Transcript: Weekly Wrap 8 December

As the festive season and new year approach, let’s take a look at Bell Potter’s outlook and stock picks. We’ll consider three industry sectors – fast moving consumer goods or FMCG, technology and real estate, and some interesting Bell Potter stock picks in each of those sectors.

Firstly, considering the agricultural and FMCG sector, these are investments that tend to have higher risk, due to their exposure to commodity prices and season factors. Bell Potter’s stock picks in this sector therefore don’t focus on directional share price movements for the coming months, but rather, focus on where they see value in the current share price relative to potential cycle earnings. The three buying opportunities they have identified are Bega Cheese (ASX:BGA), Rural Funds (ASX:RFF) and Elders (ASX:ELD). Bega Cheese is a manufacturer and distributor of dairy products and Bell have a $3.35 price target on the company. Rural Funds is a listed agricultural REIT with a portfolio focused on vineyards, cattle, cotton, almond orchards, and macadamias – also a Buy rating with a $2.40 price target. And Elders is a leading supplier of fertiliser and agricultural chemicals and products, another Bell Potter Buy rating with a $8.35 price target.

Secondly, the technology sector. Last week, we highlighted how the tech sector has performance in 2023. This week, let’s consider Bell Potter’s outlook on the sector for 2024. Now, Bell Potter have a positive outlook for tech. Interest rate rises have hurt the sector over the year and commentary is starting to suggest we may be at the end of the rate rise cycle. This is a positive for high growth stocks with low cash earnings, who fund operations through borrowings. The three stock picks in this sector are Life360 (ASX:360), WiseTech Global (ASX:WTC) and Task Group (ASX:TSK). 360 is a location sharing family safety app, which is a Bell Buy with an $11 price target. WiseTech is a software provider to global supply chains and Bell Potter analysts currently have a Hold rating with a price target of $72.25. Finally, Task Group, is an enterprise management platform with a Buy rating and a price target of $0.54.

The final sector to look at today is real estate, which like tech, is sensitive to the rising interest rate environment. As interest rates continued to increase over 2022 and 2023, the real estate industry underperformed the ASX200. Bell Potter’s stock picks in this sector are HMC Capital (ASX:HMC), Dexus (ASX:DXC) and HealthCo (ASX:HCW). HMC is a real estate fund manager with a Buy rating and a $5.55 price target. Dexus is a convenience retail and service station RIET with a network of over 100 assets – the recommendation is a Buy and a $2.85 price target. Lastly, HealthCo, Australia’s largest diversified healthcare RIET, has a Buy rating and a $1.75 12-month target.

Look out for the full reports, available to Bell Direct clients on our platform.

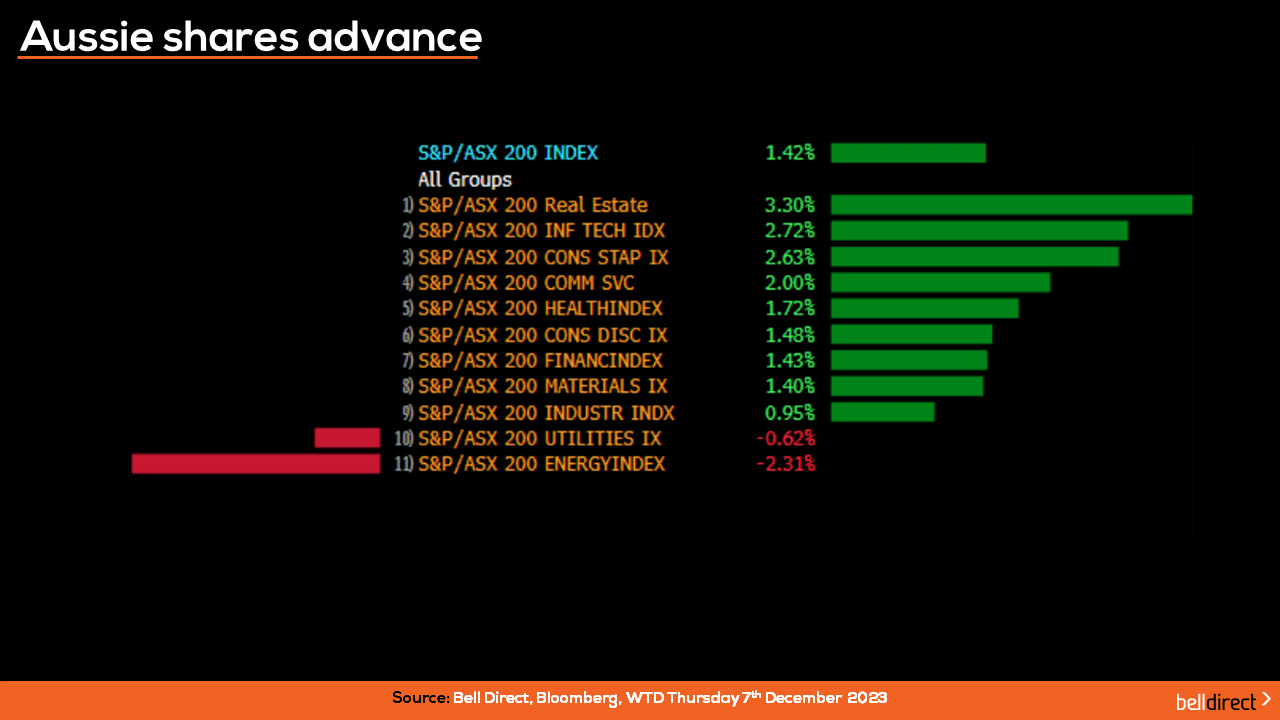

Taking a look now at the market’s performance this week so far, the ASX200 has advanced 1.42% Monday to Thursday, with real estate and information technology sectors in the lead, which rallied after the RBA announced it is holding the cash rate at 4.35%. Most industry sectors have seen strong gains this week, apart from energy and utilities. The energy sector is down the most, falling over 2%, after oil prices sharply declined to a 5-month low. The price of oil fell to its lowest level since early July, due to demand worries and increased supply. The US Energy Information Administration reported that gasoline inventories in the US were up by 5.4 million barrels in the week ending December 1st, which is the largest increase in nine weeks and well above forecast of 1 million. This implies weaker demand, so keep watch of the share price movements of energy producers. In addition, concerns on the economic outlook of China also appear to be weighing heavily on crude prices.

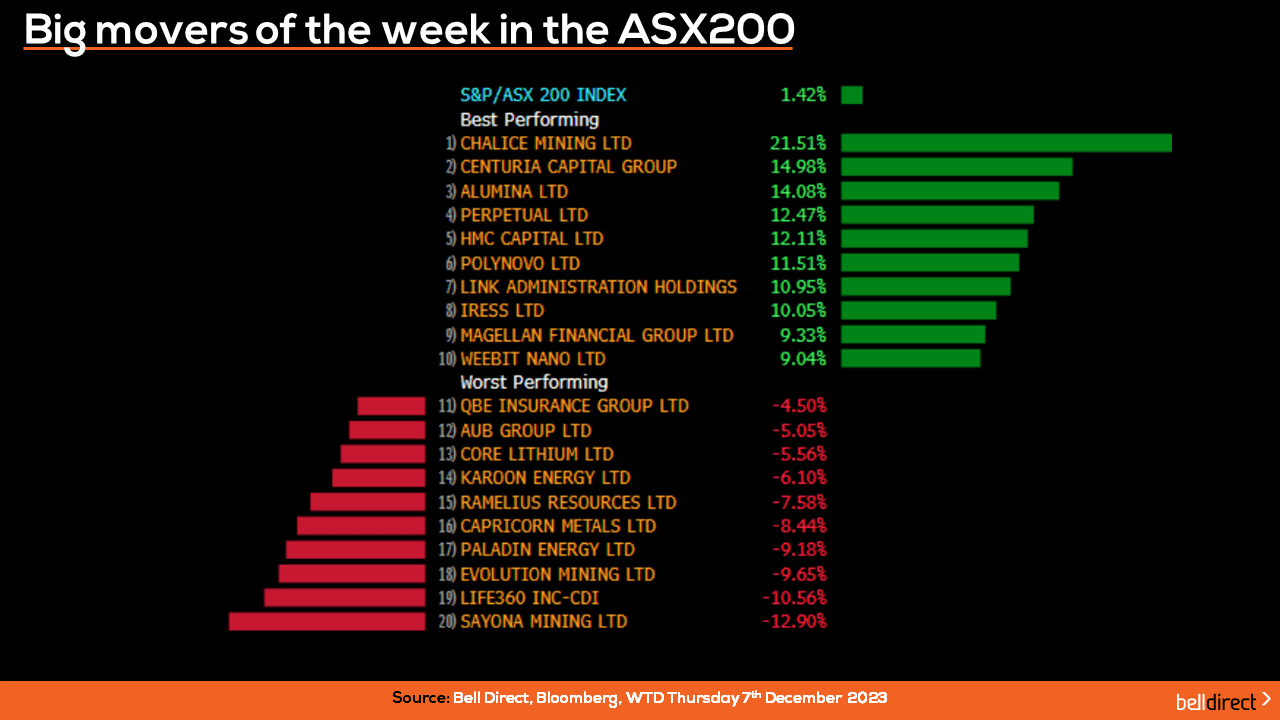

On the ASX200 leaderboard:

Chalice Mining (ASX:CHN) advanced an impressive 21.5% this week, after securing government approvals to commence exploration drilling across the entire 30-kilometre interpreted strike length of their Julimar Complex. The drilling will focus on targeted diamond drilling.

Chalice Mining was closely followed by Centuria Capital Group (ASX:CNI), Alumina (ASX:AWC) and Perpetual (ASX:PPT).

Meanwhile, stocks that declined the most were Sayona Mining (ASX:SYA), Life360 (ASX:360) and Evolution Mining (ASX:EVN).

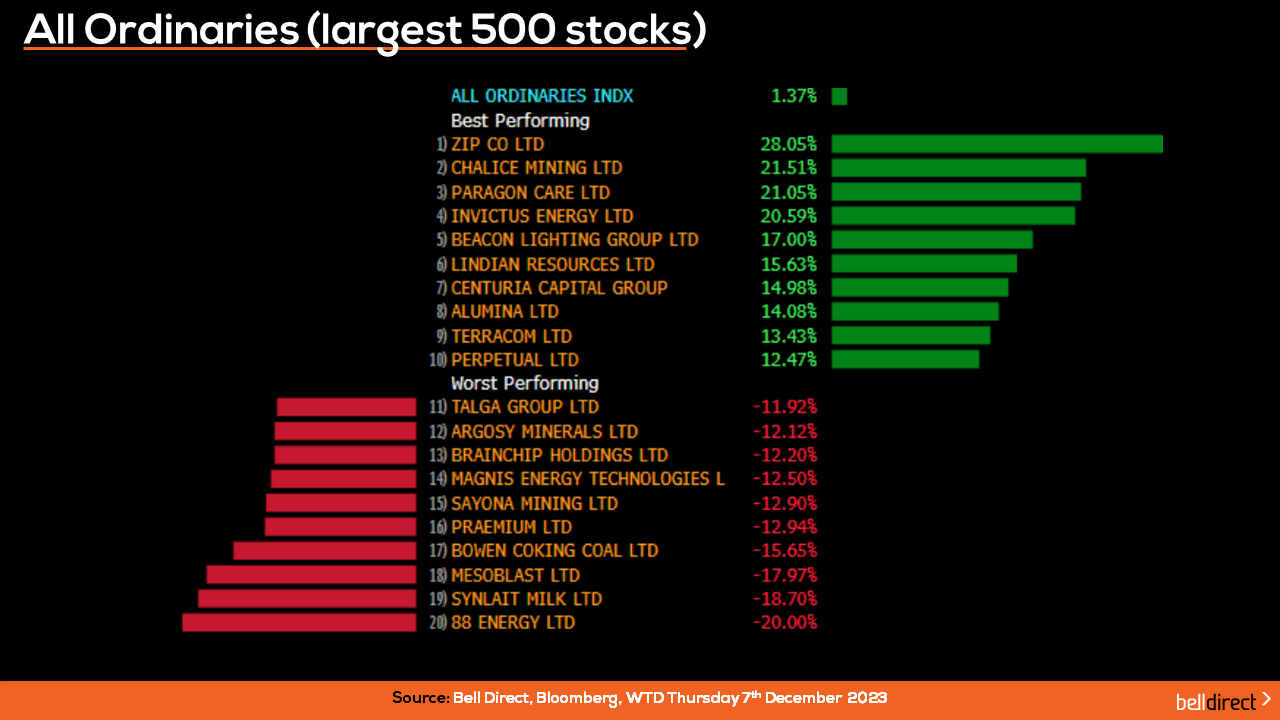

And on the All Ords, BNPL company Zip (ASX:AIP) jumped 28%, driven by a positive broker note out of Citi, while 88 Energy (ASX:88E) declined 20%.

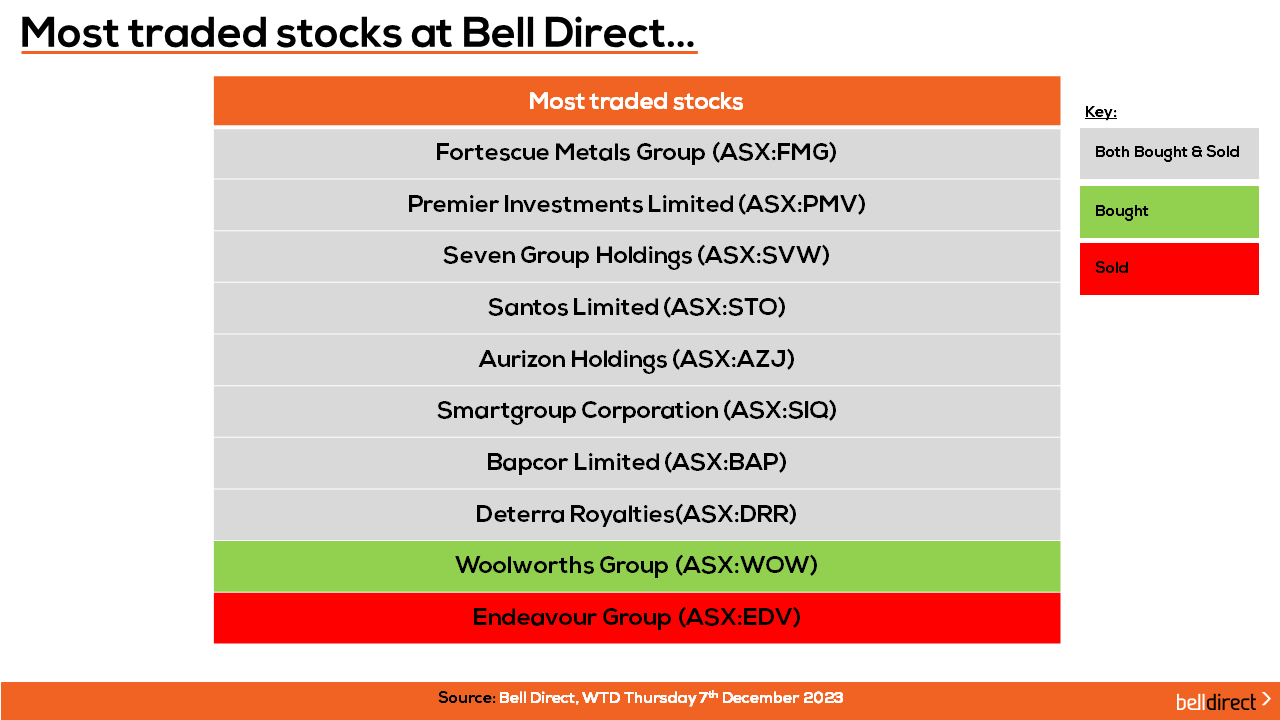

Looking now at the most traded stocks by Bell Direct clients this week, these include Fortescue Metals (ASX:FMG), Premier Investments (ASX:PMV), Seven Group Holdings (ASX:SVW), Santos (ASX:STO), Aurizon Holdings (ASX:AZJ), Smartgroup Corporation (ASX:SIQ), Bapcor (ASX:BAP) and Deterra Royalties (ASX:DRR).

Clients also bought into Woolworths Group (ASX:WOW), while took profits from Endeavour Group (ASX:EDV).

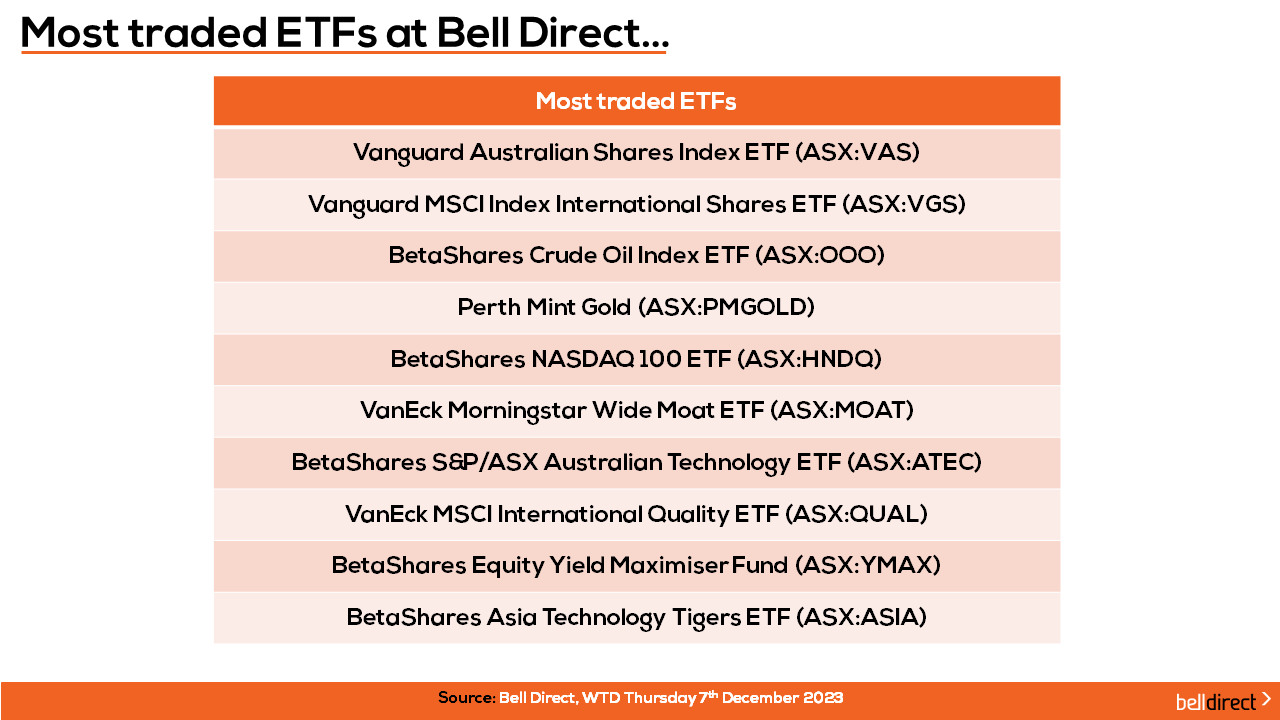

And the most traded ETFs this week were the Vanguard Australian Shares Index ETF (ASX:VAS), the Vanguard MSCI Index International Shares ETF (ASX:VGS), BetaShares’ Crude Oil ETF (ASX:OOO).

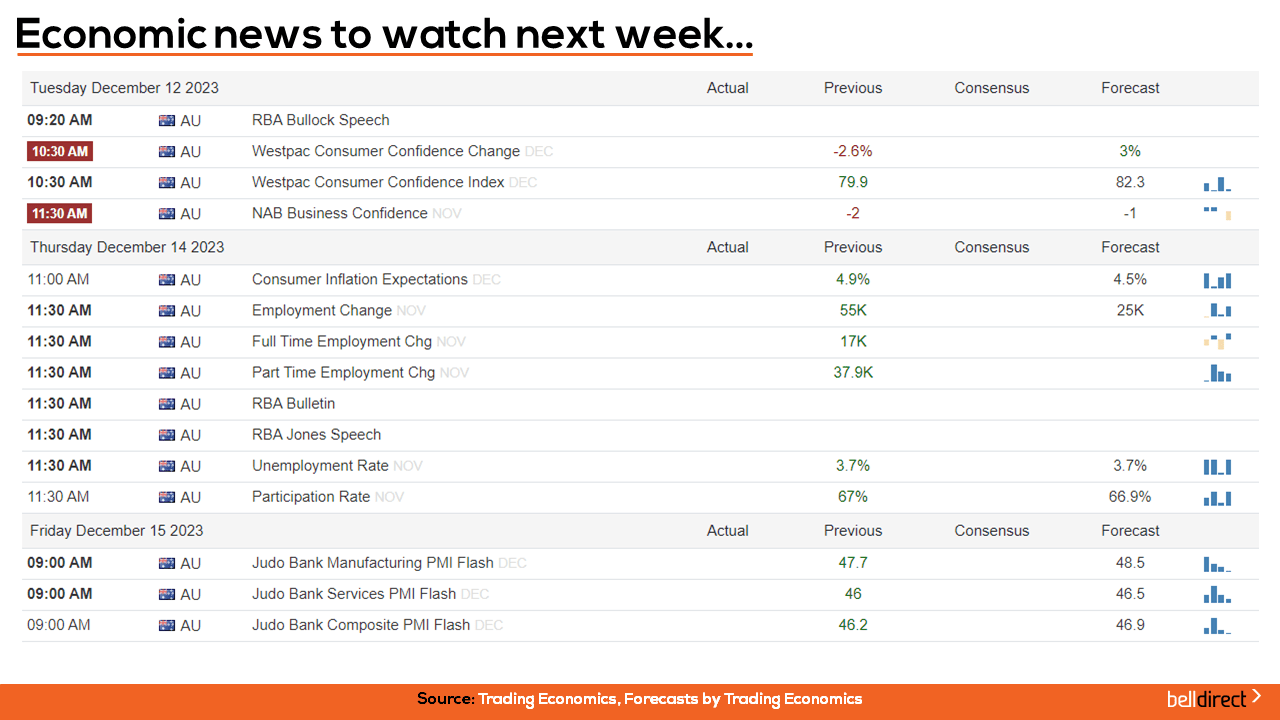

And to end, economic data to watch out for next week:

On Tuesday we’ll receive NAB’s data on business confidence for November and Westpac’s data on consumer confidence for December, which is expected to fall, considering concerns on the rising cost of living and the potential for rate rises, as well as family finance pressures during the holiday season. Then on Thursday, the unemployment rate for November will be announced.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. I hope you have a great weekend, and happy investing.