Transcript: Weekly Wrap 29 September

Thank you for joining me this Friday the 29th September, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

Ahead of the RBA’s rate announcement next week, let’s look at the predicted rate outlook for the remainder of CY23, what this means for companies and most importantly, what the outlook means for your portfolio this festive season.

Higher for longer is the general fear across the local and international economies heading into the next round of rate announcements out of global central banks, starting with the RBA on Tuesday next week. While it is widely expected that the RBA will maintain the nation’s cash rate at 4.1% for the month ahead with all four big Aussie banks expecting the RBA to pause again in October, NAB still believes there is one more rate hike in this cycle either in November or December which will take the cash rate to 4.35% until it is expected to ease from September 2024.

Rising fuel costs, cost of travel, food and transport were the key drivers of the latest CPI reading increase. But will this data be used as a reason to raise the cash rate on Tuesday?

Tuesday’s RBA meeting will mark the first with Michele Bullock at the helm as the new Governor of Australia’s Central Bank and the release of key economic data over the last week will guide Ms Bullock’s either bullish or bearish move come Tuesday. The last three consecutive months of pause for the cash rate at 4.1% have been to assess the impact of interest rate rises to date on taming inflation. This week though, the monthly CPI or inflation data reading for August came in as a rise to 5.2% for the month, up from 4.9% in July but this rise was in-line with market expectations.

So, what does higher for longer mean for businesses and how can you judge company resilience in the high interest rate environment? Firstly, inflation remains stubbornly high despite interest rate rises. Rising retail sales spend and low unemployment are supporting reasons for the RBA to maintain higher interest rates for longer to tame inflation back to the target 2-3% range. For businesses in the higher cost operating environment, it is important that cost-management and pricing reviews are of priority. James Hardie Industries (ASX:JHX) and Boral (ASX:BLD) were two companies that excelled in FY23 reporting season as investors were impressed with the respective company’s raising their prices without impacting demand from customers. Ingham’s (ASX:ING) also followed suit and saw revenues rise as a result. While rates remain high, investors should look at how the companies they either invest in or are watching, either absorb costs or pass them onto customers, and how much debt each company carries as the rising interest rates mean higher levels of interest on debts to repay.

Interest rates are anticipated to remain elevated until at least mid-2024 according to the big four, so how will this impact your portfolio and what do you need to consider when making investment decisions?

Cost reviews are key – analyse company annual reports to determine how the business fared in FY23, what cost levels look like, how they are prioritising cost management and if price rises are on the horizon. If the company is addressing all of these points, their likelihood to weather the high-cost environment is stronger than those who absorb the full impact of rising costs.

- Inventory levels – if you are invested in retail stocks or companies that hold inventory of some kind, look at the level of inventory compared to forecast sales for FY24. If there is high inventory against an outlook for slowing consumer demand, this could be a reason to reconsider investment in this stock.

- Debt levels – with interest rates likely to remain higher for longer, a company’s debt level is the key to determining their strength on a financial front. Higher levels of debt will incur higher costs of interest which will impact a company’s ability to spend on growth in the time of high interest rates.

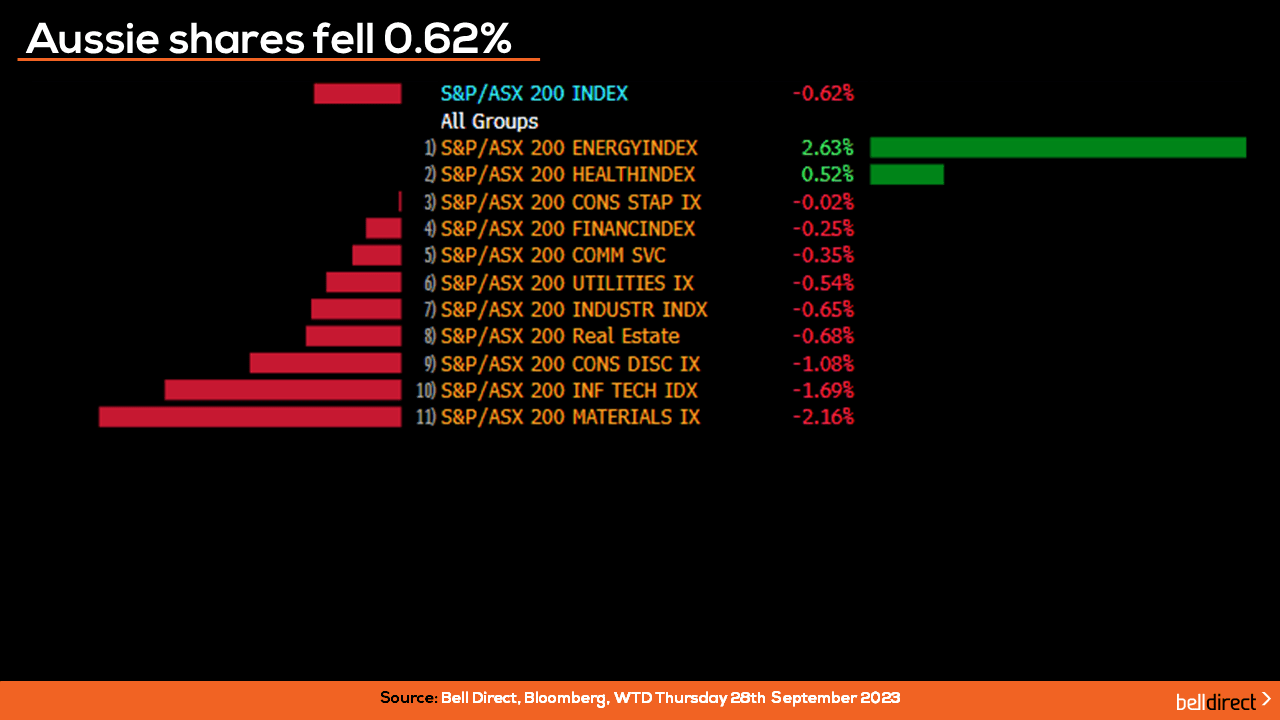

Locally from Monday to Thursday the ASX200 fell 0.62% as materials and technology stocks weighed down the key index, losing 2.16% and 1.7% respectively. The energy sector on the other hand offset some of the week’s losses by gaining 2.63% over the four trading days following the price of oil rising over 3% on lower-than-expected oil inventory levels in the US.

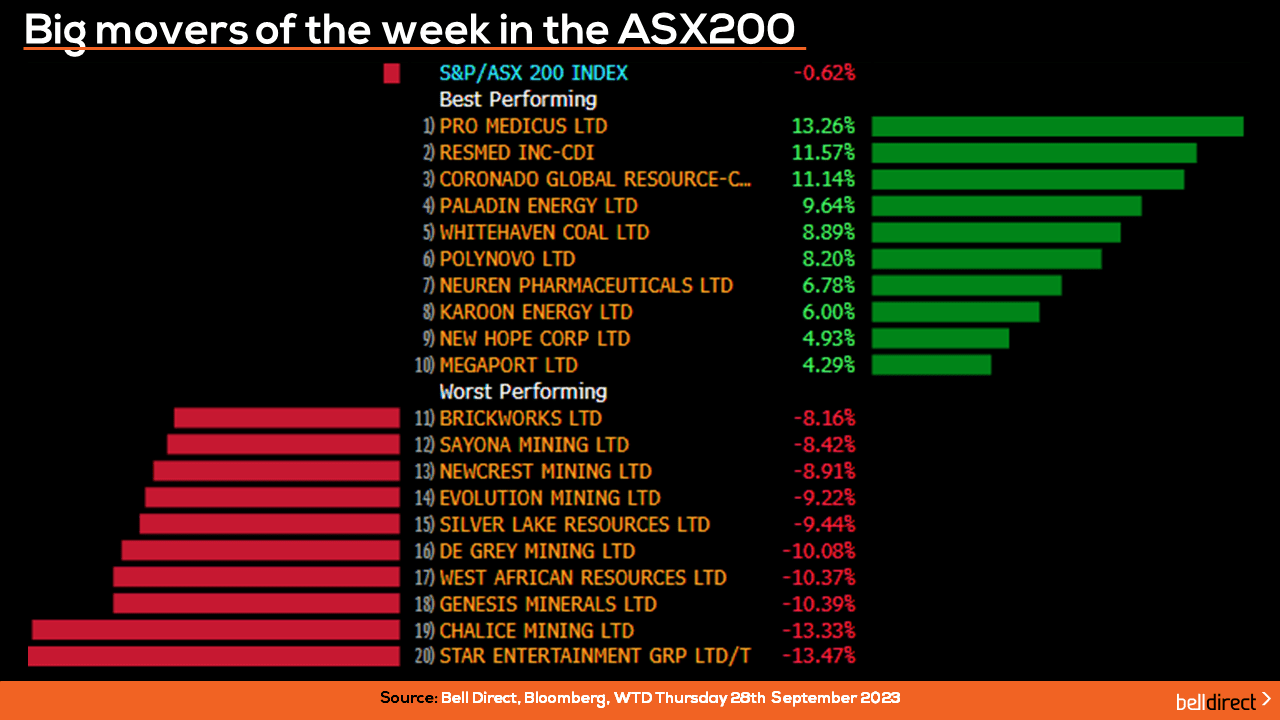

The winning stocks on the ASX200 this week were led by Pro Medicus (ASX:PME) jumping 13.26% after Goldman Sachs reiterated their buy rating on the health imaging technology company, while ResMed (ASX:RMD) also gained 11.6% over the week and Coronado Global Resources (ASX:CRN) rallied 11.14%.

And on the losing end of the ASX200 Star Entertainment Group (ASX:SGR) fell 13.5% after completing a $565m raise from institutional investors, while Chalice Mining (ASX:CHN) dropped 13.33% and Genesis Minerals (ASX:GMD) fell 10.4%.

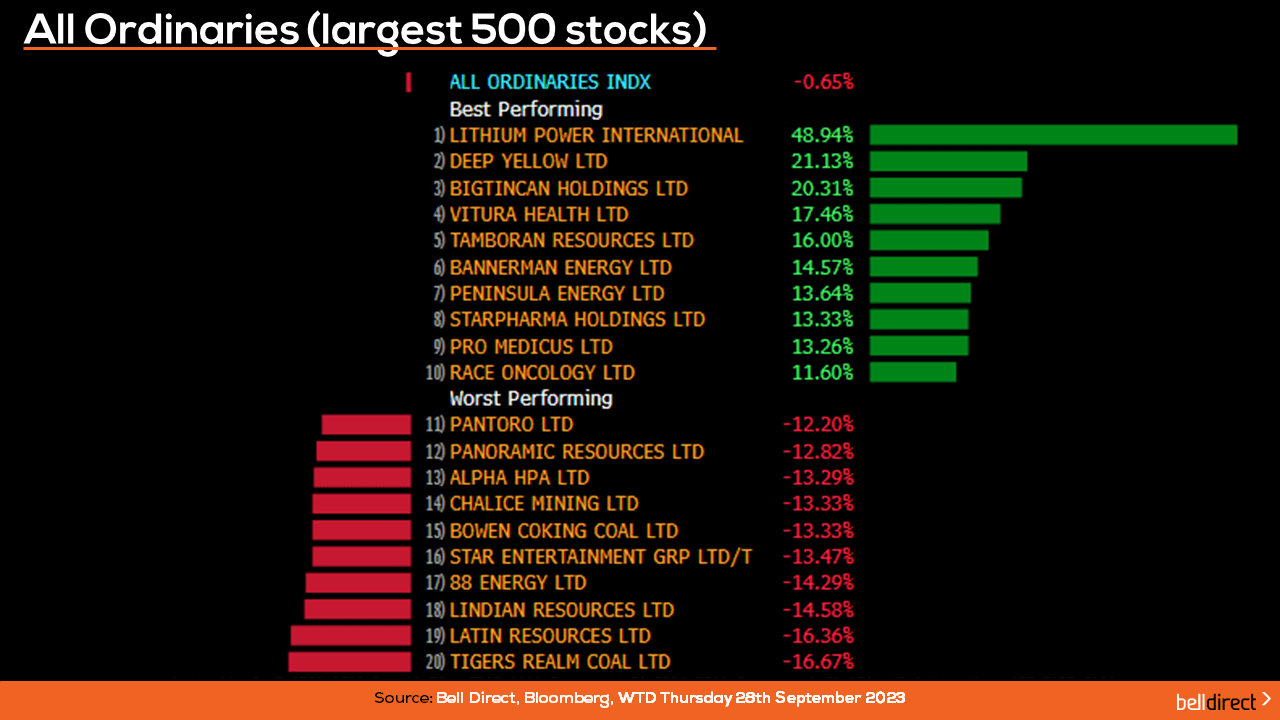

Taking a look at the broader market, the All Ords fell 0.65% this week despite Lithium Power International (ASX:LPI) soaring just shy of 49% after the company confirmed it is in exclusive negotiations with Corporacion Nacional Del Cobre de Chile, about a potential takeover. Deep Yellow (ASX:DYL) also jumped over 21% this week and Bigtincan Holdings (ASX:BTH) rose 20.3%. Tigers Realm Coal (ASX:TIG) and Latin Resources (ASX:LRS) weighed down the All Ords, falling over 16% each.

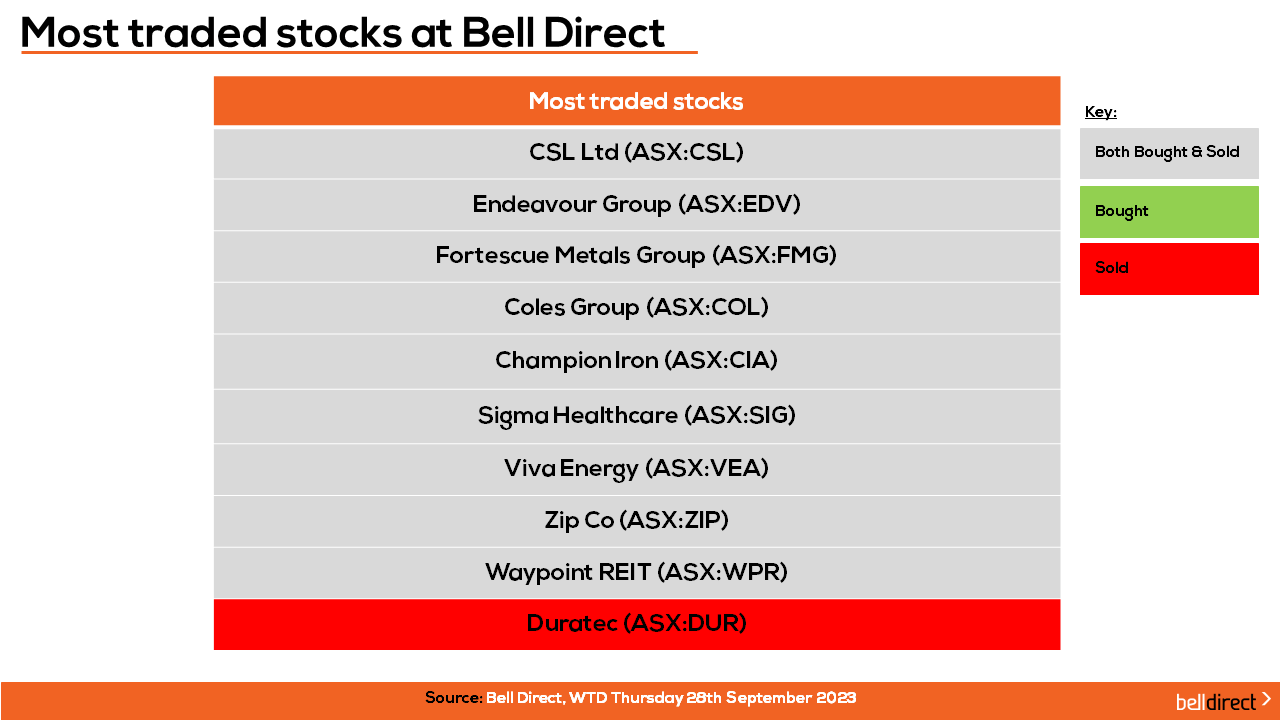

The most traded stocks by Bell Direct clients from Monday to Thursday were CSL (ASX:CSL), Endeavour Group (ASX:EDV), Fortescue Metals Group (ASX:FMG), Coles Group (ASX:COL), Champion Iron (ASX:CIA), Sigma Healthcare (ASX:SIG), Viva Energy (ASX:VEA), Zip Co (ASX:ZIP), and Waypoint REIT (ASX:WPR). Clients also sold out of Duratec (ASX:DUR) this week.

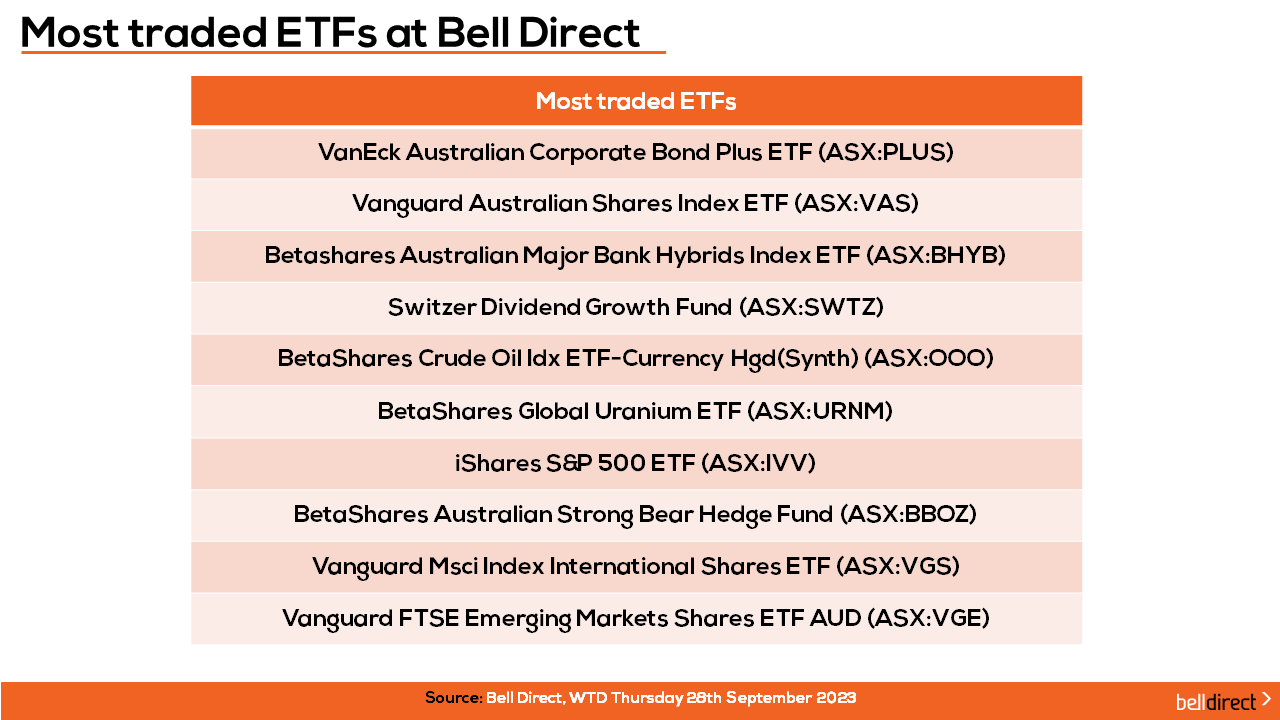

On the diversification front, the most traded ETFs by Bell Direct clients this week were led by

VanEck Australian Corporate Bond Plus ETF, Vanguard Australian Shares Index ETF and BetaShares Australian Major Bank Hybrids Index ETF.

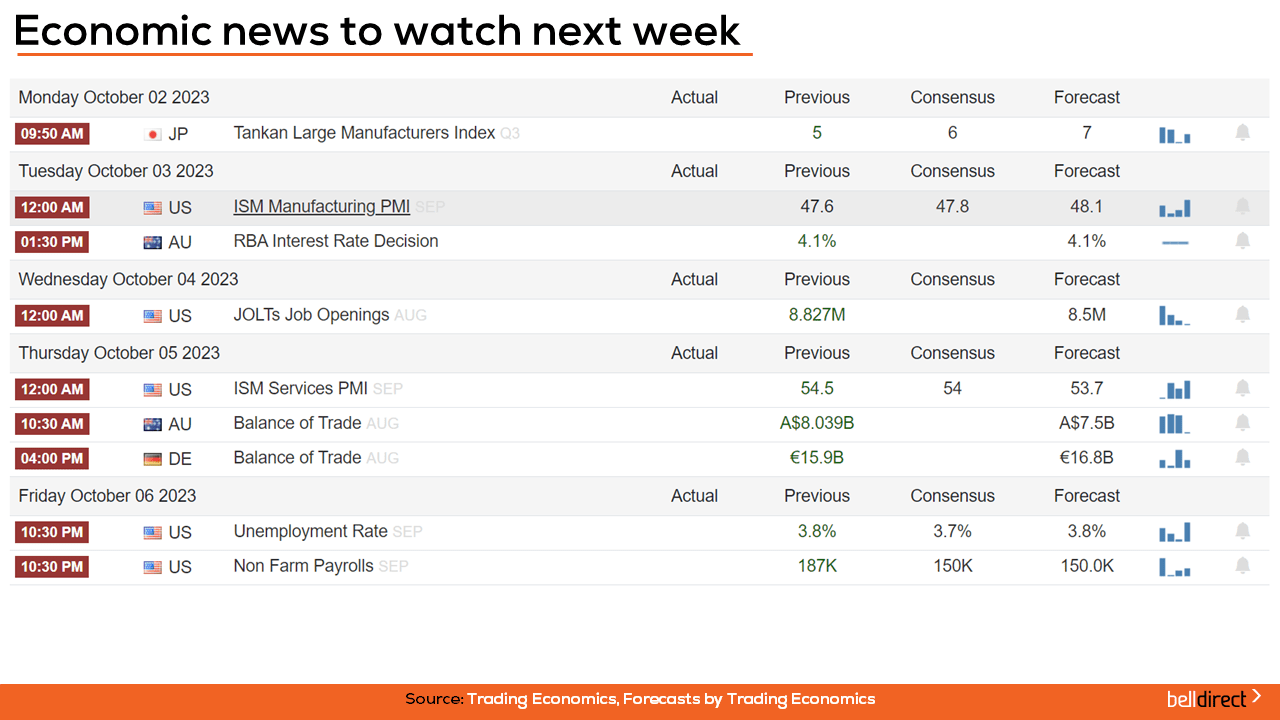

Taking a look at the week ahead, all eyes will be on the RBA’s rate announcement on Tuesday with the expectation of the current 4.1% cash rate to be maintained for another month. Australia’s trade balance data for August is also out next Thursday with the forecast of a decline in trade surplus to $7.5bn from $8.04bn in July.

Overseas, US JOLTs job openings data for August is out on Wednesday with the forecast of a fall in job openings to 8.5m from 8.827m in July. US ISM Services PMI is also out next Thursday and later in the week we will gauge US employment data through the release of September’s unemployment and non-farm payrolls data.

And that’s all we have time for today, have a wonderful weekend and as always, happy investing!