Transcript: Weekly Wrap 2 February

This week was arguably the biggest week on the US reporting season calendar as we saw some of the Magnificent 7 release quarterly results that made waves on markets. The Nasdaq composite fell 2.52% over the last 5-trading sessions so why were investors not impressed with the tech-heavy index this week?

For those who don’t know the Magnificent 7, it is the big tech names including Amazon, Apple, Google parent company, Alphabet, Meta Platforms, Microsoft, Nvidia and Tesla. As of the 3rd of January 2024, these seven global tech companies had a combined valuation of US$11.7tn which is equal to the UK, Japan, and Canada stock markets combined. The tech titans delivered returns of 107% in 2023 and accounted for most of the gains on the S&P500. While the magnificent 7 were expected to have year-on-year earnings growth of 53.7% for Q4, we have seen mixed results so far.

Investors piled out of Tesla shares this week despite the EV giant posting stronger-than-expected fourth-quarter results including companywide operating profit margins and automotive gross profit margins rising quarter on quarter. Investors were more concerned about Tesla’s warning of headwinds to come amid the expectation of lower vehicle volume growth for the year ahead.

Microsoft followed suite topping expectations across all metrics and posting significant growth on FY23 including total revenue of US$62.02bn compared to expectations of US$61.1bn and well above the US$52.7bn reported a year earlier. Following the results, Microsoft shares jumped over 1.5%.

Alphabet shares, on the other hand, fell over 6% this week after the Google parent company reported Q4 results that beat expectations across the board, but investors sold out amid disappointing ad revenue.

Apple shares fell 3.13% in after-hours trade on Thursday following the tech giant’s results release. Despite topping Wall Street estimates, lower services revenue and declines in the company’s Chinese operations weighed on investor sentiment.

Meta shares soared 14% in after-hours trade after the Facebook parent company also beat expectations in Q4 with revenue topping US$40bn and AI product development exciting investors in the tech space. Meta also won investors over by announcing its first ever dividend of 50cps.

Amazon rounded out 6 of the 7 magnificent tech titans on Thursday night with reporting a 27% lift in its advertising business to US$14.65bn for the quarter, in addition to a 14% rise in overall sales to US$170bn. The results topped Wall Street estimates, Google and Meta’s advertising revenue and announced the launch of AI advertising tools. Shares popped over 7% in after-hours trade.

Nvidia, a world leader in AI computing, is set to close out the magnificent 7 results by releasing theirs on Feb 21. While all 6 of the tech giants have beat Wall St expectations so far, the key learnings are: headwinds will always cause investors concern e.g. Tesla, AI is driving growth, and ad revenue is a key metric of success.

So, the question now arises, just how far can the tech titan valuations go before the magnificent 7 turns into the magnificently overvalued 7?

Locally, we are preparing for a bumper earnings season for the first half and expectations are for cost inflation impacting margins, lowered profits for the big four banks as NIM may have peaked and switching is on the rise as Aussies continue searching for the best option for servicing their home loans. At the same time, we are experiencing NIM increases for the smaller banks which was the case for Judo Bank this week as it soared 16.8% on a 24% profit before tax jump for the first half.

Retailers are expected to report headwinds as we enter the second half of the 2024 financial year amid declining retail spend and the concept of higher interest rates for longer.

Iron ore miners will be on watch as the price of iron ore has held up, but China’s declining economic state has weighed on sales of the key commodity.

And on the tech front, AI is still the word, but profitability is an investors core focus. Any companies approaching profitability will garner investor support this reporting season.

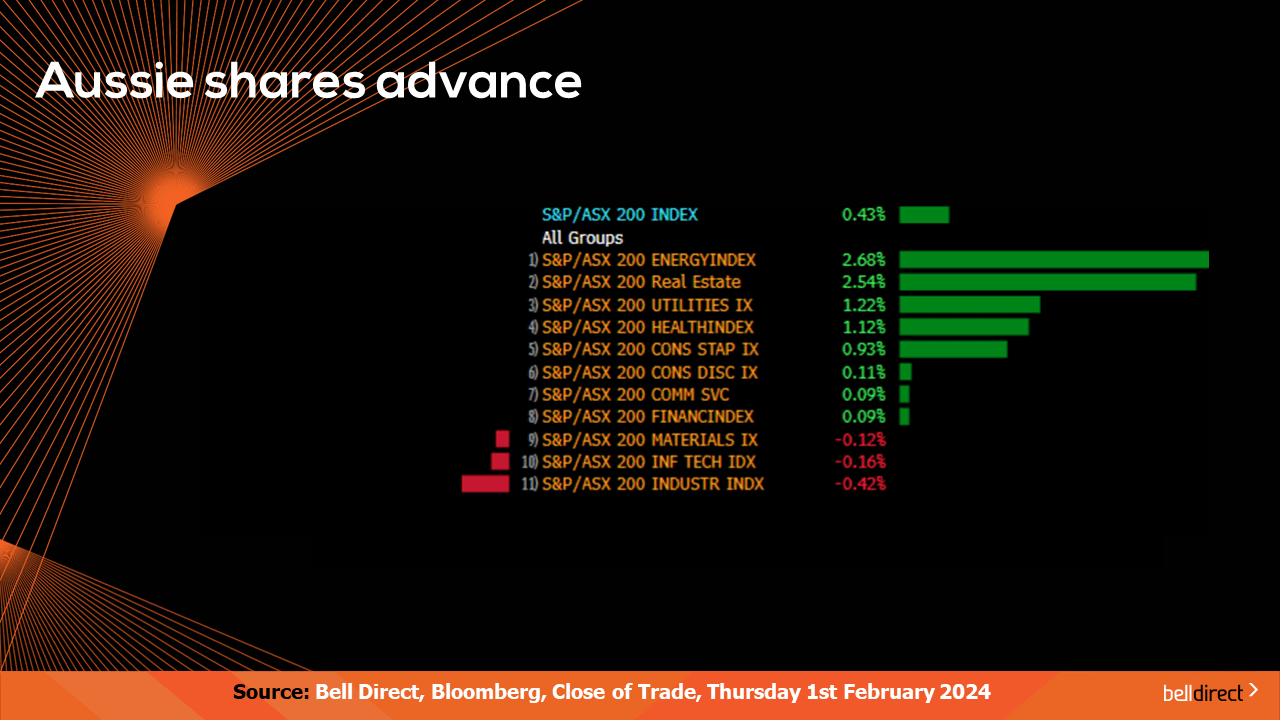

Locally, from Monday to Thursday the ASX200 rose 0.43% including closing at a record high as a surge in energy and REIT stocks boosted the key index into record territory, while industrials and tech stocks weighed on the market gains.

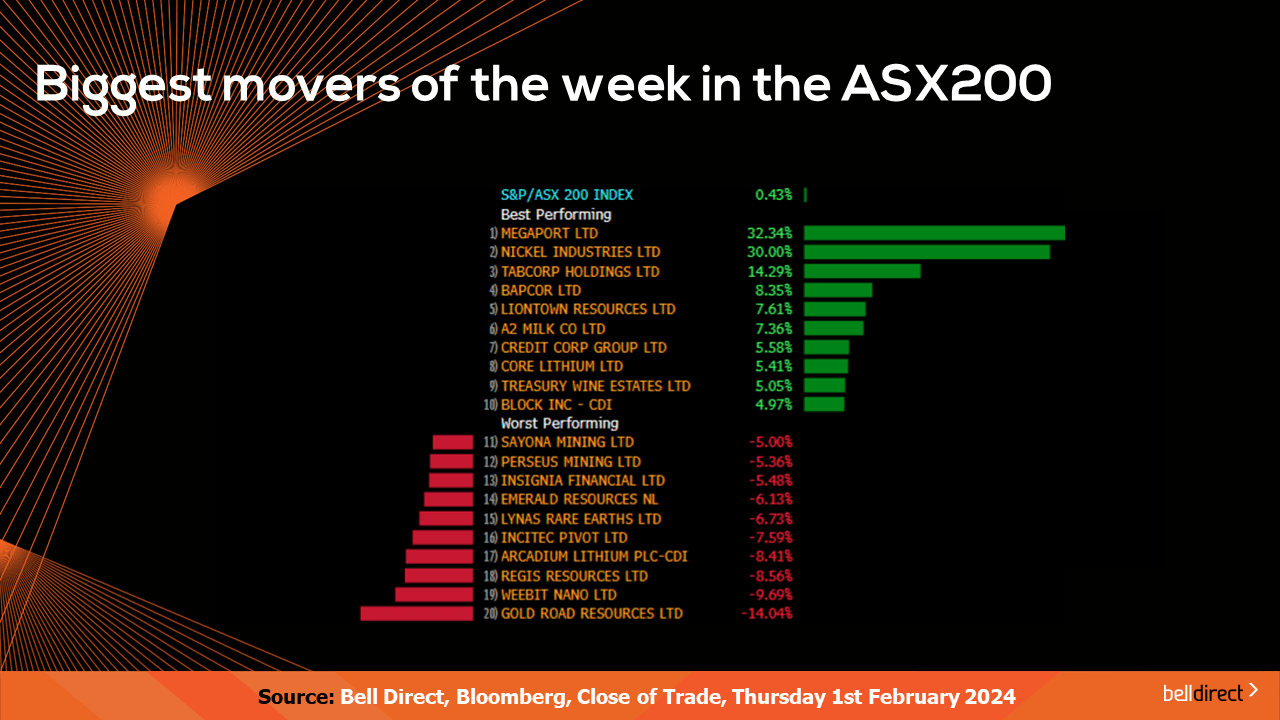

The winning stocks over the four trading days were led by Megaport (ASX:MP1) soaring 32.34% after the cloud connectivity provider impressed in the latest quarterly update. Nickel Industries (ASX:NIC) followed suit jumping 30%. Tabcorp (ASX:TAH) rounded out the top 3 winners on the ASX200, rising 14.29%.

On the losing end, Gold Road Resources (ASX:GOR) fell 14.04% over the trading week after releasing a quarterly update including lower production quarter-on-quarter due to delays accessing higher grade ore from the company’s open pit alongside labour constraints that impacted performance. Weebit Nano (ASX:WBT) also tumbled almost 10% this week after releasing a trading update and Regis Resources (ASX:REG) fell 8.56%.

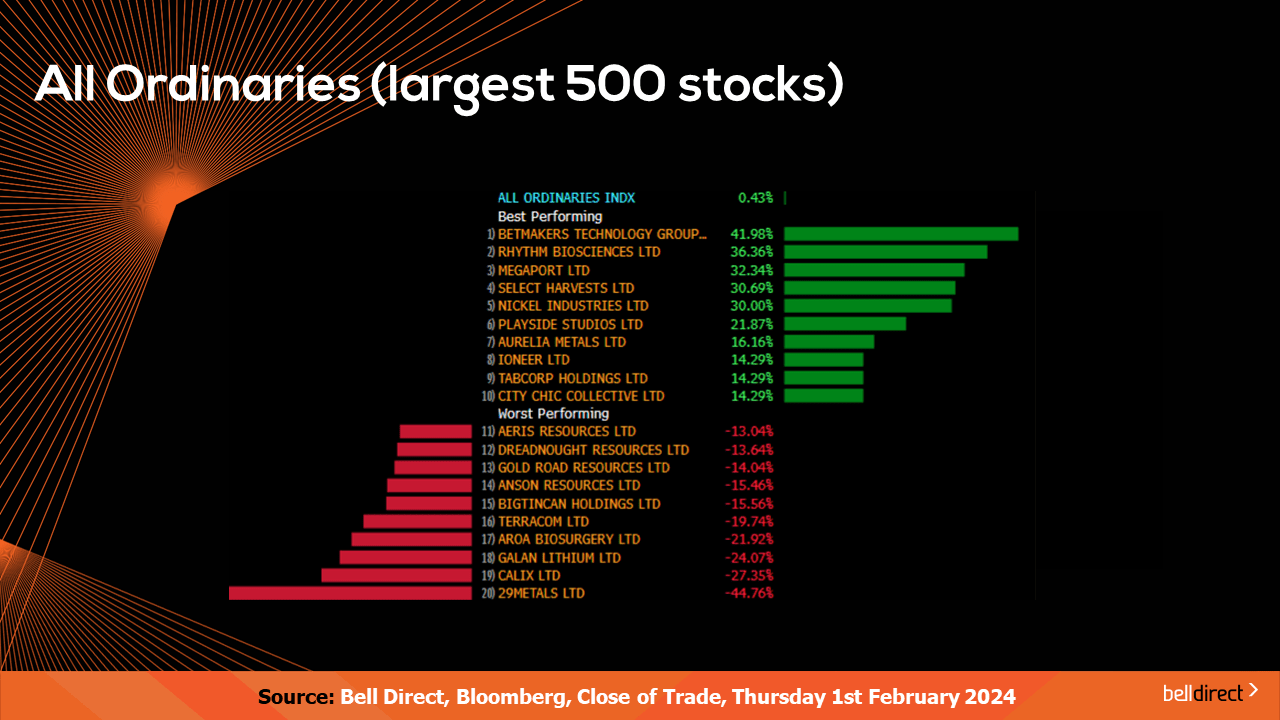

Taking a look at the broader index, the All Ords also rose 0.43% this week led by Betmakers (ASX:BET) soaring 42%, Rhythm Biosciences (ASX:RHY) jumping 36.36% and Select Harvests (ASX:SHV) adding 31%.

On the losing end of the All Ords, 29Metals (ASX:29M) tanked 45% after the copper producer released a disappointing quarterly update, Calix (ASX:CXL) also fell 27% and Galan Lithium (ASX:GLN) tanked 24%.

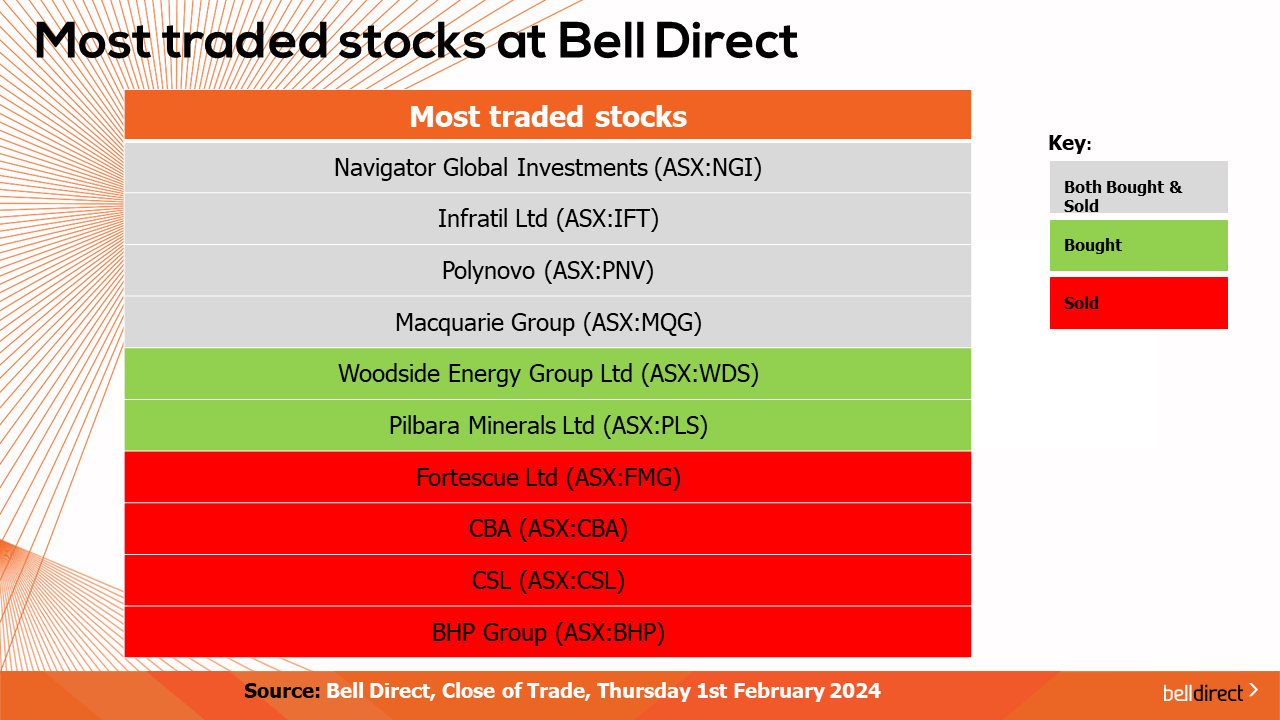

The most traded stocks by Bell Direct clients this week were Navigator Global Investments (ASX:NGI), Infratil (ASX:IFT), Polynovo (ASX:PNV) and Macquarie Group (ASX:MQG).

Clients also bought into Woodside Energy (ASX:WDS) and Pilbara Minerals (ASX:PLS) while taking profits from Fortescue Metals Group (ASX:FMG), CBA (ASX:CBA), CSL (ASX:CSL), BHP (ASX:BHP).

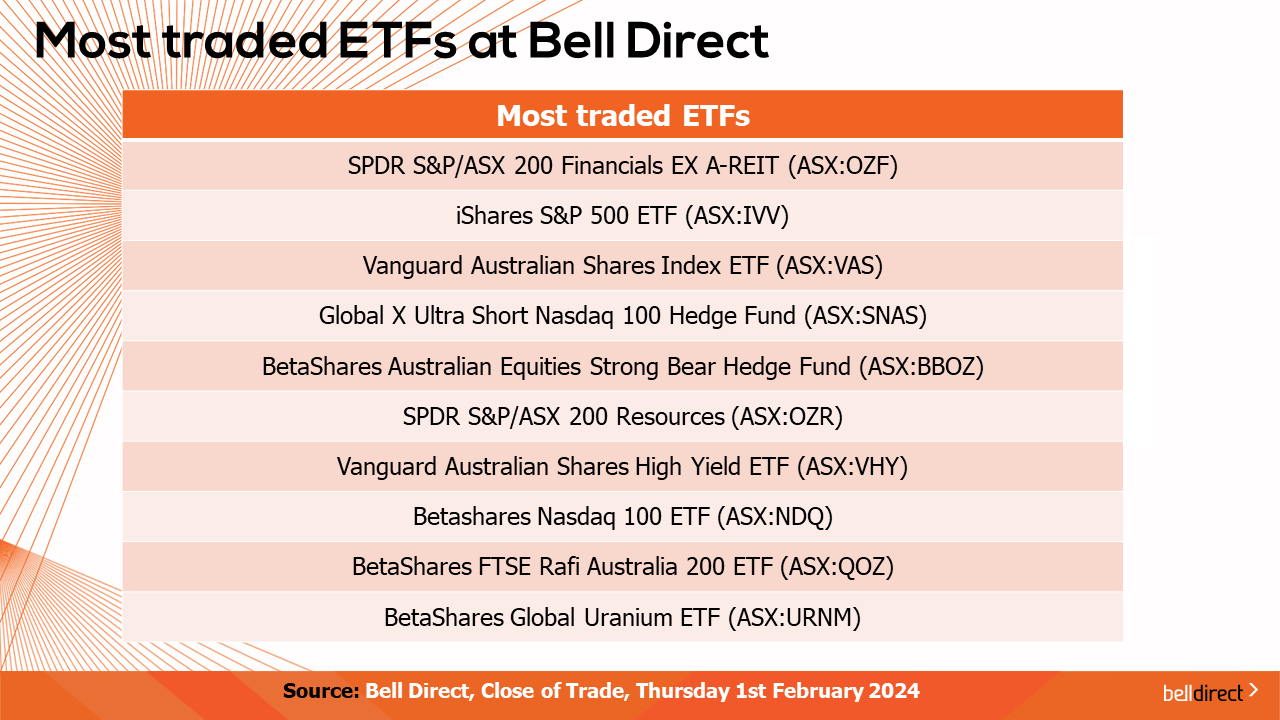

The most traded ETFs from Monday to Thursday were SPDR S&P/ASX 200 Financials EX A-REIT, iShares S&P 500 ETF and Vanguard Australian Shares Index ETF.

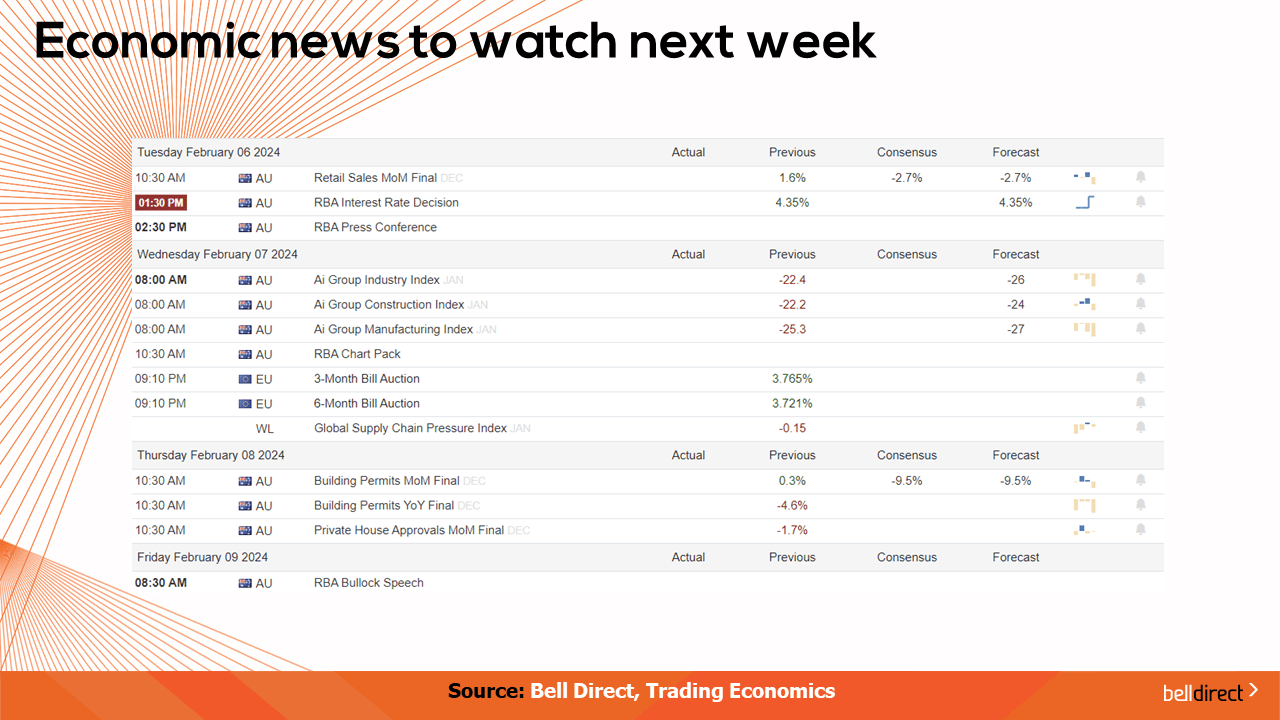

Looking to the week ahead on the economic calendar, Australia’s trade balance data for December is out on Monday with the expectation of a drastic decline in trade surplus from $11.44bn in November to a surplus of $7.9bn in December. The RBA will also hand down the nation’s cash rate on Tuesday with the market pricing in a hold at the current rate of 4.35% despite recent CPI data falling to a two year low this week.

Overseas, China’s Inflation rate data is due out on Thursday which will give key insight into the exact state of the economic recovery.

And that’s all we have time for this week. Have a wonderful weekend and happy investing!