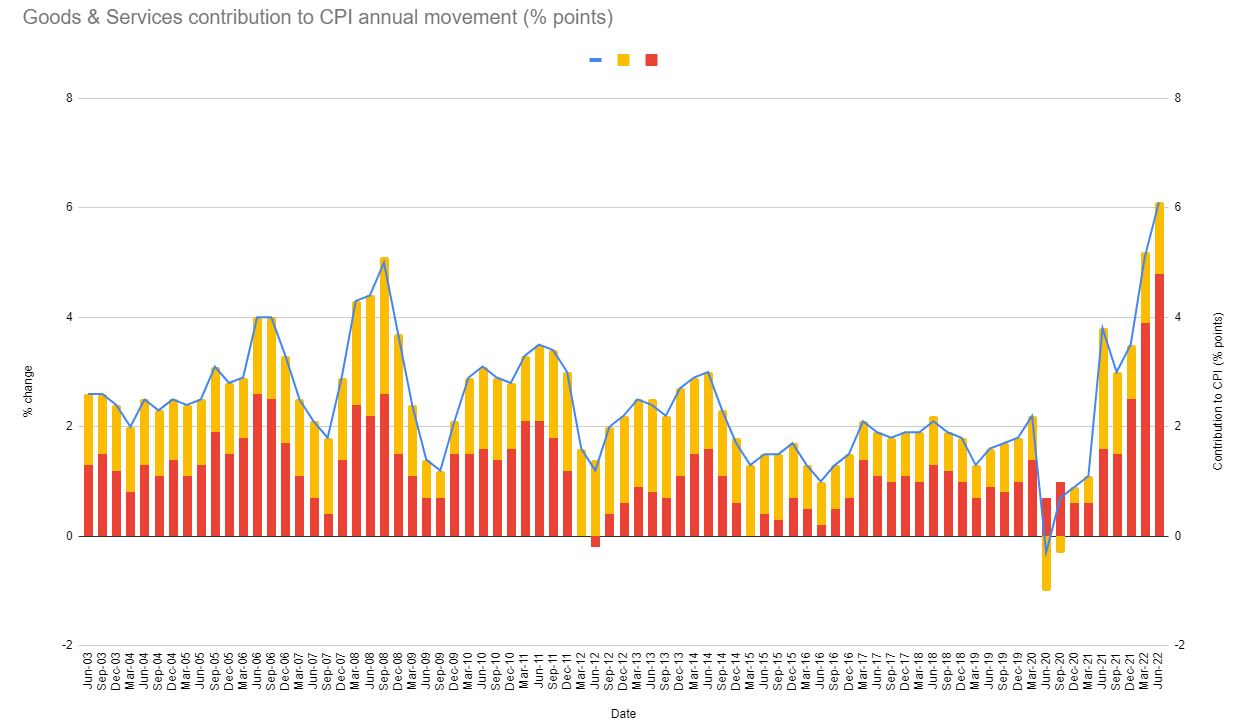

Inflation, is the word of the moment in 2022. As consumers and investors, we are living with the highest inflation rate since June 2009 just after the global financial crisis (GFC).

Inflation is the overall change in consumer prices based on a representative basket of goods and services. The ‘basket’ contains segments including food & non-alcoholic beverages, alcohol & tobacco, clothing & footwear, housing, furnishings, household equipment and services, health, transport, communication, recreation and culture, education, and insurance and financial services.

Source: ABS Data

Automotive fuel had the largest annual % increase in CPI, rising 13.1% from the prior quarter as price pressures flowed through to customers following a disruption to the oil market caused by Russia’s invasion of Ukraine, as well as ongoing easing of COVID-19 restrictions increasing demand for the commodity.

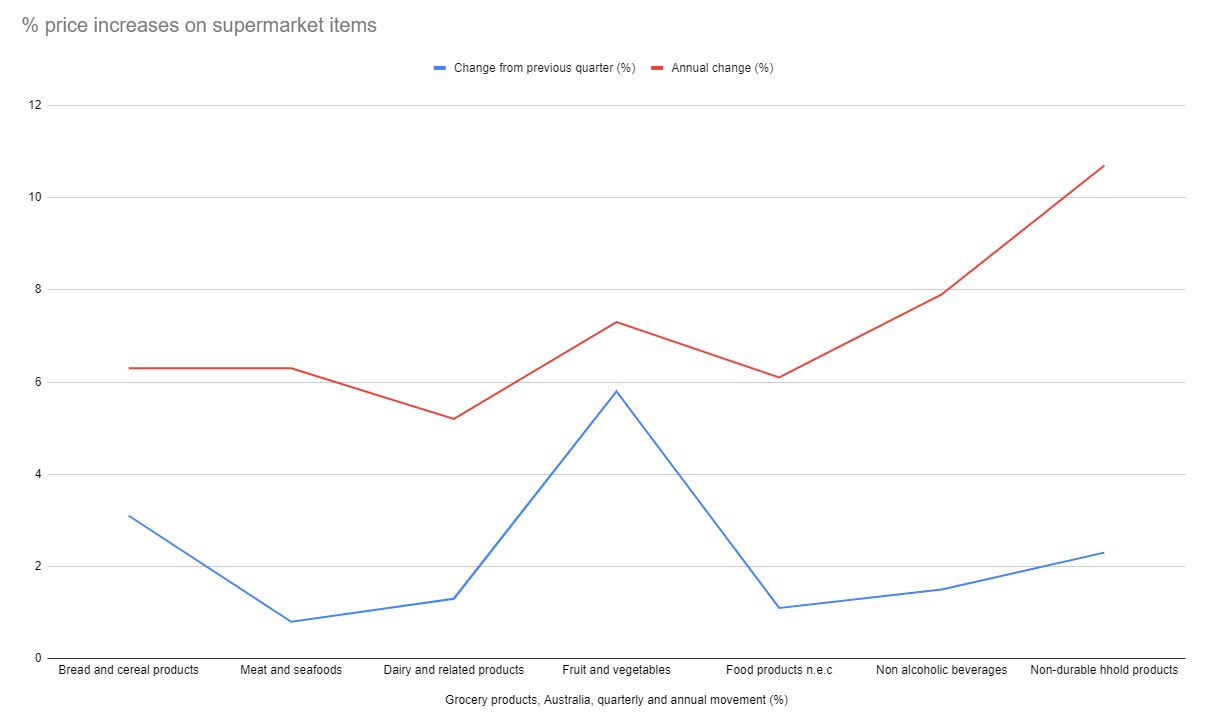

Scaling further into the everyday items that impact consumers the most, groceries jumped 5.9% from June quarter 2021 to June quarter 2022.

With supermarket giants Woolworths (ASX:WOW) and Coles (ASX:COL) both signalling price hikes are here to stay for the foreseeable future in their respective FY22 reports, we as customers feel the brunt of inflated product prices, but how can we afford our eggs, meat and groceries in 2022?

Source: ABS data

The perfect inflationary storm on grocery prices has been caused by a combination of factors including supply chain disruptions, increased transport costs, weather events like flooding and higher raw material costs. In the June quarter, fruit and vegetables experienced the highest annual change in price with growth of 7.3%, aside from non-durable household products which rose 10.7%. We all know the story of iceberg lettuces soaring from $2 to $12 in the peak supply shortage period recently, which was the prime example of inflationary pressures in the supermarket.

Meat and seafood prices have risen by 6.3% annually, with beef alone up 22% to April 2022, while salmon has soared around 43% over the last year.

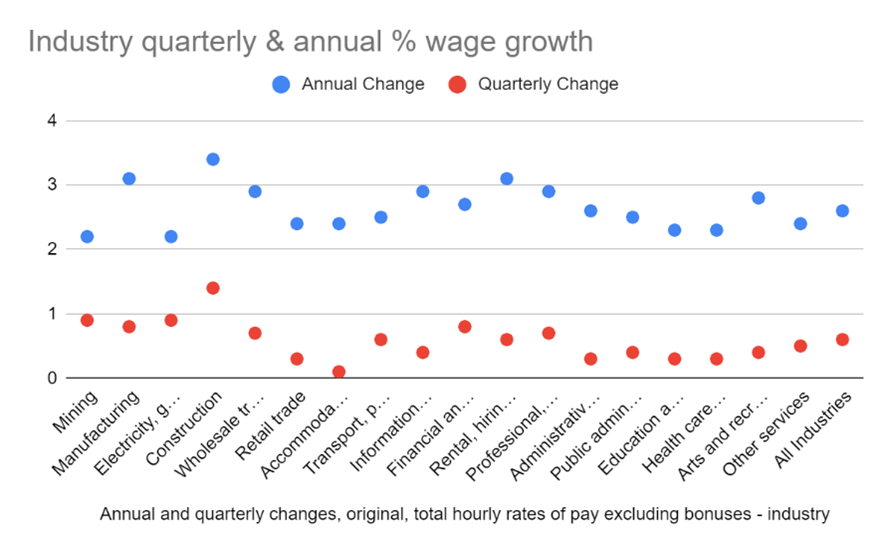

Now to the checkout… how exactly do we pay for the heavily inflated products in our shopping trolleys? Put simply, those working in the private sector have more bang for their buck when it comes to affording the rising cost of living, especially at the supermarket checkout. Wages in the private sector rose 2.7% over the year to June quarter 2022, the highest seasonally adjusted rate of growth for the sector since September 2013.

Source: ABS data

Unsurprisingly, the construction industry experienced the largest annual jump in wages growth, up 3.4% to the June quarter 2022 as Australia’s building crisis worsens due to skilled labour shortages, supply chain disruptions, material shortages and soaring demand. Those in the construction industry can afford the premium cut beef and iceberg lettuces for a little while to come.

On the other end of the scale, workers in the accommodation and food services industry may need to opt for the cheaper grocery options as wage growth in this sector only rose 0.1% QoQ and 2.4% YoY for the same period.

Around the states, Queenslanders and Tasmanians experienced the strongest annual growth rate in wages of 2.9%, while Western Australia topped the nation for the highest quarterly increase in wages by 0.8%.

For the supermarket giants, investors were looking for guidance as to whether the rising costs will be absorbed or passed onto customers over FY23, which for both Coles and Woolworths wasn’t included in their respective FY22 reports. As a result of the lack of guidance from both companies, investors sold out of their respective shares following the release of the results.