Weekly Wrap Transcript 14 June

Financial markets are caught in a balancing act, dissecting recent economic data including the Federal Open Market Committee (FOMC) meeting and US Consumer Price Index (CPI) report, while also looking ahead to upcoming events that could rattle investor confidence.

Fresh data on US producer prices (PPI) and jobless claims caused some initial market jitters. The PPI data hinted at potentially lower core inflation than expected, which triggered a brief sell-off in the US dollar. However, these concerns were quickly overshadowed by concerns surrounding the upcoming French election.

Investors hedge the risk of the National Rally party’s victory, with concerns of fiscal indiscipline, given the sizeable French bond supply coming to the market this year. This may lead to a credit rating downgrade, raising concerns about the country’s economic stability.

Despite these economic worries, US stock markets closed higher, fueled by strong performances from big tech companies including Apple, Adobe and Broadcom. The broader market however, wasn’t as enthusiastic, with many smaller companies experiencing losses.

The strength of the US dollar seems to be behind the decline in gold and silver prices. Asian markets are also bracing for a potentially sluggish opening, as the positive performance of US tech stocks may not translate as well in the region.

And the Bank of Japan concludes a 2-day meeting today. Investors are keenly waiting to see if the bank will make any tweaks to its bond-buying program, which could have further repercussions on global markets.

Also this week, to sum up local corporate news:

- Deterra Royalties is making a move to acquire a British lithium mining company.

- Qantas Airways is expanding its reach by purchasing the remaining stake in TripADeal.

- The ACCC is raising concerns about a potential merger in the pharmacy sector, citing potential harm to competition.

- Beach Energy successfully made its first gas sale

- And ASX shares faced pressure after the stock exchange announced forecasts for higher expenses and capital expenditures in the coming years.

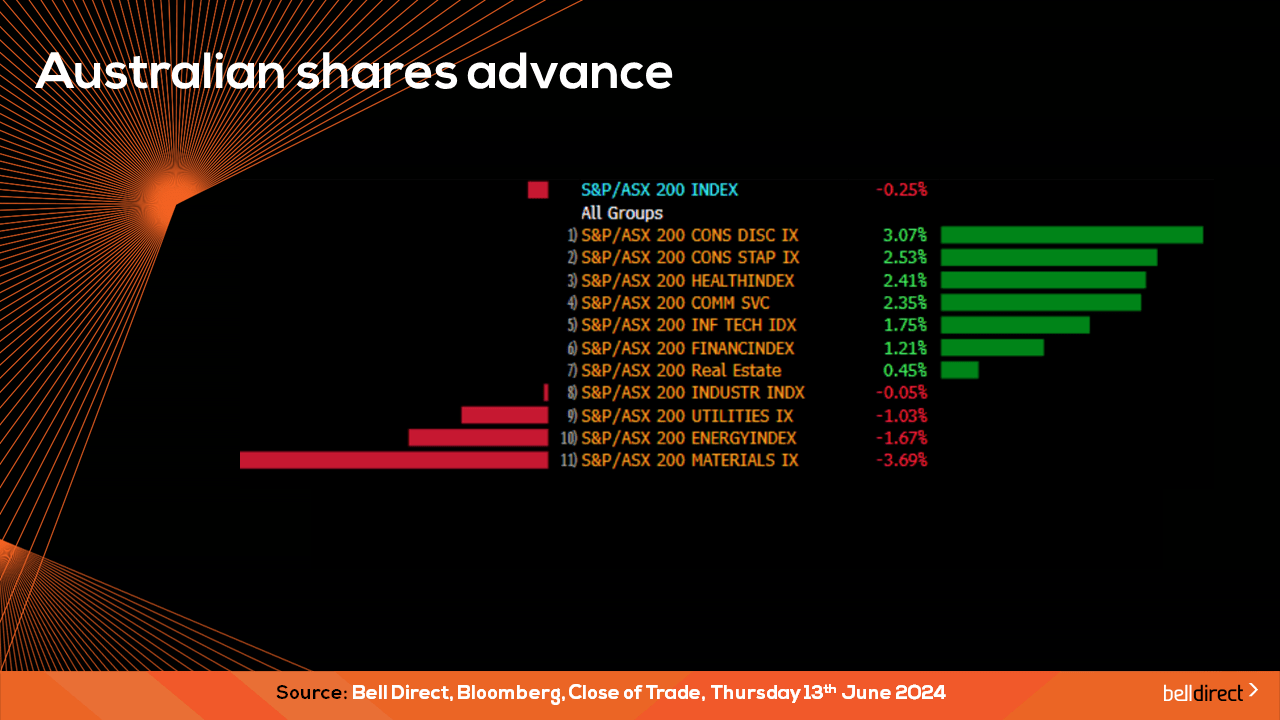

Looking at how the market performed this week so far:

The ASX200 is down 0.25% Monday – Thursday, with the materials and energy sectors weighing down on the market the most. Meanwhile, the consumer discretionary and consumer staples sectors advanced the most, up 3.07% and 2.53% respectively.

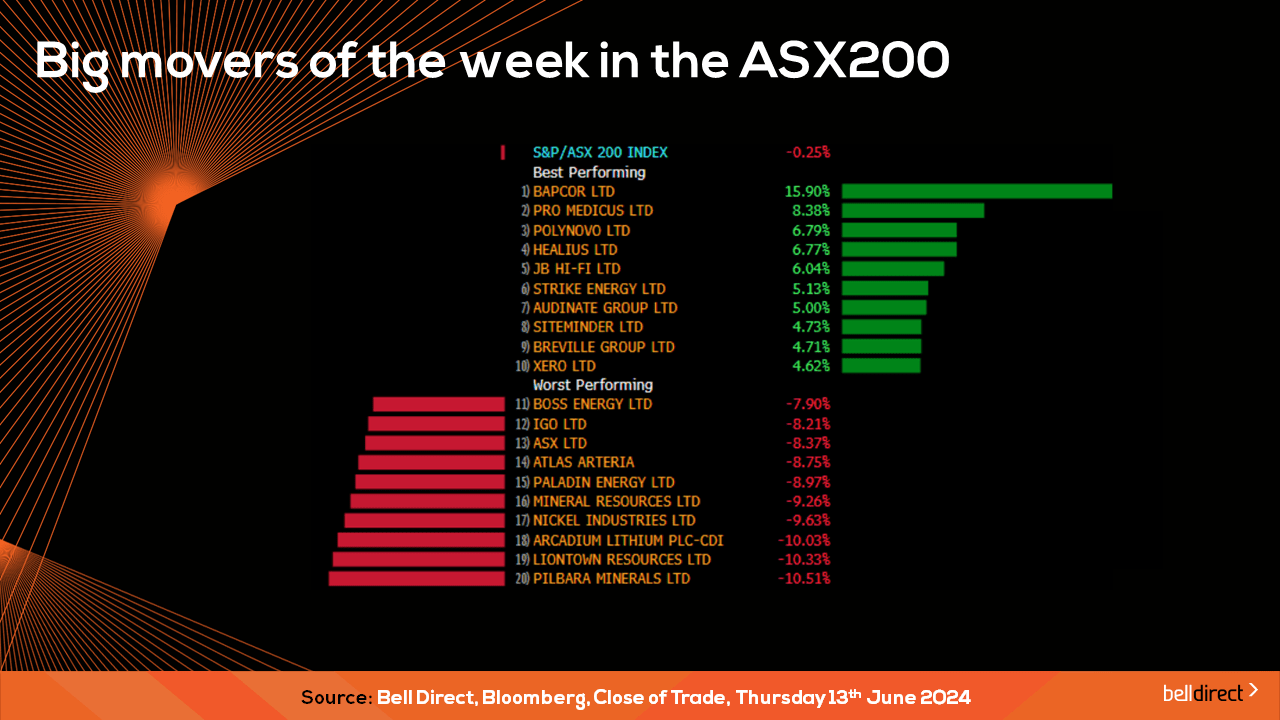

Auto repair retailer Bapcor (ASX:BAP) was the best performing stock this week, with investors buying in after the company received a conditional and non-binding takeover proposal from Bain Capital, which would see Bapcor shareholders receive $5.40 cash per share from the private equity giant. The Bapcor board are currently considering the offer.

Meanwhile, Pro Medicus (ASX:PME), Polynovo (ASX:PNV) and Healius (ASX:HLS) advanced this week. And some big miners suffered this week. Pilbara Minerals (ASX:PLS) declined the most, down 10.5% as the lithium price continues to fall, and general consensus is that the lithium price will stay lower for the foreseeable future. Liontown resources (ASX:LTR), Arcadium Lithium (ASX:LTM), Nickel Industries (ASX:NIC) and Mineral Resources (ASX:MIN) are also in red.

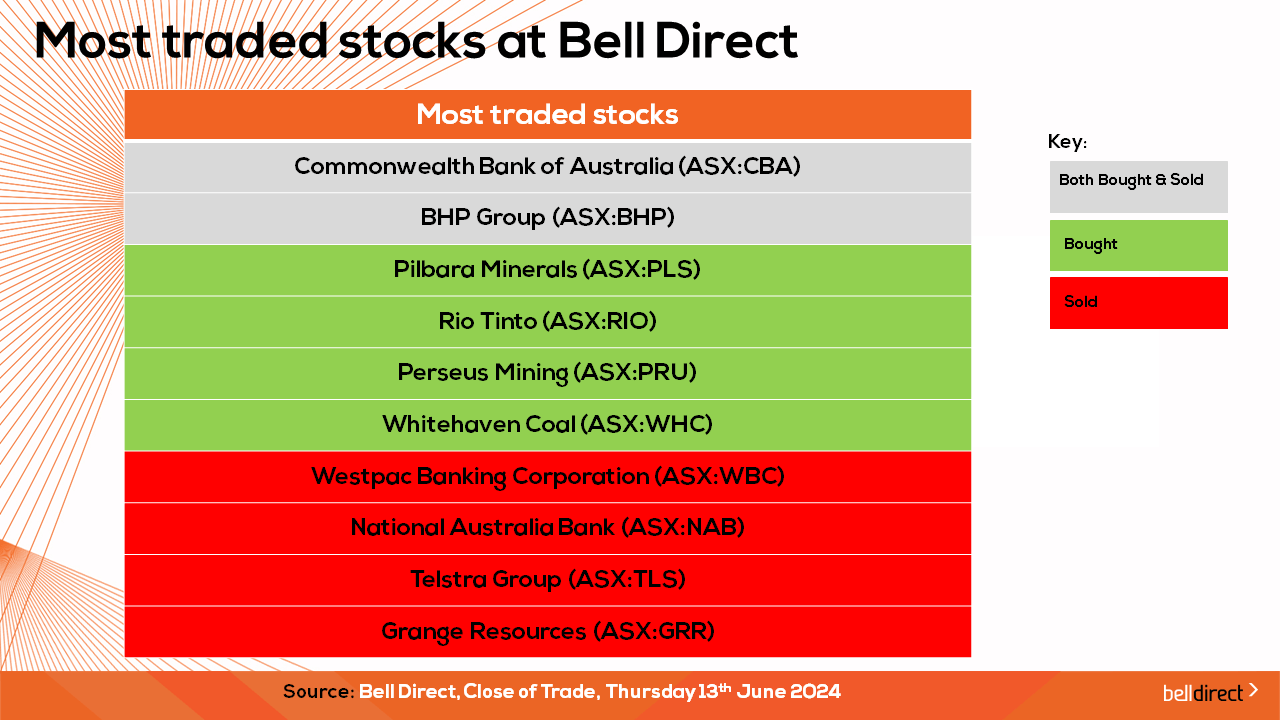

And the most traded stocks by Bell Direct clients this week were CBA and BHP. Clients also bought into Pilbara Minerals, Rio Tinto, Perseus Mining and Whitehaven Coal. While took profits from Westpac, NAB, Telstra and Grange Resources.

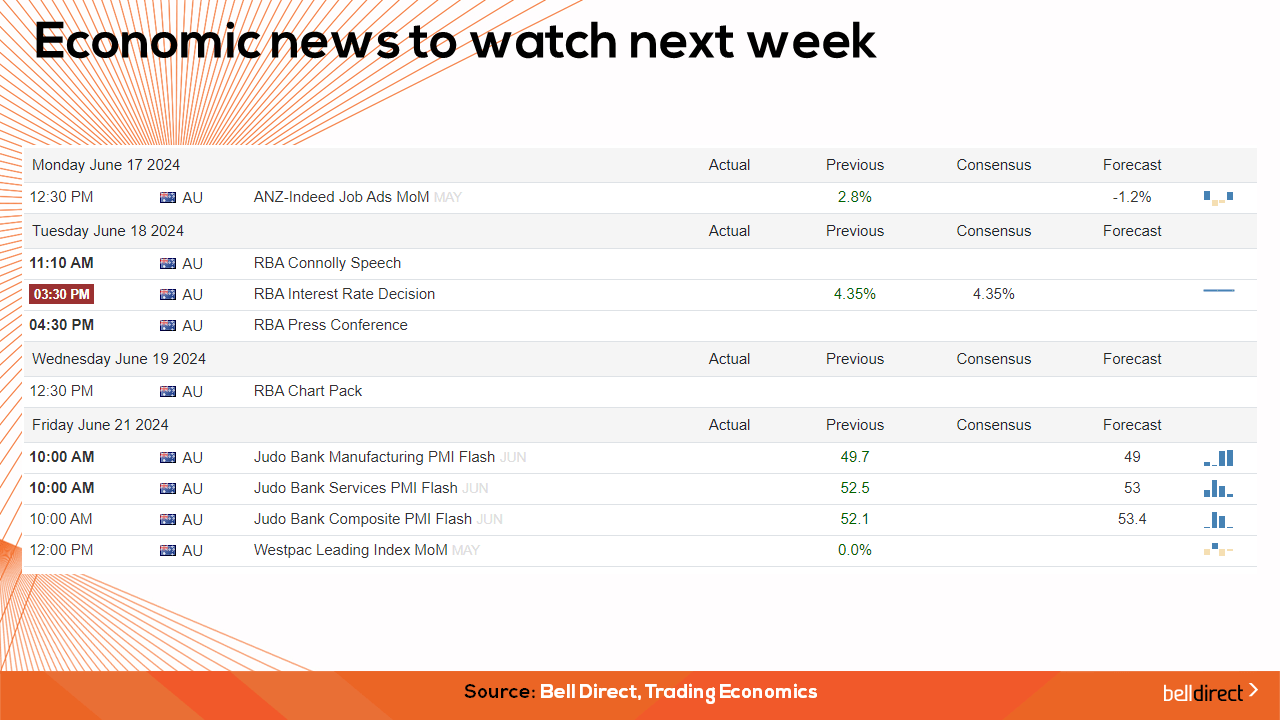

And to end, economic news to watch out for next week include the RBA’s next interest rate decision on Tuesday, which is expected to remain unchanged at 4.35%, and on Friday, the Manufacturing and Services Flash PMI will be released.

That’s our wrap up for this week, enjoy your weekend and as always, happy investing!