The rise of artificial intelligence (AI) has fuelled the local tech sector to soar just shy of 31% over the last 12-months, in a time that would typically see the high growth tech sector slide given the high interest rate environment. Many investors and markets are questioning the skyrocketing valuations within the tech space and just how long such valuations can be sustained, however, with Nvidia’s recent stellar results indicating further earnings inflation on the horizon, the sky may really be the limit for the newfound AI sector. With generative AI expected to become a $1.3tn market by 2032, according to Bloomberg, where are the opportunities for investment in the current market environment?

As an investor you may think you have missed the boat for buying into semiconductor and AI stocks at reasonable valuations, however, looking outside of the tech sector presents some attractive exposures to AI without buying into the direct producers themselves.

Firstly, the infrastructure required to house the AI movement includes hefty computer machinery, millions of gallons of fresh water for cooling the machinery, and electricity, this presents the first opportunity for investment outside of direct AI exposure. The utilities service providers of water, power and machinery producing the AI components are an investment opportunity in themselves to ensure they run efficiently and sustainably overtime.

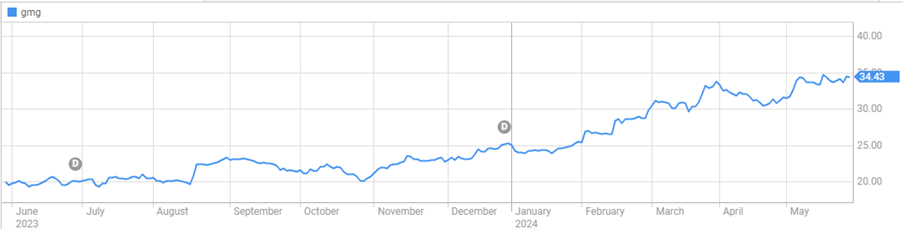

Next, there’s the homes of the physical machines that house the AI infrastructure. While still a very new scope in the investment space, locally listed companies like Goodman Group (ASX:GMG) have pivoted focus to expand and capitalise on the AI movement through expansion into the industrial data warehousing space. As of the company’s latest results at 31st March, 2024, Goodman has $12.9bn of development work in progress across 82 projects with 40% of the WIP projects representing data centres currently under construction. Goodman’s global power bank increased by 0.3GW in Q3 to 4.3GW across 12 major global cities as cited in their March results. The global expansion of GMG in the high-demand datacentre market makes the industrial property REIT as an attractive AI exposure investment opportunity in 2024.

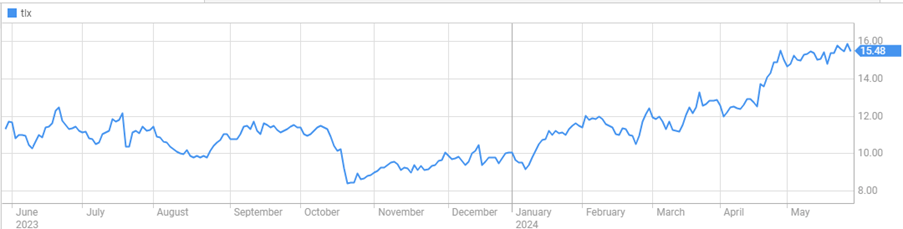

You may be surprised to hear that AI is even operating in the healthcare sector in many diverse forms, from imaging to clinical trial facilitation and beyond. Telix Pharmaceuticals (ASX:TLX) is a leading cancer imaging and therapy development pharmaceuticals company that is leading the way in the use of AI, through its acquisition of Dedicaid in April 2023. Dedicaid’s core asset is a clinical decision support software (CDSS) AI platform capable of rapidly generating indication specific CDSS applications from available datasets for use with specific types of imaging modalities (Telix), i.e. the AI has the ability to accelerate Telix’s testing and clinical trial scope by adding predictive AI capabilities to automate the classification of lesions and enhance efficiency in the imaging workflow. AI will by no means replace human clinical trials in the healthcare space, however, it has the power to predict clinical trial outcomes and enhance the efficiency of clinical trials to reduce the high costs associated with such processes.

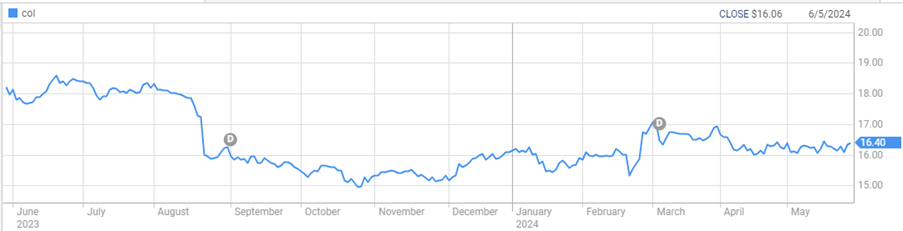

Even the big supermarket giants are diving into the AI space with Coles using the movement to strengthen its relationship with shoppers. Using AI, Coles has pioneered an AI journey that helps the company to predict the flow of units and even streamline the checkout process by scanning fresh produce that comes up immediately, saving the customer scrolling through pages upon pages of product options to find the correct item. It doesn’t stop there, with Coles also using AI to personalise the delivery of promotions and suggested purchased to customers through its FlyBuys customers every week.

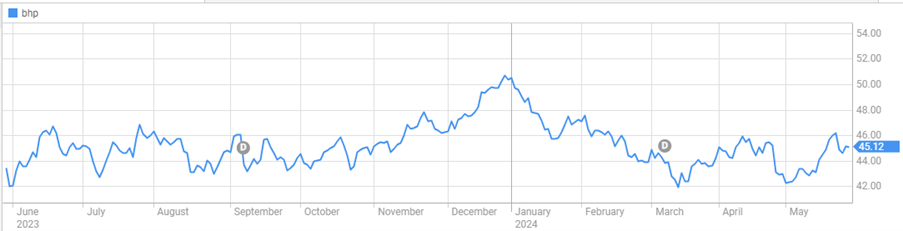

And we can’t forget the mining industry which is already harnessing the AI revolution across a vast array of operations from safety to assay testing and more. BHP launched a collaboration with Microsoft to utilise AI and machine learning for improving copper recovery at the world’s largest copper mine, the Escondida Mine in Chile. Given copper’s growing use in the green energy transition globally, declining grades at existing copper mines and fewer new discoveries made, the use of AI and machine learning at the Escondida Mine unlocks greater production and value potential for BHP. BHP is also using AI to optimise and increase operation efficiencies in the loading process of iron ore exports from WA by reducing spillage and damages to rail infrastructure during times of unexpected surges in volumes.

The use of AI across all industries is becoming extensive and offers some creative and diverse exposure to the movement for your portfolio, however, if you are keen to gain direct investment exposure to AI technology providers in your portfolio there is always ETFs to choose from that combine some of the best AI offerings in the one trade. The BetaShares Global Robotics and Artificial Intelligence ETF (ASX:RBTZ) invests in 42 global companies positioned in the robotics, machinery, AI and semiconductor space including Nvidia, SMC and Keyence, while the Global X Artificial Intelligence ETF (ASX:GXAI) seeks to invest in companies that are involved in AI development and the scope of the AI value chain from hardware companies to enablers developing the foundations of the AI platforms and more.

If AI is on your investment radar, be sure to research the full scope of exposure to the latest and greatest technology revolution driving markets globally before deciding the perfect AI investment to match your investment strategy.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.