Transcript: Weekly Wrap 17 May

This week Treasurer Chalmers revealed the Federal Budget, announcing a surprise surplus of $9.3 billion for the past financial year. This windfall stemmed from strong commodity prices, inflation boosting tax revenue, and unexpected job growth. However, the good times aren’t expected to last – forecasts predict a return to deficits in the coming years, with an initial deficit of $28.3 billion projected for 2024-2025. The budget also anticipates inflation dipping back down to the Reserve Bank’s target range by the end of the year.

Now, the budget historically has limited implications for the financial markets. Most new spending plans and tax cuts were already anticipated and even the predicted deficits are modest compared to Australia’s overall economic output.

However, here are some key financial planning takeaways you should know about:

Considering the cost of living:

- Lower Electricity Bills: Starting July 1st, households will automatically receive a $300 credit on their electricity bills. Around one million small businesses will also get a $325 boost to help manage their energy costs.

- And the reworked tax cuts originally aimed at high-income earners have shifted gears. Now, most Aussies earning above the tax-free threshold will benefit, with an average weekly tax cut of around $36.

Looking at housing supply:

- The budget proposes a significant investment – $11.3 billion – to construct 1.2 million new homes within five years. These houses will specifically target women in crisis, low-income families, and the homeless, helping to address the housing shortage.

- And in the aim of increasing social and affordable housing: An additional $1.9 billion in loans will be allocated to build 40,000 new social and affordable homes, further expanding housing options for vulnerable Australians.

And considering your superannuation,

The government recently unveiled the superannuation changes included in the 2024-2025 budget. These changes focus on boosting retirement savings and giving Australians more control over their super.

- Super guarantee increase was confirmed: The gradual rise of the Super Guarantee Contribution (SGC) rate to 12% remains on track. From July 1st, employers will contribute 11.5% to your super (up from 11.0%).

- And higher contribution limits is good news for savers! The maximum amount you can contribute to your super each year is increasing to $30,000 from July 1st. Empowering You:

What Didn’t Change:

- The new tax rules for high-balance super funds (Div 296) will still come into effect from July 1st, 2025.

Now looking at the market’s performance this week so far,

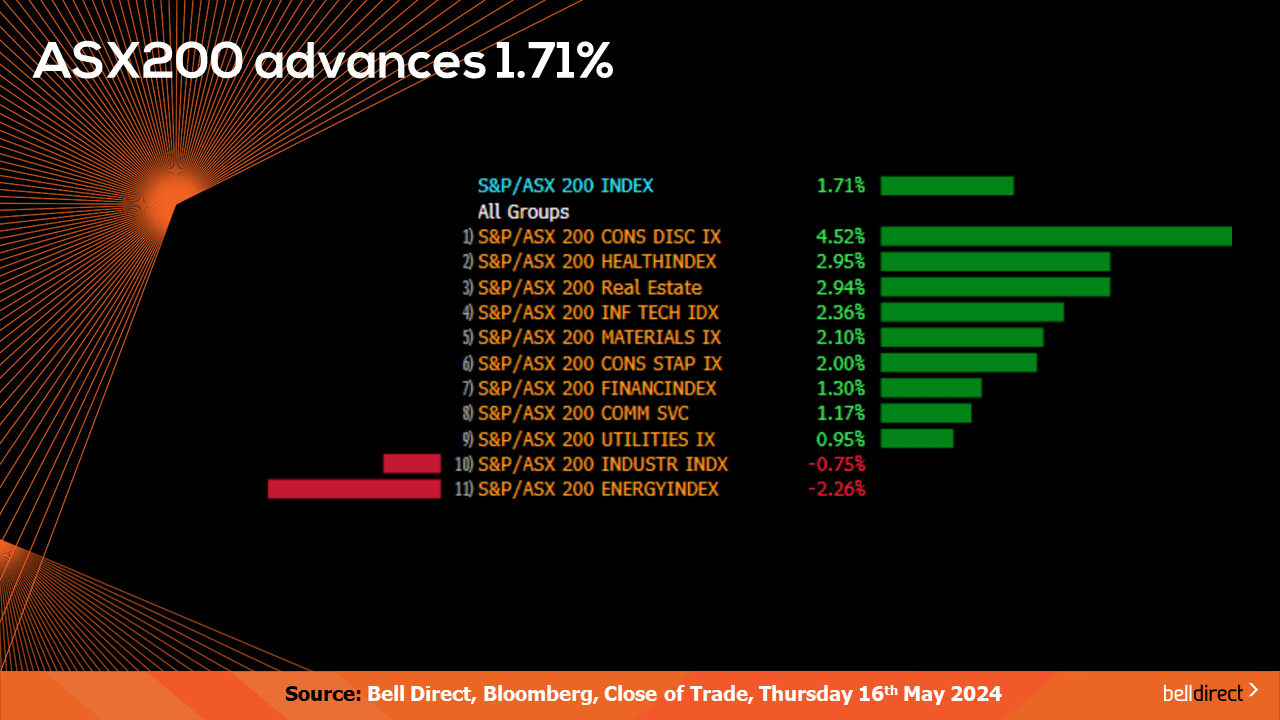

Our local market advanced 1.7% this week so far, with the consumer discretionary sector gaining 4.5%, followed by the healthcare sector.

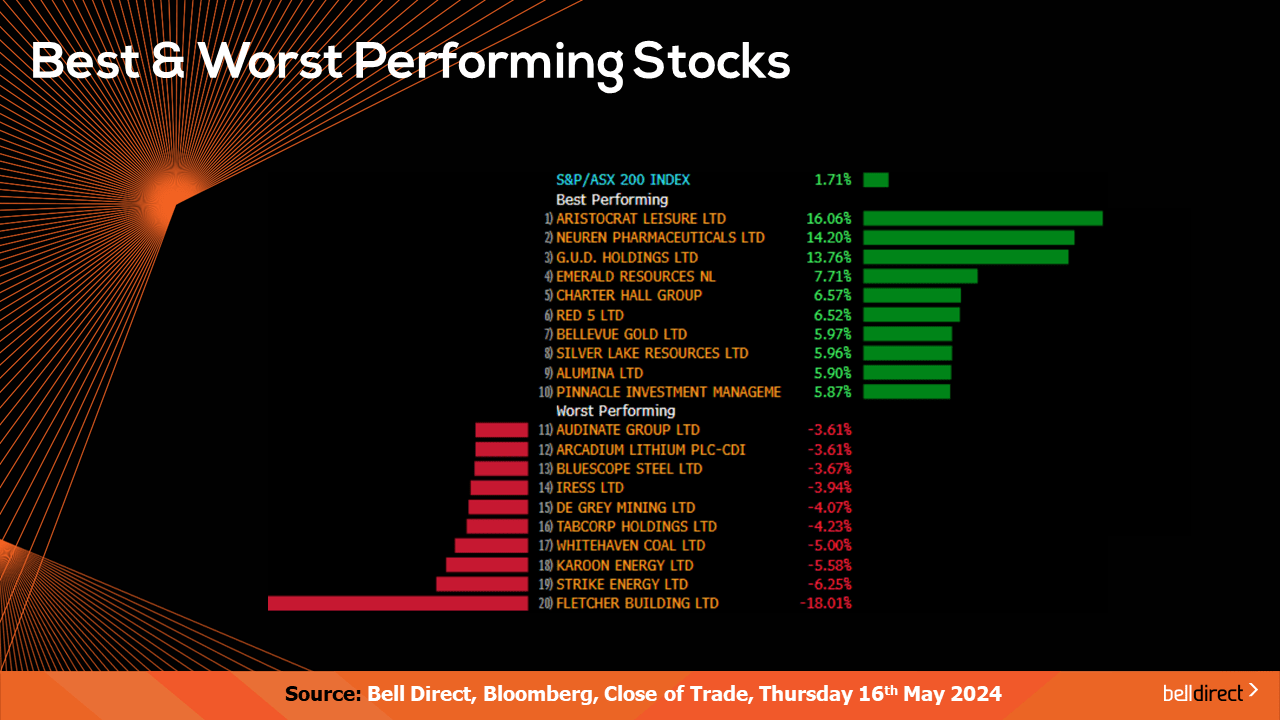

On the ASX200 leaderboard, Aristocrat Leisure (ASX:ALL) was the best performing stock, gaining an impressive 16% on a profit beat following the release of its FY24 first-half report. Meanwhile, Fletcher Building (ASX:FBU) declined the most after the building company released a disappointing trade update.

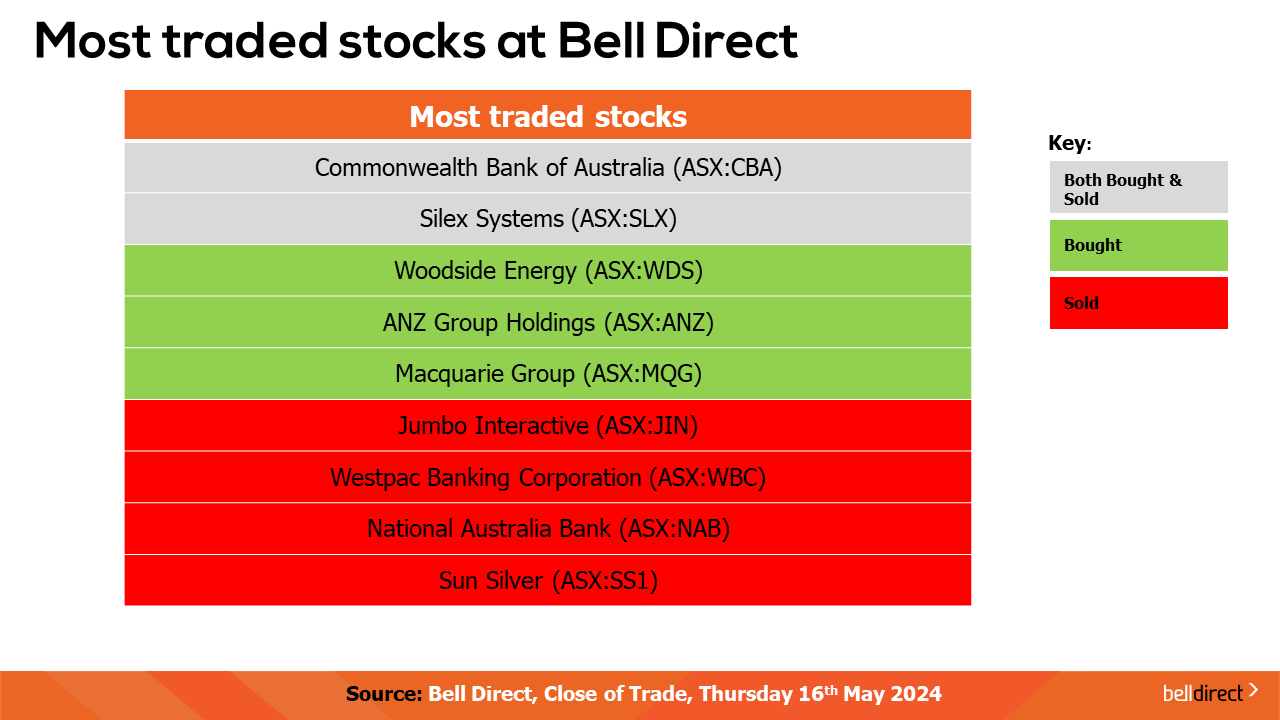

As for the most traded stocks by Bell Direct clients this week, these included Commonwealth Bank (ASX:CBA) and Silex Systems (ASX:SLX). Clients also bought into Woodside Energy (ASX:WDS), ANZ, and Macquarie (ASX:MQG), while took profits from Jumbo Interactive (ASX:JIN), Westpac (ASX:WBC), NAB, BHP and Sun Silver (AS:SS1).

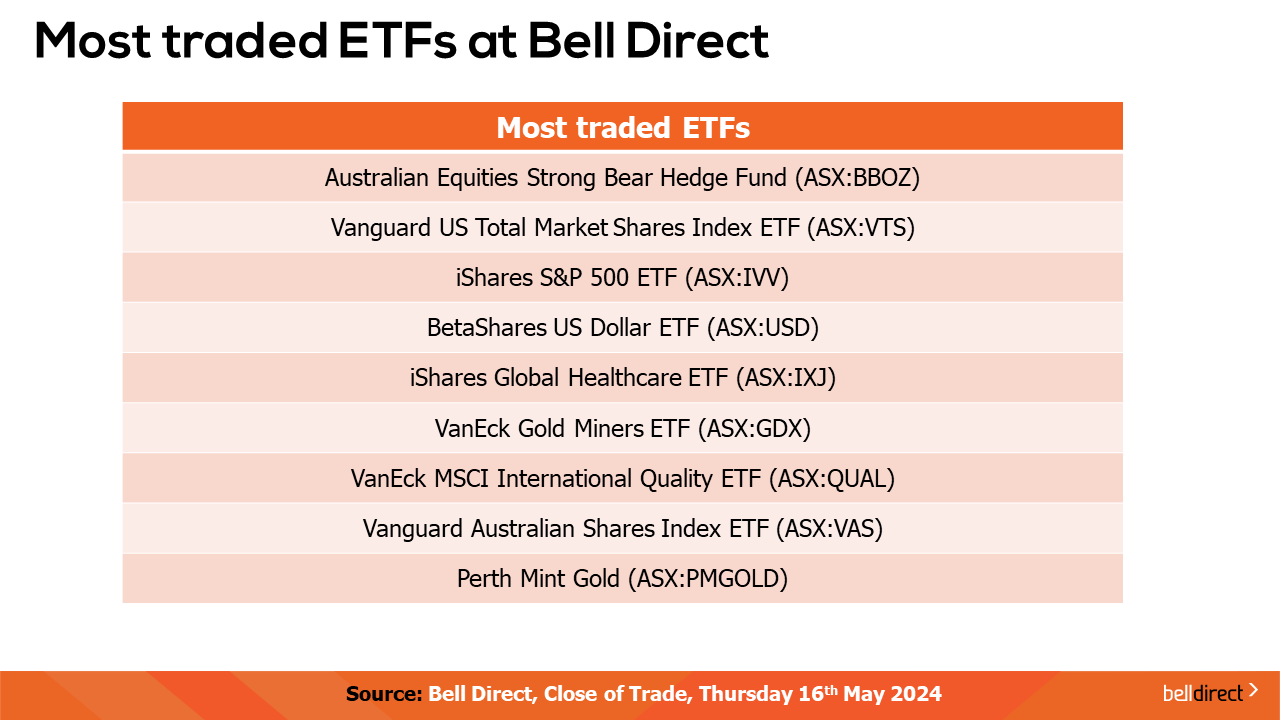

And the most traded ETFs by Bell Direct clients this week were the Australian Equities Strong Bear Hedge Fund (ASX:BBOZ), the Vanguard US Total Market Shares Index ETF (ASX:VTS) and the iShares S&P 500 ETF (ASX:IVV).

And to end, economic data to look out for next week,

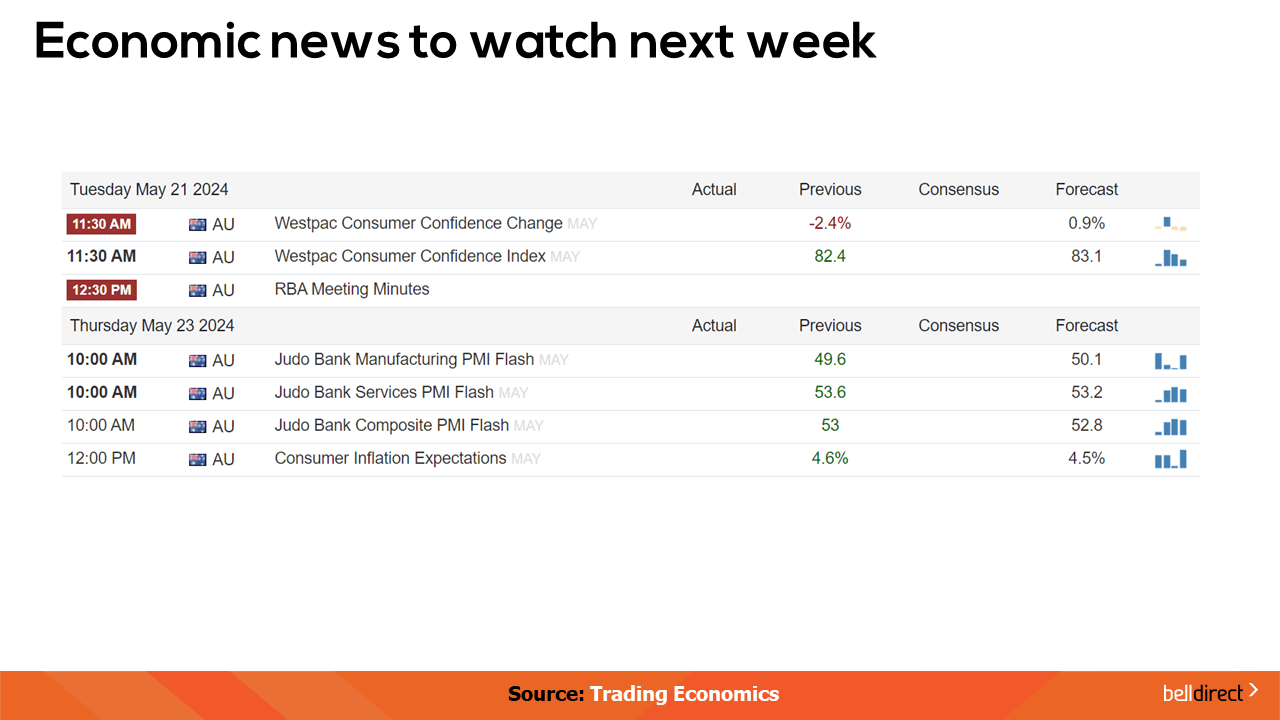

On Tuesday, Westpac’s consumer confidence data will be released and the RBA’s meeting minutes, then on Thursday the Manufacturing and Services Flash PMI is out, a forward looking estimate of the final PMI released the following week.