Wall Street pushed to another record close on Tuesday driven by tech darling Nvidia becoming the most valuable public company, surpassing Microsoft with a new market cap of US$3.3tn. The S&P500 hit a fresh record at the closing bell, rising 0.25% to 5487.03 points while the Nasdaq set a new record ending the day up 0.03% at 17,862.23 points and the Dow jones rose 0.15% to end the day at 38,835.86.

Retail sales data out in the US overnight showed a rise of 0.1% in May from a decline of 0.2% in April which was softer than economists were expecting but indicates a slight rebound in US consumer spending.

Across European markets overnight markets closed higher in the region on Tuesday following a choppy start to the week with the STOXX600 rising 0.66% on Tuesday while Germany’s DAX added 0.35%, the French CAC rose 0.76% and, in the UK, the FTSE100 ended the day up 0.6%.

Across the Asia region overnight markets closed higher overnight taking lead from Wall Street’s rally and as the RBA held rates steady in Australia. Japan’s Nikkei closed Tuesday’s session up 1%, while South Korea’s Kospi index rose 0.72% at the session’s end.

What to watch today:

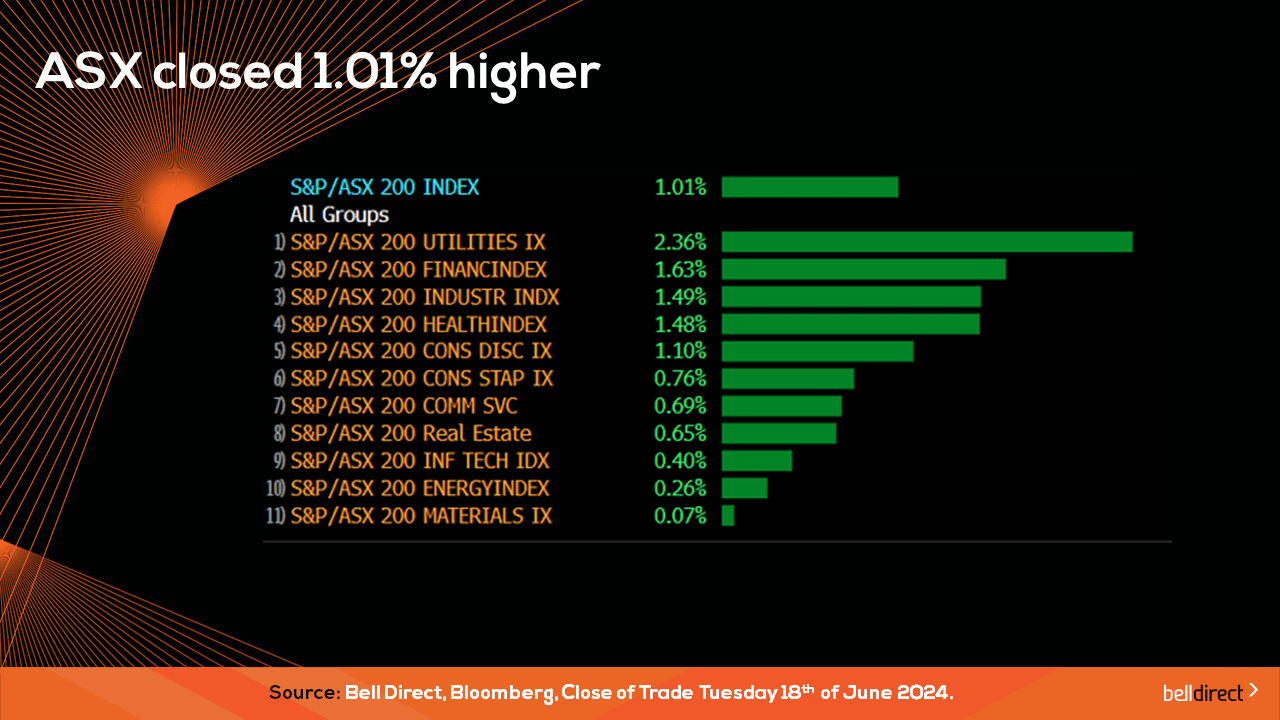

- The local market took strong lead from Wall Street’s record finish on Monday, to close Tuesday’s session up 1% buoyed by the banks on the back of the RBA maintaining the nation’s cash rate at the current 12-year high rate of 4.35%, for the next period.

- The rate announcement was followed by commentary out of the RBA around outlook toward inflationary pressures with RBA Governor Michele Bullock saying the outlook remains highly uncertain. Ms Bullock went on to say the path of interest rates will best ensure that inflation returns to the target in a reasonable timeframe, and the nation’s central bank did not rule anything out.

- On the commodities front this morning, crude oil is trading just shy of 1.5% higher at US$81.51/barrel, gold is up 0.41% at US$2330/ounce and iron ore is down 0.26% at US$107.05/tonne.

- The Aussie dollar has strengthened overnight to buy 67 US cents, 104.98 Japanese Yen, 52.16 British Pence and 1 New Zealand dollar and 8 cents.

- Ahead of the local trading session here in Australia the SPI futures are expecting the ASX take no lead from Wall Street’s rally with an anticipated open of 0.10% in the red.

Trading Ideas:

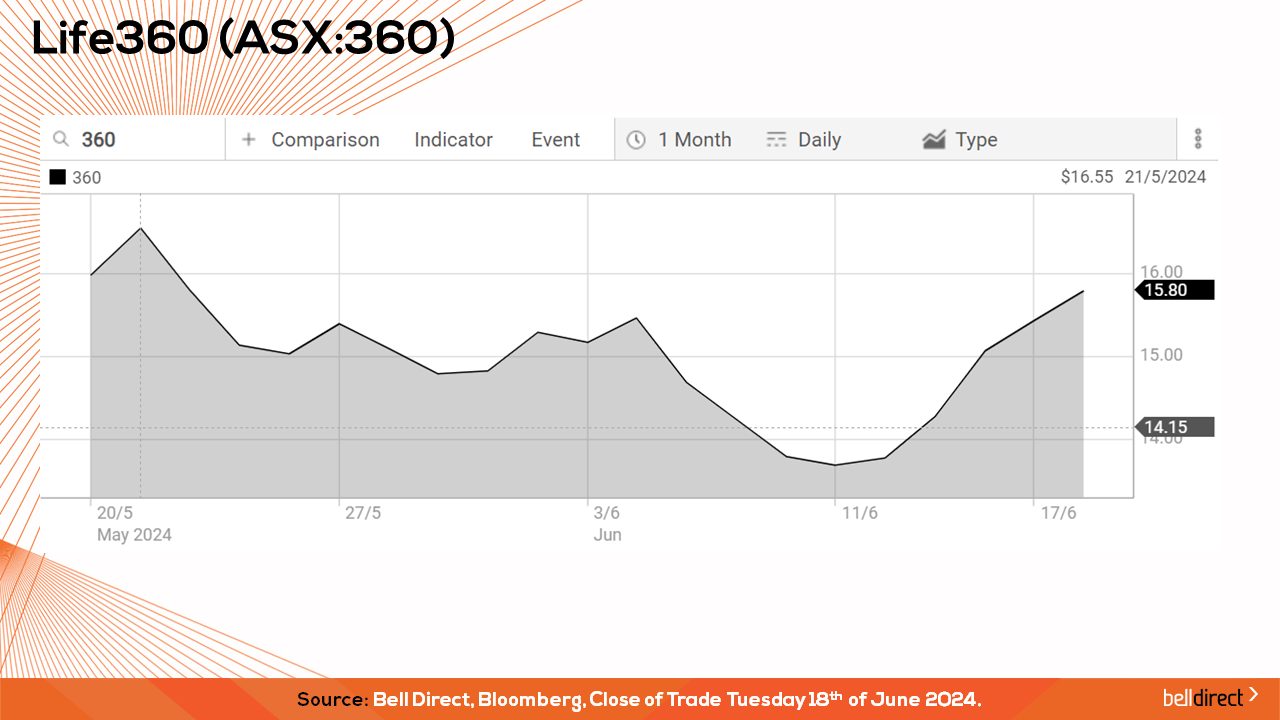

- Bell Potter has maintained a buy rating on Life360 (ASX:360) and have raised the 12-month price target on the company from $17.00 to $17.75 following the release of a media release out of the company outlining it has reached 2m global paying circles which is notably ahead of Bell Potter’s forecast and indicates a growing paying subscription model base for the company as it approaches profitability.

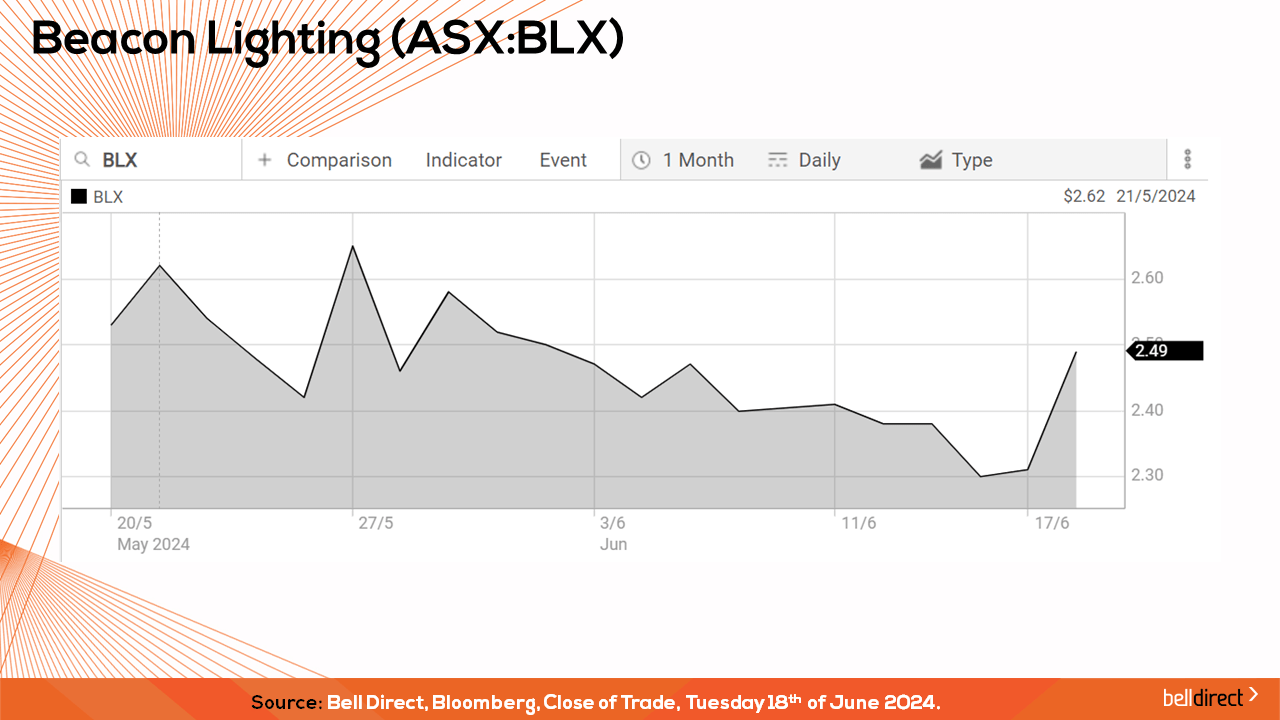

- Trading Central has identified a bullish signal on Beacon Lighting (ASX:BLX) following the formation of a pattern over a period of 29-days which is roughly the same amount of time the share price may rise from the close of $2.49 to the range of $2.90 to $3.00 according to standard principles of technical analysis.