Since the US election in early November, Australian equity indices have rallied strongly. However, the growth has not been even across all sectors. Some sectors such as materials have seen only weak growth, whereas others like industrials and healthcare have seen double digit gains.

The Australian financial services sector saw very strong gains through the end of April but has pulled back sharply in the month of May. In fact, the ASX Financials sub-index is now down approximately 9% this month already. Assuming continuing expansion of the Australian economy, many of these stocks may now offer compelling valuations.

Finding good value in the financial sector with Recognia’s Strategy Builder

We will be using Recognia’s Strategy Builder to search for large cap Australian financial services stocks looking well valued due to the recent pullback in the sector.

- We begin by setting a minimum market capitalisation threshold of $3.0B to focus on larger, more established companies in the sector.

- To find stocks that appear to be well valued in today’s market, we will use two valuation metrics common for financial services stocks: First, we will filter on trailing price to earnings ratio (P/E) using an upper threshold of 25. Next, we will set a lower threshold on return on equity (RoE) of 7%.

- To focus on financial stocks with efficient operations and long term records of earnings growth, we will also set a lower threshold on 5-Year historical EPS growth of 7% per year.

You can find this strategy pre-built for you in the Featured Screens section of the Strategy Builder in the member area.

What did we find?

- Topping our list is Macquarie Group (MQG). In addition to having the lowest P/E ratio on our list at 13.7, the company also has a strong five year EPS growth rate of 23.1%. Although the stock price is off about 6% so far in the month of May, the stock has a very respectable one year gain of 21%. With Australian interest rates now at multi-decade lows, the prospect of higher rates in the coming years will lift the profitability of many financial services firms. Macquarie seems well positioned to capitalise on this trend.

- The highest return on equity on our list belongs to asset management giant Magellan Financial Group (MFG). Unlike most of the rest of the stocks in the financial services sector, Magellan has soared in the month of May – up 8.7% month to date. With very strong historical EPS growth and a reasonable P/E valuation, Magellan looks poised for continued growth.

- Brisbane-based Bank of Queensland (BOQ) has the second lowest P/E ratio on our list at 13.8 as well as return on equity of 9.3% and five year annual EPS growth rate of 7.3%. Since the start of May, the stock has weathered the downturn better than some other financial service stocks and is down about 5%.

Please note: this strategy was first featured on 23/05/2017.

Historical Performance

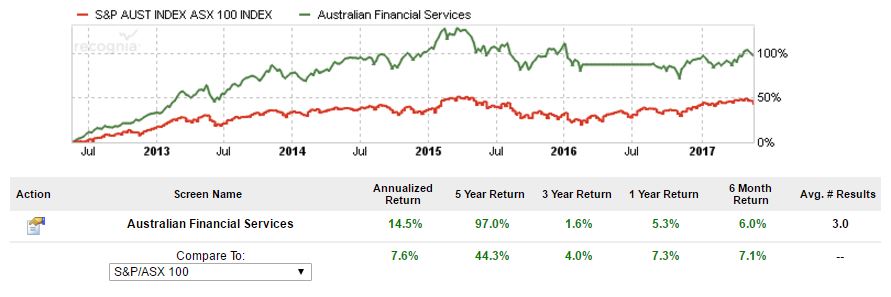

Recognia Strategy Builder provides a backtesting capability (see image below) to evaluate how well an investing strategy would have worked in the past. Using a five year historical period with quarterly re-balancing, the screen described had a 14.5% annualised return compared to 7.2% for the Australian All Ordinaries Index and 7.6% for the ASX 100.

To start using Stratregy Builder, simply log in to your account, go to the ‘Research & tools’ tab and click on ‘Strategy Builder’.

The investment ideas presented here are for information only. They do not constitute advice or a recommendation by Recognia Inc. in respect of the investment in financial instruments. Investors should conduct further research before investing.