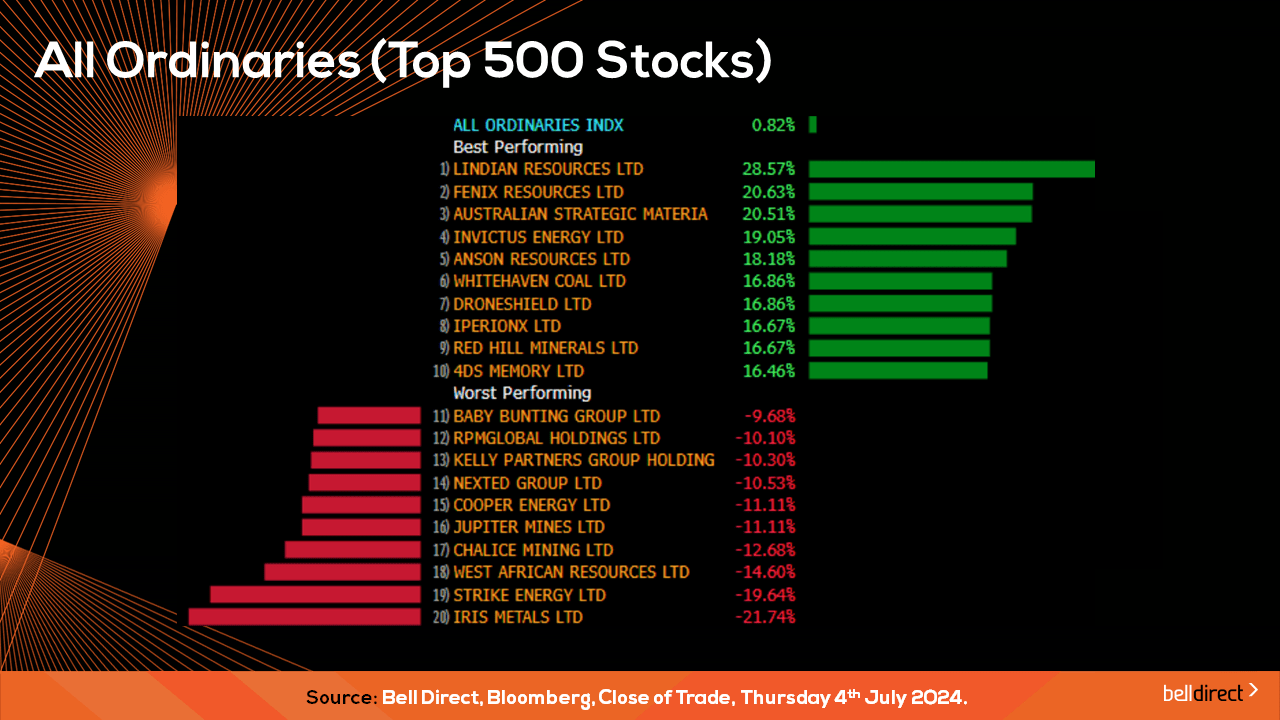

Across the broader market index, the All Ords rose 0.82% as Lidian Resources and Fenix Resources rose 28.57% and 20.63% respectively.

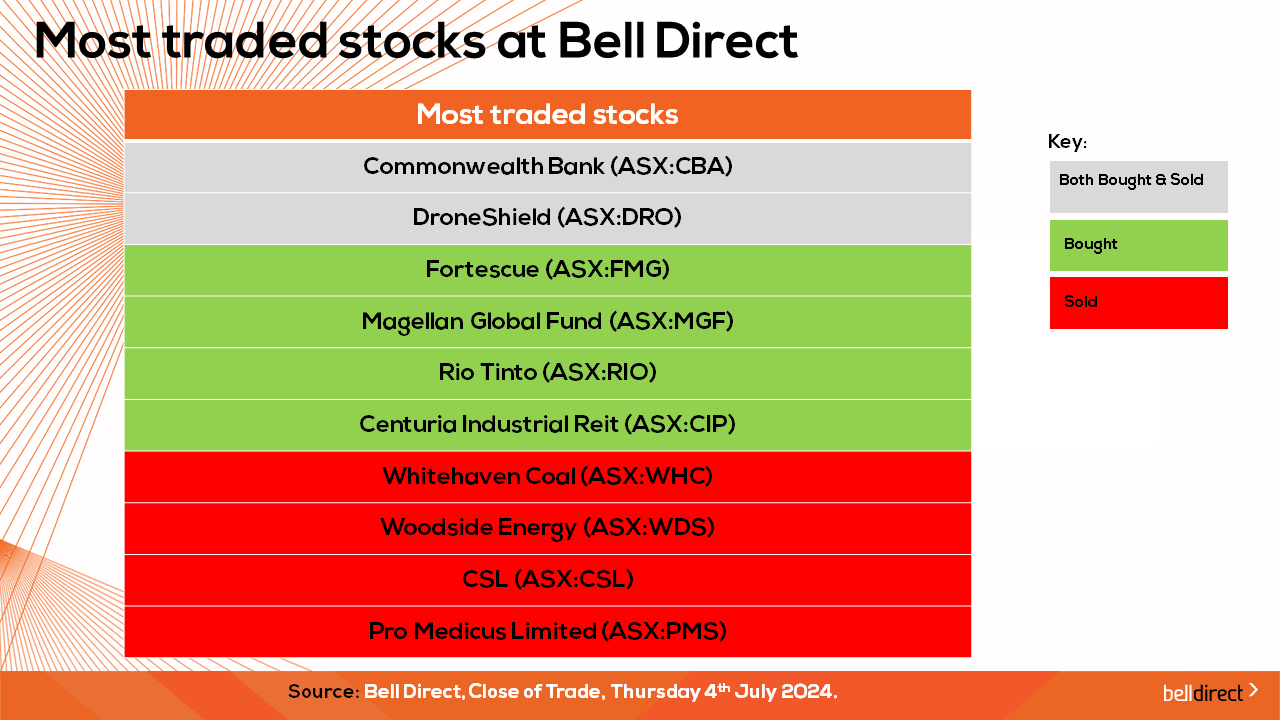

The most traded stocks by Bell Direct clients this week were Commonwealth Bank (ASX:CBA), DroneShield (ASX:DRO), and Rio Tinto (ASX:RIO).

Clients also bought into Fortescue (ASX:FMG), Woodside (ASX:WDS) and Pro Medicus (ASX:PME) while taking profits from Magellan Financial (ASX:MGF), Centuria Industrial REIT, (ASX:CIP) Whitehaven Coal (ASX:WHC), and CSL (ASX:CSL).

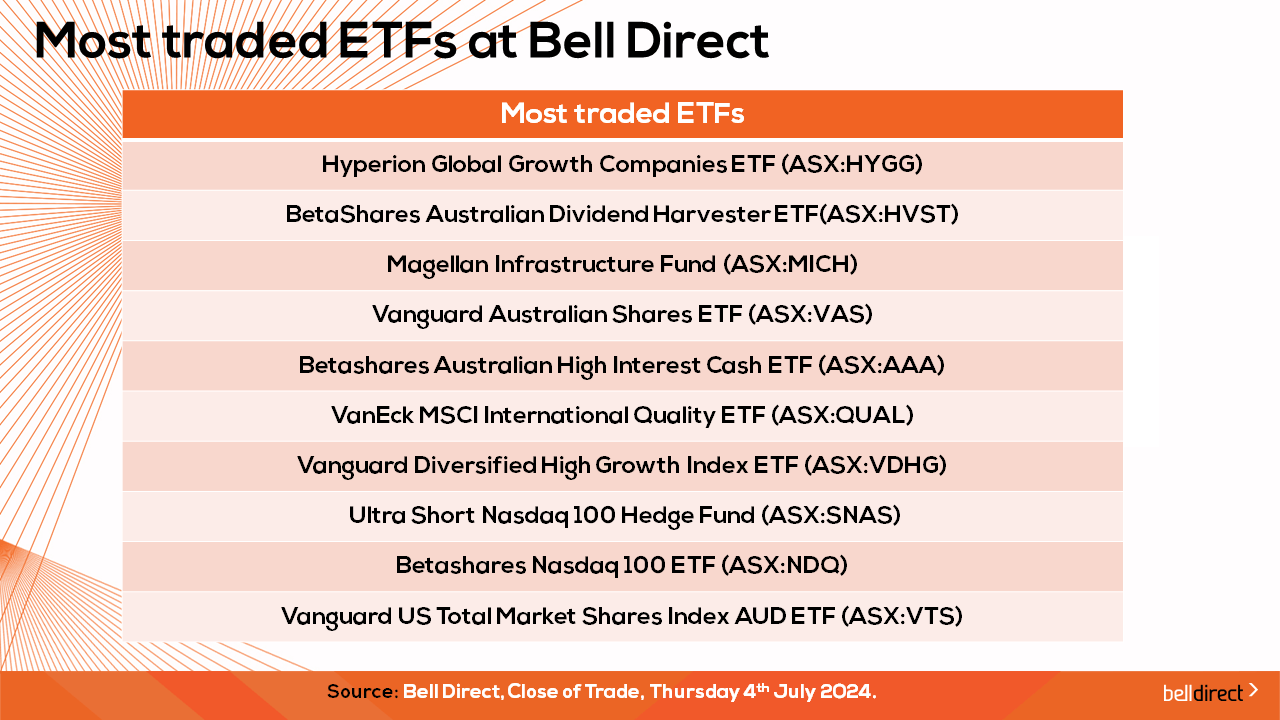

And the most traded ETFs by our clients this week were led by Hyperion Global Growth Companies fund, BetaShares Australian Dividend Harvester ETF and Magellan Infrastructure fund.

: Taking a look at the week ahead on the economic calendar, Westpac consumer confidence data for July and NAB business confidence data for June are released on Tuesday.

Overseas, China’s inflation rate for June will be announced on Wednesday with economists’ expecting a flat reading of 0.3%. China’s trade balance and GDP data are also out later next week with the forecast of an increase in trade surplus to $85bn and a decline in GDP from 5.3% in Q1 to 5% in Q2. Chinese retail sales and industrial production data are also out later next week with the forecast of a decline in both readings as the region struggles to recovery post-pandemic.

US core inflation data is out next Thursday with the market forecasting a slight decline in the inflation rate from 3.3% in May to 3% in June. Any reading higher than forecast will signal inflation remains sticky in the world’s largest economy and we may see an equity pullback during that session as investor fears of a prolonged rate hold escalate.

If you’ve found these insights useful, don’t miss out on a special offer available right now.

When you join and trade with Bell Direct you get access to more than 150 Bell Potter research reports AND live streaming data for a year – on us (it’s usually $330).

This offer is available for a limited time only, so join today.

And that’s all for this Friday, have a wonderful weekend and happy investing.