Transcript: Weekly Wrap 9 February

Thanks for joining me this Friday the 9th February, I’m Grady Wulff, Market Analyst with Bell Direct and this is the weekly market update.

So far this reporting season, just 13 companies have released results with 6 beating expectations while 7 met expectations and no companies have mixed expectations yet. Amcor (ASX:AMC) posted a weak result on the volumes front however cost-outs (the practice of eliminating costs in the supply chain) helped mitigate the full impact of lower volumes. The global leader in packaging solutions announced it had axed 2,000 jobs and is working to close up to 10 plants globally to continue its cost-cutting measures as customer demand remains subdued. The company also noted it believes destocking in protein, coffee and confectionary has eased but ongoing destocking in the healthcare division is expected in the post-pandemic era.

Centuria Industrial REIT reported a small beat on forecasts and management upgraded FY24 funds from operations guidance following a 6% rise in like-for-like growth on leasing spreads. Low vacancy rates and growing demand for industrial property is driving the performance of REITs like Centuria in the eye of investors. Dexus Industrial REIT also posted very strong first half results that beat expectations across the board driven by higher net income and lower costs.

ResMed (ASX:RMD) kicked off reporting season for the healthcare stocks with a beat across all metrics including the anticipated improvement in gross margins which were a downfall last reporting season. The sleep apnoea device specialist also issued guidance for lower freight costs, favourable FX tailwinds and price rises to further boost growth in the second half of FY24. With Philips, ResMed’s closest US competitor, still delayed in attempts to return to the US market following previously recalled devices, ResMed is likely to maintain is market share and dominance even if and when Philips returns to the competitive landscape.

Record production was reported for Champion Iron (ASX:CIA) this quarter which also beat broker forecasts and with new production levels mean the Bloom Lake has now reached its expanded nameplate capacity of 15 million tonnes per annum. Despite the record production quarter, sales volume for the period was impacted by the reduced railway capacity. The gross average realised price of the iron ore concentrate sold was higher at US$126.1/dry metric tonne due to the elevated commodity prices which led to higher revenues for the first half. The strong results led to a rise in the share price following the results release, however, fell a day later after unionised employees voted against the company’s proposed terms on a new collective bargaining agreement and instead voted in favour of a strike action mandate enabling the company’s employees to initiate a strike if a new agreement is not formed.

Transurban (ASX:TCL) rounded out the results released by Thursday this week with results that impressed investors, especially on the dividend front. The toll road developer and operator announced a 13% rise in the interim dividend to 30cps. For the first half, Transurban reported proportional toll revenue rose 6.3% to $1.763bn but this was a miss of consensus expectations which was for $1.850bn. Proportional EBITDA came in at $1.331bn which was just below expectations of $1.337bn, which indicated greater cost management over the period. Average daily traffic in the first half rose 2.1% YoY supported by growth across all regions and the opening of new assets, but the traffic result came in below consensus expectations. Following the release of the results, Transurban shares traded slightly weaker attributed to the revenue and traffic misses.

As reporting season ramps up next week, we are keeping a close eye on dividend payments amid slowing earnings growth across the board over the last year, guidance forecasts in the second half of FY24 as interest rates remain on hold at 4.35%, and cost management as key metrics to determine the strength of results this reporting season.

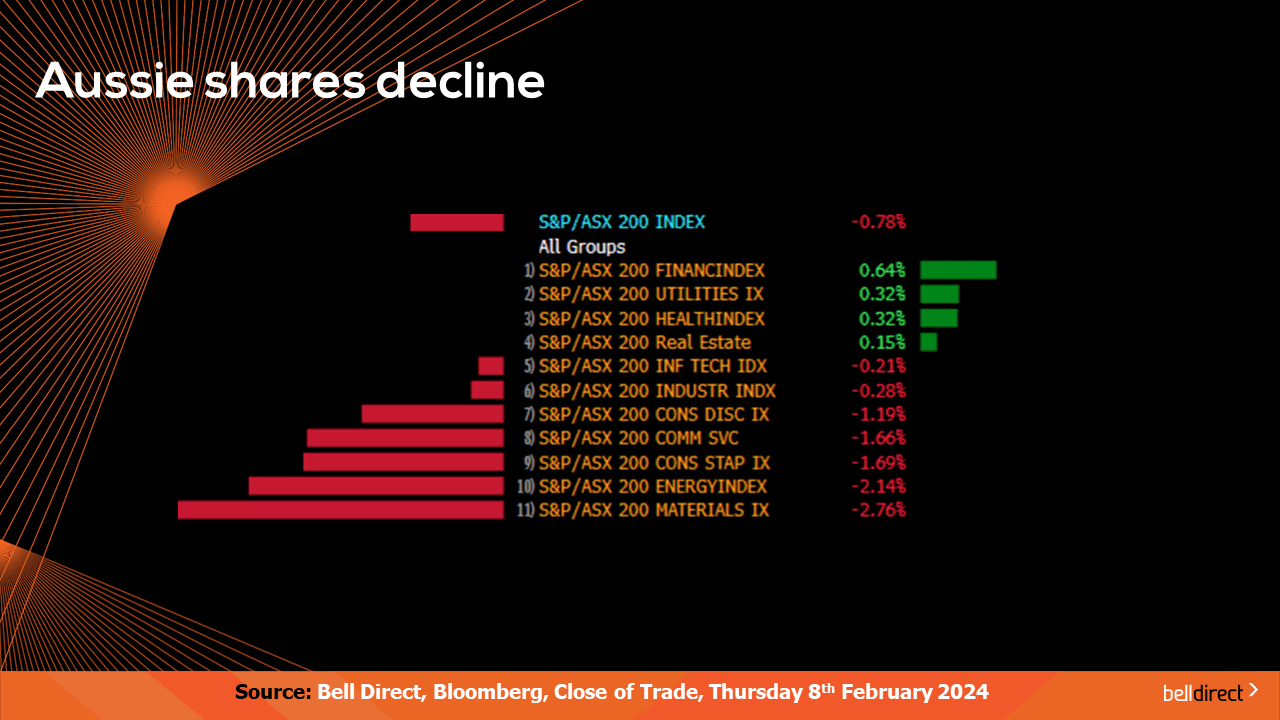

Locally from Monday to Thursday the ASX200 fell 0.78% tracking the heavy losses on global markets that started the week lower, and locally weighed down by the materials and energy sectors amid the sliding price of key commodities.

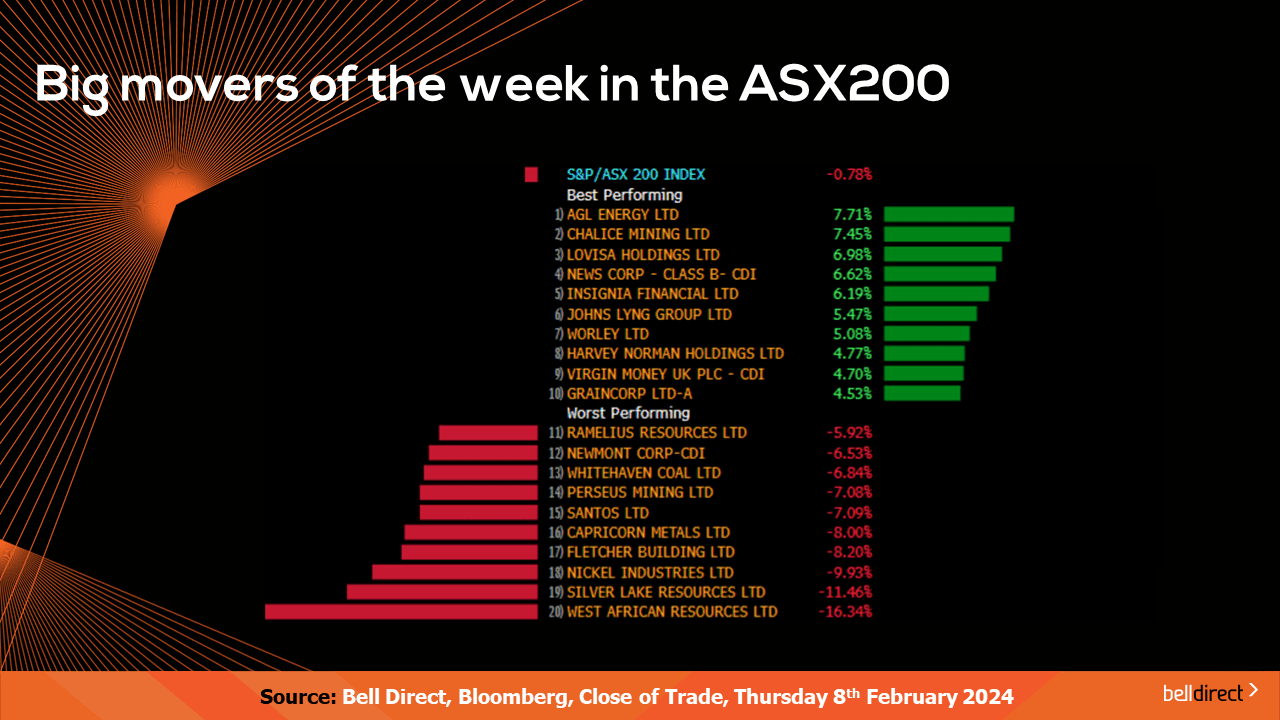

The winning stocks on the ASX200 were led by AGL Energy (ASX:AGL) rising 7.71% on the release of strong first half results, while Chalice Mining (ASX:CHN) and Lovisa (ASX:LOV) added 7.45% and 6.98% respectively.

And on the losing end, West African Resources (ASX:WAF) fell 16.34% after lowering its gold production guidance and raising costs outlook. Silver Lake Resources (ASX:SLR) fell 11.46% after announcing it is merging with fellow gold miner Red 5 (ASX:RED), and Nickel Industries (ASX:NIC) ended the four trading days down 9.93%.

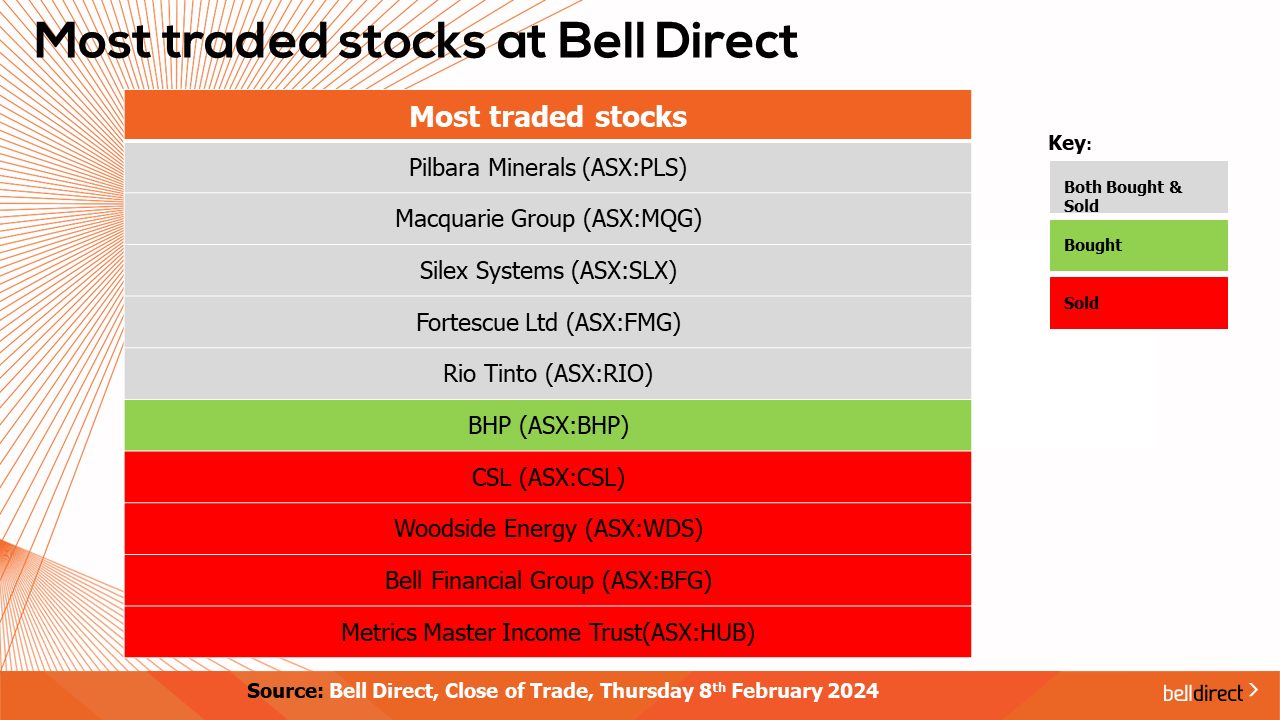

The most traded stocks by Bell Direct clients from Monday to Thursday were, Pilbara Minerals (ASX:PLS), Macquarie Group (ASX:MQG), Silex Systems (ASX:SLX), Fortescue Metals Group (ASX:FMG), and Rio Tinto (ASX:RIO).

Clients also bought into BHP (ASX:BHP) and took profits from CSL (ASX:CSL), Woodside Energy (ASX:WDS), Bell Financial Group (ASX:BFG) and Metrics Master Income Trust (ASX:MXT).

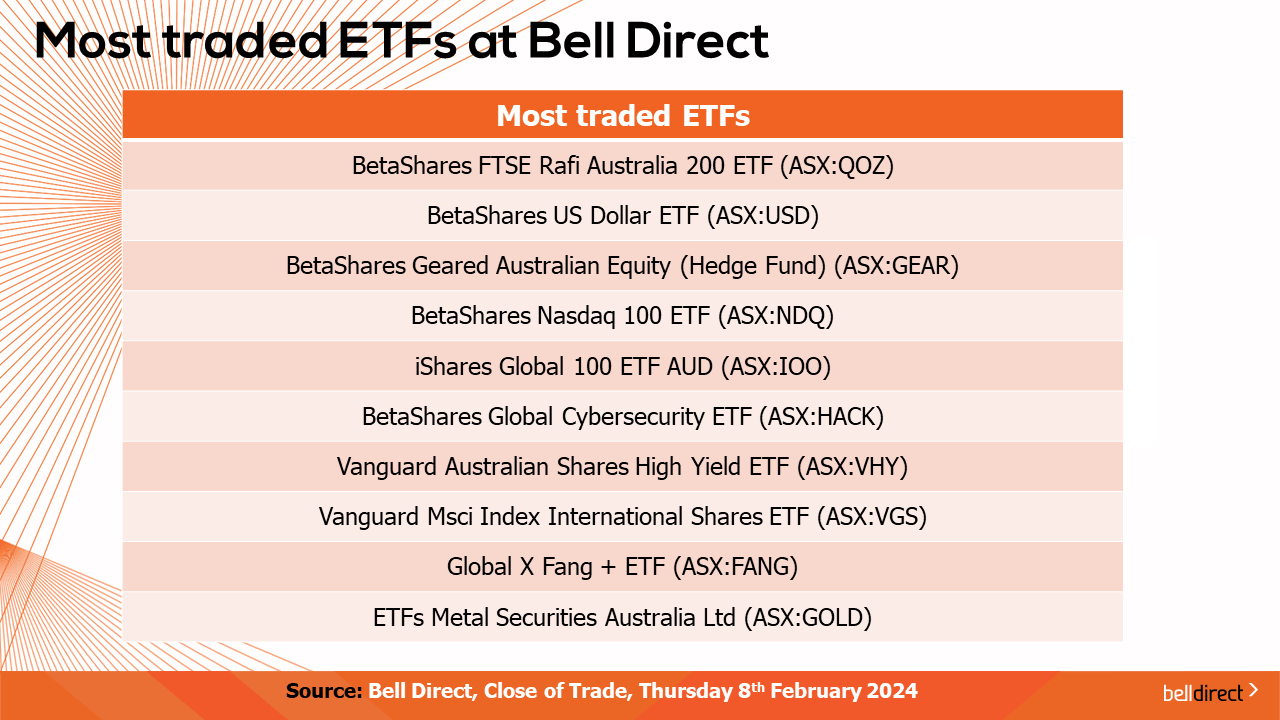

And the most traded ETFs were BetaShares FTSE Rafi Australia 200 ETF (ASX:QOZ), BetaShares US Dollar ETF (ASX:USD) and BetaShares Geared Australian Equity (Hedge Fund) (ASX:GEAR).

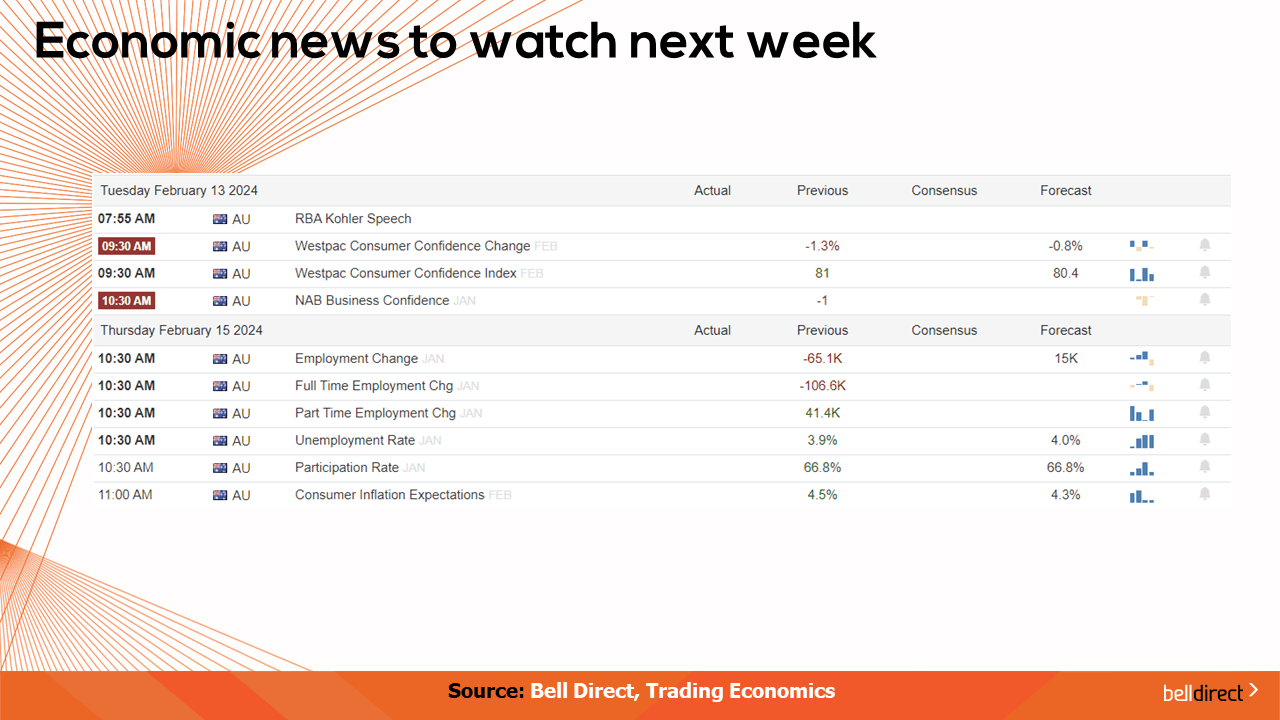

On the economic calendar front next week, Westpac Consumer Confidence data for February and NAB Business Confidence data for January are out on Tuesday with the forecast of a 0.8% decline in consumer confidence for the month ahead amid the higher interest rate environment set to stay around for longer.

Overseas, it is a big week for US inflation data out on Tuesday with the forecast of core inflation falling to 3.7% in January while the inflation rate is predicted to remain steady at 3.4%. US producer price index data is also out on Friday next week with the expectation of a 0.1% uplift, while building permits data in the US is also out at the end of next week which is also forecasted to rise.

In the UK, GDP data is out in the second half of next week with economists expecting a flat reading as the country struggles with the high interest rate environment in the region.

And some big names headlining reporting season results released next week include CSL, James Hardie Industries, JB Hi-Fi, CBA, IDP Education, Goodman Group, Wesfarmers, Inghams Group, and QBE Insurance to name a few.

Be sure to sign up to become a Bell Direct client if you are not already part of the BD family to ensure you receive our special reporting season video distributed every Wednesday over reporting season.

That’s all we have time for this Friday, have a fantastic weekend and as always, happy investing!